Market Data

February 17, 2016

SMU HR Price MoMo Index Positive for Seventh Week

Written by Brett Linton

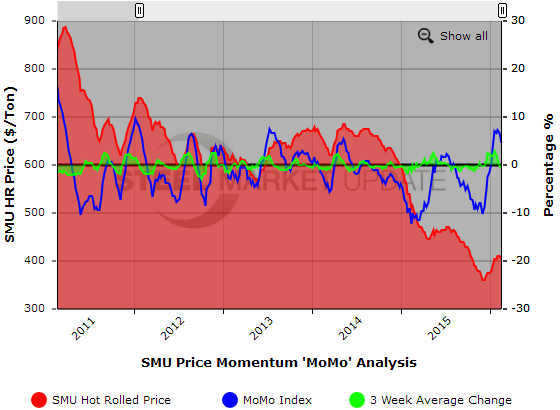

The Steel Market Update (SMU) Price Momentum Index (MoMo) for hot rolled steel in the United States was positive this week for the seventh consecutive week, following a 21 week negative streak. MoMo, a trailing indicator, is measured as a percentage and shows the relation of the current U.S. hot rolled coil price movements against the previous 12-week average spot price as recorded by Steel Market Update. A positive MoMo index indicates hot rolled steel prices are increasing, while a negative index indicates a decline in prices.

MoMo should not be confused with the SMU Price Momentum Indicator which is a forward looking indicator and is currently pointing toward higher pricing over the next 30 to 60 days.

MoMo was measured at 4.63 percent this week, meaning that the current HRC price is higher than the average price over the last 12 weeks.

The change in MoMo can be a useful indicator in depicting the severity of price movements and evaluating the directional trend for flat rolled steel prices. The week-over-week change in MoMo was -1.98 percent, following a change of -0.70 percent last week and a change of +0.61 percent two weeks ago. This indicates that the rise in hot rolled prices is slowing down and at a greater rate than the previous week.

To get a wider sense of the change in the MoMo Index and eliminate weekly fluctuations, we calculate a 3-week average change. The 3-week average change in the MoMo Index is -0.69 percent, following a change of -0.15 percent the week before. This also shows that the movement in hot rolled prices is loosing momentum and slowing down compared to the previous 3-week period.

The graph below demonstrates the relationship between the SMU hot rolled coil price, the SMU Price MoMo Index, and the three week moving average change in the MoMo Index. As published in our Tuesday evening issue, the SMU HRC price range for this week is $380-$430 per ton with an average price of $405, down $5 per ton from from last week.