Prices

February 21, 2016

Where Will Steel Prices Go From Here?

Written by John Packard

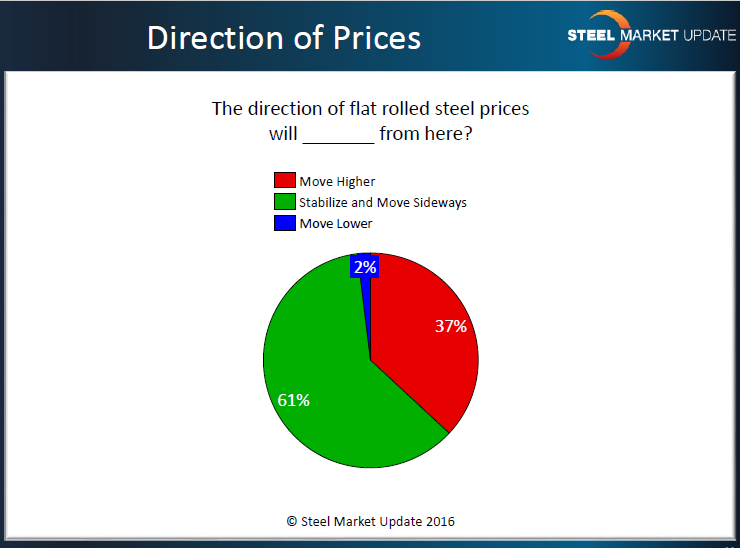

Flat rolled steel prices have been slowly rising since the domestic mills made price increase announcements in early December 2015. Even though the trend has been for higher steel prices for almost three months now, 37 percent of those responding to our flat rolled steel market trends analysis this past week believe prices will rise from here. The majority (61 percent) are of the opinion that prices will move sideways while a very small minority (2 percent) believe prices will move lower from here.

Since January 1, 2009 we have only seen three occasions where prices remained “range bound” (+/- $10/ton) for an extended period of time. The first was the end of October 2013 until the third week of January 2014. The second came soon after when prices remained stuck around $675 per ton between the third week of April until the beginning of September 2014. The most recent one was last year when prices were stuck around $465 per ton beginning in late May through the second week of August. However, the last range bound period was sandwiched between two strong downward moves.

You can see the graphic (and interact with it) for yourself online under the pricing tab on our website.

What our respondents are saying:

When asked to comment on their response to our question about what direction prices will go from here a number of our respondents provided the following observations:

“I think they will keep moving up until foreign again possibly takes over. China is still supplying substrate to other countries who are not listed in the suits.” Manufacturing company

“For at least a couple of months.” Manufacturing company

“I think the rise in price was a bubble. Buyers came off the sidelines in Dec to take advantage of the bottom, this in addition to the AD and reduced capacity helped push lead times out. I think lead times will come back in line early 2Q. It just doesn’t feel like anything is happening out there right now!” Manufacturing company

“Really nothing at this point to make it go higher.” Service center

“Prices will move higher but with a cautious approach by the domestics.” Manufacturing company

“With current input cost and the opportunity for foreign coupled with moderate demand it is hard to see prices moving much higher.” Service center

“[Prices will move higher] Except for hot rolled.” Service center