Prices

March 17, 2016

March Steel Imports Trending Toward Higher Slab/HR Tonnage

Written by John Packard

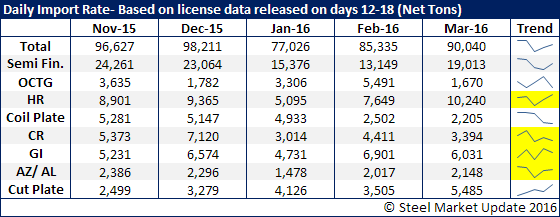

The U.S. Department of Commerce updated foreign steel import license data earlier this week. The trend is for March steel imports to come in around 2.4-2.7 million net tons or in line with what we saw during the months of January and February 2016.

Since we are still early in the month, we are less concerned with what the ultimate total tonnage number will be and more interested in finding changes in trends. For example, the domestic steel mills appear poised to increase semi-finished steel (slabs) imports by a couple of hundred thousand tons. If the month comes in higher than January and February, slabs will be one of the main reasons.

There is also a changing trend on hot rolled coil imports which have gone from an average of 7,650 tons per day in February and 5,100 tons per day in January up to 10,240 tons per day so far this month. When looking at the individual countries, we found that Korea continues to be the major exporter and we assume much of that steel is going to USS/POSCO on the west coast of the U.S. Two other countries that were involved in the just announced HR dumping decision increased shipments compared to the previous month (February): the Netherlands has already requested 28,000 tons of HRC licenses and Turkey with 18,800 tons of license requests. The Netherlands has a 5.07 percent dumping margin while Turkey will depend on the specific mill as dumping margins range from 5.24 percent to a high of 7.08 percent.

Who are the new players in HRC? One country is Venezuela which has gone from zero tons in both January and February to 15,000 tons of license requests for March. New Zealand (7,400 tons), Belgium (5,600 tons) and France (3,400 tons) are also bringing in HRC in larger than normal tonnages (based on the past few months).

In the graphic below we are showing the trend line for import license requests by the middle of the month. We are then able to compare how the license data for March is trending against prior months. The highlighted items are the four flat rolled products we carefully watch: hot rolled, cold rolled, galvanized and Galvalume (other metallic).