Market Data

March 31, 2016

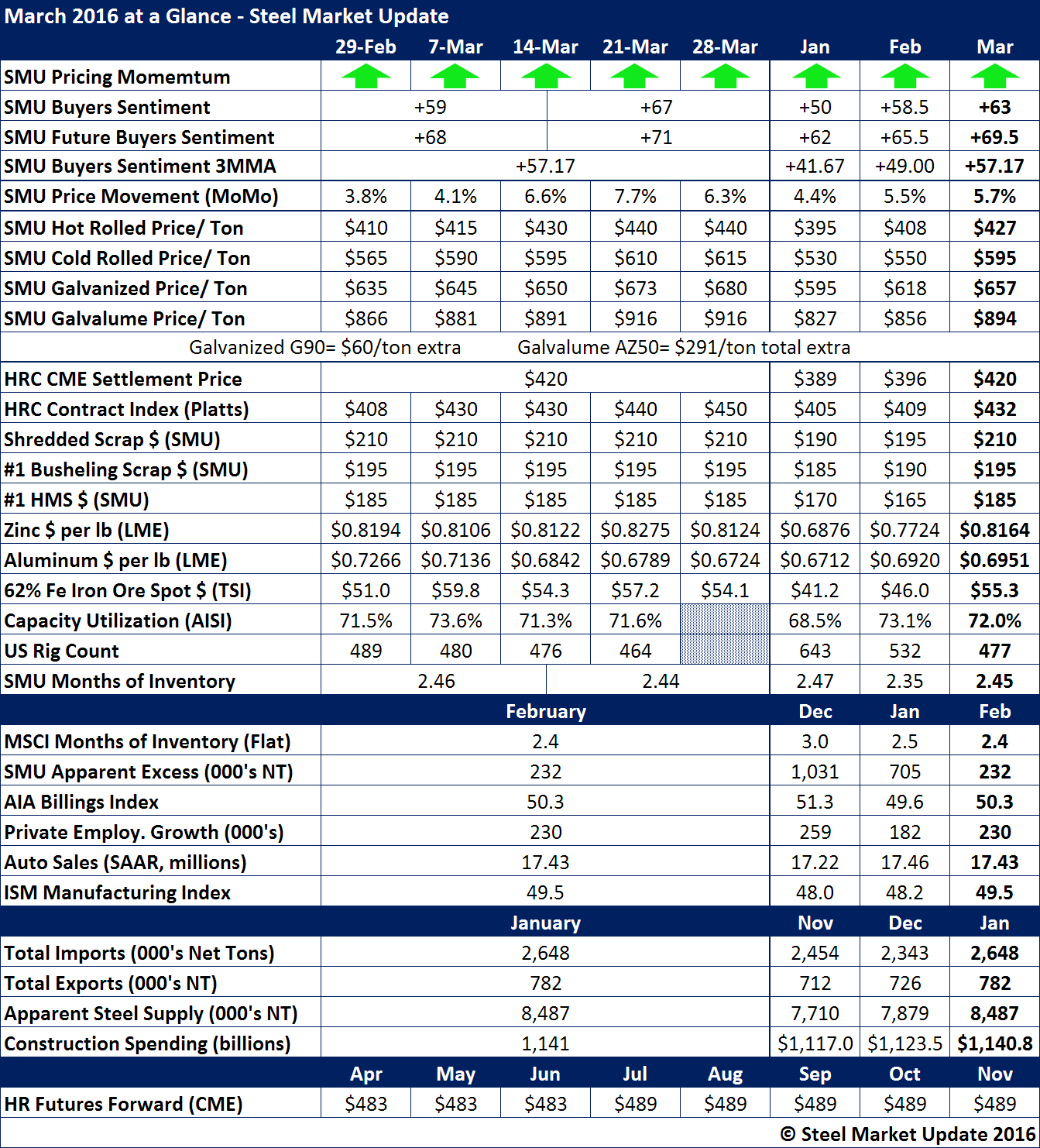

March 2016 at a Glance

Written by John Packard

March saw flat rolled steel prices rising throughout the month. SMU benchmark hot rolled average for the month was $427 per ton. This was slightly lower than Platts which revised their HRC number on the 30th which took their average up to $432 per ton. Both Platts and SMU monthly averages were higher than the CME Settlement which was $420 per ton for the month of March.

Hot rolled closed out the last week of the month at $440 per ton, cold rolled was $615 per ton while .060” G90 galvanized finished at $680 and .0142” AZ50, Grade 80 Galvalume ended the month at $916 per ton.

As we enter the month of April the SMU Price Momentum Indicator is pointing to Higher prices over the next 30 days. Momentum has been pointing toward Higher flat rolled prices since early December 2015.

The higher prices and consistent price movement is helping guide our SMU Steel Buyers Sentiment Index to new higher levels (and close to record highs for our index). We like to watch our three month moving average (3MMA) which takes any wrinkles out of the data. Our 3MMA average for Sentiment jumped during the month of March from +49.0 in February to +57.17 by the end of March.

We are seeing higher scrap prices in the Midwest and we expect them to move even higher once April pricing is finalized.

Zinc trading on the LME saw the metal moving higher. Aluminum, on the other hand has been relatively constant around $0.70 per pound over the past few months.

MSCI reported flat rolled inventories at service centers as being 2.4 months as of the end of February. This is down from 2.5 months in January and 3.0 months at the end of December 2015.

As inventories at the service centers drop so does out proprietary “Apparent Excess” which dipped to +232,000 tons at the end of February vs. +705,000 tons at the end of January. We have been projecting that distributor inventories would be balanced by the month of March. It is this balanced situation which is creating the opportunity for domestic mills to raise (and collect) price increases as service centers need to order new product. “Apparent Excess” is a proprietary model of Steel Market Update provided to our Premium level members.