Analysis

May 3, 2016

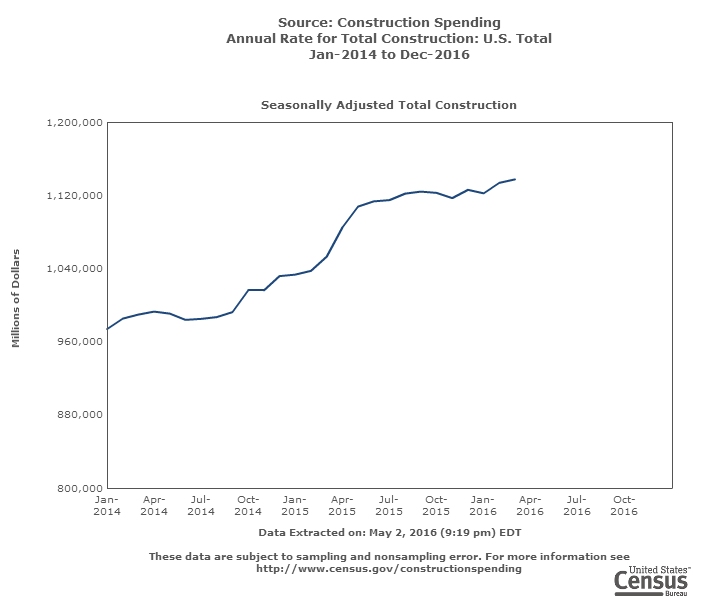

Construction Spending On 3 Year Upward Trend

Written by Sandy Williams

The Associated General Contractors of America, on May 1, released their March analysis of construction spending. Construction spending in March 2016 was at a seasonally adjusted annual rate of $1.138 trillion.

SMU looked back at past March analyses and found an upward trend in spending for the month. In March 2014 construction spending totaled $943 billion and was followed by an increase to $967 billion in 2015.

In residential construction, multi-family construction spending led the increase all three years. Millennials continue to choose apartment living over home purchase, spurring growth in the multi-family construction sector.

Private nonresidential construction in March 2015 grew 9.3 percent year over year. In 2015 the March figures were up 6.4 percent year over year and in 2014 rose 8.6 percent from the previous year.

Public construction was up 6.7 percent year over in the latest March report. The recent growth was driven by an 18.8 percent increase in highway and street construction, supported by federal transportation investments enacted last year. In March of 2015, public construction increased only 1.7 percent, but that was a recovery from a decline of 0.8 percent in 2014.

The AGC March report on construction spending follows:

Construction spending increased by 8 percent in March compared to a year earlier and was also up slightly between February and March amid growing demand for many types of construction, as the spending total hit the highest level since October 2007, according to an analysis by the Associated General Contractors of America. Association officials said the growth comes amid strong private-sector demand and new federal investments in surface transportation programs.

“Construction should be a significant contributor to economic growth in the remainder of 2016 and beyond,” said Ken Simonson, the association’s chief economist. “Right now the biggest challenge for contractors in many parts of the country is that they are worried about finding enough qualified workers to meet demand.”

Construction spending in March totaled $1.138 trillion at a seasonally adjusted annual rate, 0.3 percent higher than the revised February total and 8.0 percent higher than in March 2015, Simonson said. Private residential spending increased by 1.6 percent for the month and 8.5 percent compared to twelve months earlier. Spending on multifamily residential construction jumped 5.6 percent for the month and 34.6 percent year-over-year, while single-family spending was flat compared to February but rose 13.4 percent compared to March 2015.

Private nonresidential construction spending increased 0.7 percent for the month and 9.3 percent from a year earlier. Simonson observed that all but one segment increased from 12 months before. The largest private nonresidential segment in March was manufacturing construction, which rose 2.2 percent for the month but dropped 2.0 percent year-over-year. The next-largest segment, power (including oil and gas pipelines), lost 1.8 percent for the month but gained 2.0 percent for the year.

Public construction spending dipped 1.9 percent from a month before but is still up 6.7 percent from 12 months earlier. The biggest public segment—highway and street construction—was up 0.4 percent for the month but is up 18.8 percent year-over-year, as new federal surface transportation investments enacted last year began to impact demand, Simonson noted.

Association officials said the new construction spending figures reinforce anecdotal reports that the industry continues to grow amid robust demand for most types of construction services. But officials warned that labor shortages are likely to become even more severe as construction firms continue to expand unless federal, state and local officials act on the measures outlined in the association’s Workforce Development Plan.

“The new spending data, combined with recent employment reports, make it clear that the construction industry is growing faster than the broader U.S. economy,” said Stephen E. Sandherr, the association’s chief executive officer. “But unless firms have enough workers to keep pace with demand, construction schedules are likely to slow as firms are forced to cope with labor shortages.”