Prices

June 7, 2016

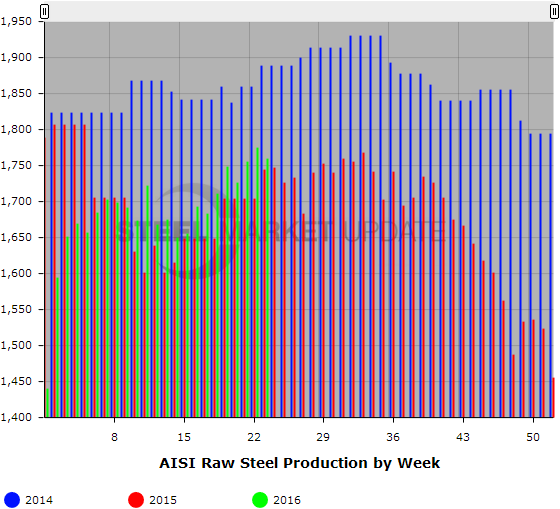

Weekly Raw Steel Production: Capacity Utilization Rate Above 75% for Third Week

Written by Brett Linton

For the week ending June 4, 2016, the American Iron & Steel Institute (AISI) estimated the U.S. steel industry produced 1,760,000 net tons of raw steel, a 0.8 percent decrease over the previous week, but a 0.9 percent increase over the same week one year ago. The estimated capacity utilization rate is 75.3 percent, down from 75.9 percent last week, but up from 73.7 percent this time last year.

Estimated total raw steel produced for 2016 YTD is reported to be 38,776,000 tons, down 0.7 percent from the 39,051,000 tons produced during the same period in 2015. The average capacity utilization rate for 2016 YTD is estimated to be 72.1 percent, up from 71.8 percent for 2015 YTD.

Note that the AISI estimates capability for Q2 2016 to be 30.4 million tons versus 30.7 million tons for the same period last year and 30.4 million tons for the Q1 2016.

Week-over-week changes per district are as follows: Northeast at 205,000 tons, down 1,000 tons. Great Lakes at 673,000 tons, up 10,000 tons. Midwest at 182,000 tons, up 17,000 tons. South at 607,000 tons, down 42,000 tons. West at 93,000 tons, up 1,000 tons. Total production was 1,760,000 tons, down 15,000 tons.

About Weekly Raw Steel Production Data

The weekly raw steel production tonnage provided by the AISI is estimated. The figures are compiled from weekly production tonnage provided by 50 percent of the domestic producers combined with monthly production data for the remainder. Therefore, this report should be used primarily to assess production trends. The monthly AISI production report provides a more detailed summary of steel production based on data supplied by companies representing over 75 percent of U.S. production capacity.

SMU Note: Below is a graphic showing the weekly raw steel production history. To use the graphs interactive capabilities, you must view it on our website. You can do this by clicking here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.