Market Data

June 20, 2016

Service Center Flat Rolled Inventories Now in a Deficit

Written by John Packard

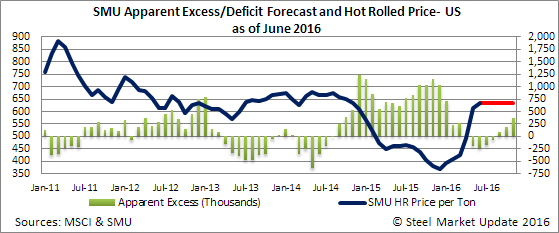

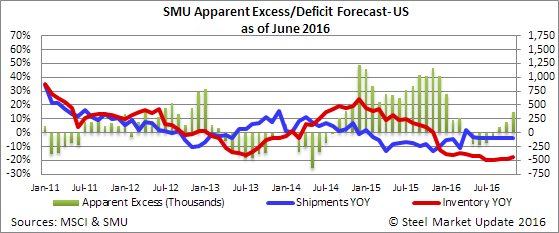

Flat rolled steel inventories being held by U.S. steel service centers have moved from an Apparent Excess to a Deficit based on our analysis of the recently released data by the Metal Service Center institute (MSCI). We have been reporting on the reduction of the Apparent Excessive inventories being held at flat rolled steel distributors for some time now. As inventories declined and moved into a Deficit based on our model, this has help move distributors from a hold mode in buying to a much more active mode. As lead times expanded the need to buy increased which resulted in the tight negotiating positions taken by the domestic steel mills.

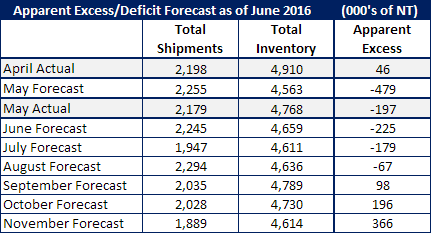

We see inventories moving back into an excess situation in September (minor excess) but we are not seeing a dramatic increase in inventories through the five month time period discussed in this article.

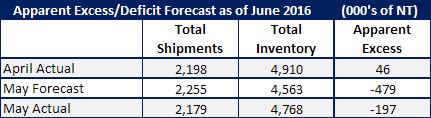

Service center shipments totaled 2,179,000 tons which was 76,000 tons less than our forecast which was based on shipments being 107,400 tons per day, the same as last year. Shipments continue to be below both the 3 year average (-6.6 percent) as well down from the prior year (-3.4 percent).

Inventories ended the month at 4,768,000 tons which was much greater than our forecast of 4,563,000 tons. Our forecast called for receipts to be 90,919 tons per day and in actuality receipts came in at 97,102 tons per day.

We did correctly forecast service center inventories would move into a Deficit which, based on our model, stands at -197,000 tons (we had forecast the deficit would be greater than the -197,000 tons).

SMU Forecast Deficit to Continue Through August

We have decided that our optimism for things to improve needs to be tempered as we move into our new forecast. Our new forecast takes into consideration the analysis of the MSCI data done by Peter Wright (produced in today’s issue as well). We are working on daily shipments to be down 4 percent year over year and receipts to be 10 percent lower than the 3 year average. The net result is a modest Apparent Deficit in June, July and August before reversing course in September.

It is our opinion that flat rolled steel prices will be relatively stable during the next 60 days and we are not expecting any large move in either direction through the next 4-5 months (assuming no changes in supply between now and then). Our pricing forecast is holding steady in the $620-$640 area.