Prices

June 28, 2016

SMU Price Ranges & Indices: See-Saw Market

Written by John Packard

The flat rolled markets are trying to find where, and what direction, prices should be moving. After being down slightly last week, this week prices are up slightly. There is no clear-cut focus to the market at this moment. As one service center purchasing director put it to us this afternoon, “[Pricing] is all need based…even our customers are on the sidelines waiting for the macro to stabilize….” While a steel mill executive told us, “Pricing is dead flat. August is pretty full. Lets call it 8 weeks on domestic coated.”

Service centers seem to be split on the market. We heard this from a Chicago based distributor, “The market is in it’s typical summer vacation quiet time. Buyers interpret this as price softness & are worried, but we have not seen evidence of price erosion. The mills will very likely hold the line on pricing until the August 5th HR duty ruling and in all likeliness the Government will continue to take a hard position on HR imports and give the market a price boost. The market needs time to digest the current higher price levels. Supply constraints will keep prices at an elevated level through 3Q.”

While an executive out of Indiana told us, “I am getting more and more pessimistic. Can we continue to have huge premiums compared to the rest of the world? We are finding additional supply out of various domestic mills… Most of the mills are beginning to ship early.” This executive also wanted to talk about how quickly allocations disappeared. This was considered to be quite unusual compared to past markets where the steel mills put customers on allocation.

From our perspective we anticipate flat rolled steel spot prices will bounce about over the next few weeks until either the buyers return in force or the domestic mills move prices in order to attract more domestic business.

Here is how we see prices this week:

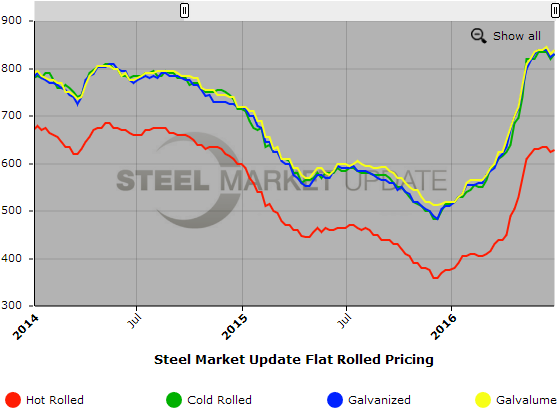

Hot Rolled Coil: SMU Range is $605-$650 per ton ($30.25/cwt- $32.50/cwt) with an average of $627.50 per ton ($31.375/cwt) FOB mill, east of the Rockies. The lower end of our range declined $5 per ton compared to one week ago while the upper end rose $10 per ton. Our overall average is up $2.50 per ton over last week. Our price momentum on hot rolled steel is for prices to remain range-bound (+/- $20 per ton) over the next 30 days.

Hot Rolled Lead Times: 4-7 weeks

Cold Rolled Coil: SMU Range is $810-$850 per ton ($40.50/cwt- $42.50/cwt) with an average of $830 per ton ($41.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to last week as did the upper end of our range. Our overall average is up $10 per ton over one week ago. Our price momentum on cold rolled steel is for prices to remain range-bound (+/- $20 per ton) over the next 30 days.

Cold Rolled Lead Times: 5-8 weeks

Galvanized Coil: SMU Base Price Range is $40.50/cwt-$42.50/cwt ($810-$850 per ton) with an average of $41.50/cwt ($830 per ton) FOB mill, east of the Rockies. The lower end of our range remained the same compared to one week ago while the upper end rose $10 per ton. Our overall average is up $5 per ton over last week. Our price momentum on galvanized steel is for prices to be range bound (+/- $20 per ton) over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $870-$910 per net ton with an average of $890 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-9 weeks

Galvalume Coil: SMU Base Price Range is $41.00/cwt-$43.00/cwt ($820-$860 per ton) with an average of $42.00/cwt ($840 per ton) FOB mill, east of the Rockies. The lower end of our range remained the same compared to last week while the upper end increased $20 per ton. Our overall average is up $10 per ton over one week ago. Our price momentum on Galvalume steel is for prices to be range-bound (+/- $20 per ton) over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $1111-$1151 per net ton with an average of $1131 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.