Market Data

December 20, 2016

SMU Apparent Excess/Deficit Model: Service Center Flat Rolled Inventories

Written by John Packard

Late last week the Metal Service Center Institute (MSCI) released service center shipment and inventories data for the United States and Canada. We published both a general recap and a more complex analysis of the data in Thursday and Sunday issues of SMU.

Steel Market Update has a proprietary model that we apply against the MSCI data in order to determine whether flat rolled distributors’ inventories are in Apparent Excess or Deficit (or balanced). We then use a second model to project what we believe will happen during the next five months. the results of these models are shared every month with our Premium level members. Today we are going to share the data with everyone.

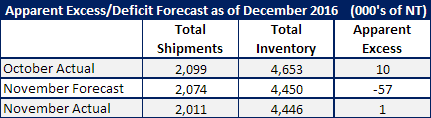

First, let’s look back to see how well we did with our forecast for November:

SMU forecast flat rolled shipments to total 2,074,000 tons during the month of November. According to the MSCI data U.S. distributors actually shipped 2,011,000 tons. We missed shipments by 63,000 tons or 3,000 tons per day.

Our shipment forecast was based on daily shipments being 1.2 percent lower than October. We got the direction correct but instead of being 1.2 percent lower the month averaged 4.2 percent lower than the prior month.

Our forecast called for receipts to be down 5 percent over the 3-year average for November. We believed inventories would drop from 4,653,000 tons to 4,450,000 tons. We got the direction correct and came within four thousand tons of hitting the ending inventory balance as actual tonnage was 4,446,000 tons.

Our previous forecast called for flat rolled steel prices to rise during the month of November which was what happened.

At the end of November flat rolled steel inventories at the domestic service centers were essentially balanced with an Apparent Excess of +1,000 tons. Our original forecast was for a sharper decline in inventory levels with an Apparent Deficit of -57,000 tons (which is also within our balanced inventory model).

December Forecast

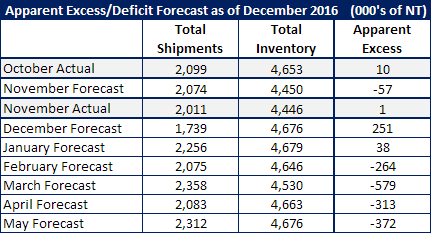

We have adjusted our model slightly for shipments as we look at December and the following months through May 2017.

The month over month changes are based on the historical changes over the past four years. Using this model we believe December shipments will be 1,739,000 tons.

We are also forecasting a slight increase in inventories expecting them to end the month of December at 4,676,000 tons.

If correct we expect an increase in Apparent Excess to +251,000 tons. However, this will be quickly eroded away once we move into the New Year due to stronger shipments. We expect domestic service centers to be in an Apparent Deficit by the end of February.

As we move into February we are tweaking our model to suggest the U.S. steel service centers will increase their inventories by approximately 3 percent above our model which reduces what would otherwise be a sizeable Deficit. We believe this will happen due to lengthening lead times and modestly strong order books at the domestic mills (based on our observations). With more price increases potentially coming as we near the New Year we believe buyers will purchasing more material in February which is still available on most flat rolled products at this time.

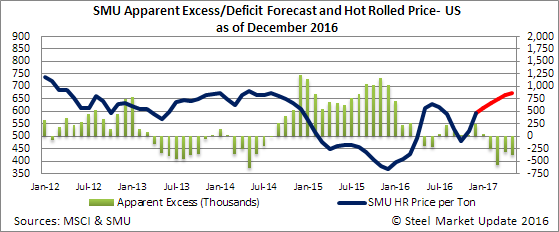

SMU continues to believe flat rolled steel prices will move higher over the next 30 days. The increase(s) being collected during December and expected to be announced and collected during early 1st Quarter are based on tight distributor inventories (as pointed out in this report), extending steel mill lead times and the expectation of an even stronger steel market once we move into calendar year 2017.

SMU Note: If you are interested in learning more about our Premium newsletters and website access please contact John Packard at: John@SteelMarketUpdate.com or by phone at 800-432-3475. There are also details on our website. Please be advise, however, we will be raising our subscription rates modestly on February 1, 2017.