Prices

January 3, 2017

2016 Through the Review Mirror…

Written by John Packard

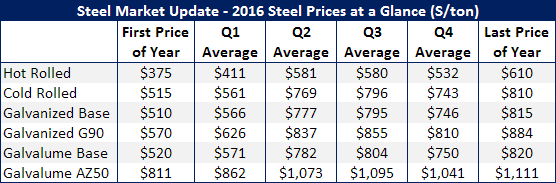

When we ended 2015 benchmark hot rolled base prices averaged $375 per ton ($18.75/cwt), cold rolled base average was $515 per ton ($25.75/cwt) and the spread between HRC and CRC base prices was $140 per ton ($7.00/cwt). Galvanized base prices averaged $510 per ton ($25.50/cwt) and the spread between HRC base and that of Galvanized was $135 per ton ($6.75/cwt). Galvalume base prices average as the year 2016 began was $520 per ton (26.00/cwt) and the spread between HRC base and that of AZ was $145 per ton ($7.25/cwt).

In the table below we review our steel price indices showing the starting number (which was the last number produced at the end of 2015) and then the quarterly averages as well as the end of the year price for hot rolled, cold rolled, galvanized base, galvanized G90, Galvalume base and Galvalume .0142” AZ50 Grade 80 which is our benchmark product for comparison purposes.

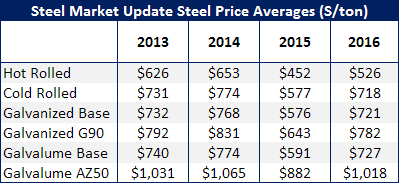

To better understand how 2016 pricing fits with from a historical perspective we have produced the yearly averages for the years 2013, 2014, 2015 and 2016. Perhaps the most striking of the data shown is that of 2015 and how far below the averages it was, so a rebound in 2016 should have been anticipated. And, based on the 2013 and 2014 averages, we should anticipate that 2017 should be more in-line with those years, with 2015 being an anomaly.

As the New Year begins Price Momentum clearly is on the side of the steel mills. Much has been done to alter the laws of supply and demand. The mills have created a situation where supply is being squeezed. Domestically the steel mills closed the hot ends of three steel mills: USS Fairfield, USS Granite City and AK Steel Ashland. Foreign steel supply to the U.S. has been interrupted using antidumping and countervailing trade suits. On top of the trade suits the mills have filed a circumvention suit against China alleging they used Vietnam to mask shipments of Chinese hot rolled and cold rolled substrate which already had AD/CVD determinations against them. US Steel also filed a Section 337 complaint against China where the mill is asking the U.S. Government to essentially prevent any Chinese flat rolled from entering the United States due to China stealing trade secrets as well as circumvention of U.S. trade laws.

We have provided a guide to the hot rolled, cold rolled, corrosion resistant (CORE) and cut-to-length (CTL) plate trade suits. Hot rolled, cold rolled and CORE suits have been completed and the CTL plate final determinations to be completed during the first half of 2017.

Both the Circumvention complaint against China as well as the Section 337 complaint are ongoing and we should learn more in the months to come on these trade cases.

We also have a change in Administration about to occur with President-Elect Trump nominating pro-steel advocates into key administrative positions with perhaps the most important selection to date being Wilbur Ross as Secretary of the Department of Commerce (which controls the AD/CVD investigations). Today (Tuesday, January 3rd) Trump officially named Robert Lighthizer as the US Trade Representative. Robert Lighthizer was a former assistant trade representative under Ronald Regan and is an active trade attorney.

2017 is shaping up to be one very interesting year.

Stay tuned to Steel Market Update to learn how we see the year progressing and what you can do to help you and your company prosper during the New Year.