Prices

January 17, 2017

Closing in on 2016 Price Highs

Written by John Packard

Flat rolled steel prices are fast approaching the highs achieved during calendar year 2016. Today, Steel Market Update (SMU) released our new hot rolled coil index average at $625 per ton. This is within $10 per ton of the $635 per ton high reported during calendar year 2016.

In the case of galvanized steel our latest price assessment put the GI average base at $42.00/cwt ($840 per ton) which is $5 per ton away from the 2016 base price peak. When taking into consideration extras, galvanized transaction averages have already exceeded 2016 levels.

One of the items discussed in the HARDI steel conference call held this morning was the concept of market cycles beginning with higher lows which then lead to the establishment of even higher cycle highs.

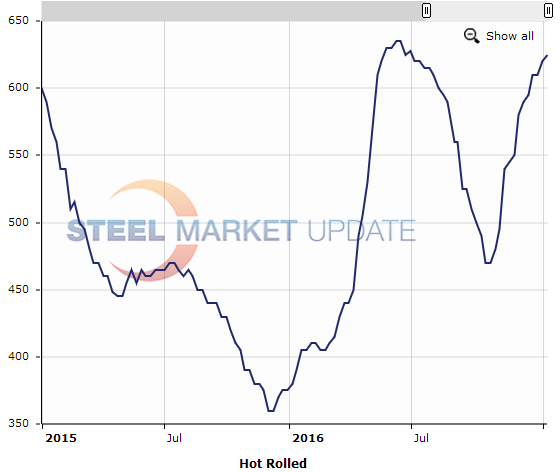

The below graphic is of hot rolled weekly average pricing over the past two years (graphic comes from our website).

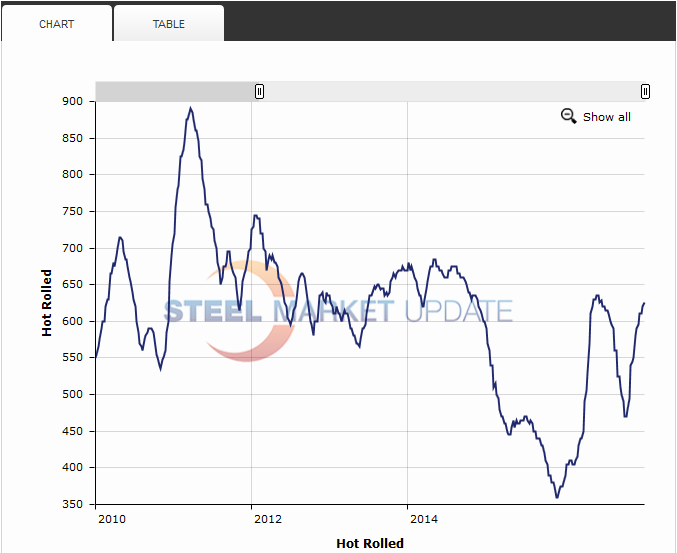

Can prices move even higher from these levels? To answer that question let’s take a look at January 2010 through today to see what the graphic looks like.

The market highs achieved during 2014 was $685 per ton on hot rolled. We are $65 per ton away from 2014 levels and Price Momentum continues to be for higher prices over the next 30 days. SMU believes we will take out the 2016 levels over the next few weeks.

SMU heard from one of the domestic steel mills who reported to us today, “We are seeing a LOT of small orders that add up to good volume. People buying weekly instead of monthly in order to keep their inventory under control.”

This mill then went on to provide commentary about what buyers should be doing, “If I were a customer…I would not buy any more than the absolute minimum at these prices unless my sales guys were setting the world on fire, or unless the lead times were 8 weeks plus and neither of those is happening. People are paying increases but there is no fear of shortage…price resistance and having no clear signal to load up = restraint.”

Restraint and controlling inventories could be another way of saying prices still have room to move.