Prices

February 5, 2017

2016 Raw Steel Production 0.5% Lower than 2015

Written by Brett Linton

The American Iron & Steel Institute (AISI) recently reported final U.S. raw steel production estimates for the month of December 2016. The monthly estimates are different than the weekly estimates we report in our Tuesday issues; the AISI bases the monthly estimates on over 75 percent of the domestic mills reporting vs. only 50 percent for the weekly estimates.

Total raw steel production for the month of December was reported to be 7,117,580 net tons with 4,811,522 tons being produced by electric arc furnaces (EAF) and 2,306,058 tons produced by blast furnaces. December raw steel production was reported to be 300,122 tons or 4.4 percent higher than the previous month and 543,287 tons or 8.3 percent higher than the same month last year.

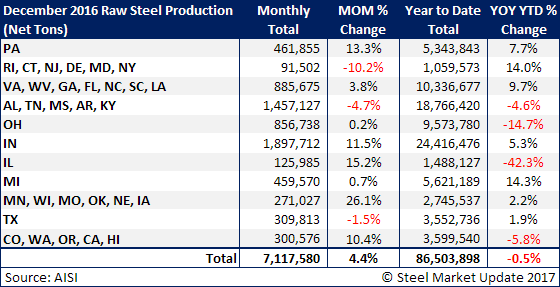

Compared to total production in 2015, 2016 production was nearly a tie; down 0.5 percent or 408,052 tons to 86,503,898 tons. The table below shows that 7 of the 11 state-groups reported increased annual production compared to the same period last year.

The capacity utilization rate for the month of December 2016 was reported to be 67.8 percent, down from 67.1 percent in November and down from 62.1 percent reported in December 2015. The yearly capacity utilization rate is now 70.5 percent, down from 70.8 percent in November and down from 70.1 percent in December 2015. Readers should be aware that there has been a reduction in available steel capacity from 2015 to 2016, making the capacity utilization rate higher in 2016 for the same amount of steel produced in 2015.

SMU Note: An interactive graphic of our raw steel production history can be seen in the Analysis section of our website here. If you need help logging into the website or navigating through it, please contact us at info@SteelMarketUpdate.com or 800-432-3475.