Market Data

February 17, 2017

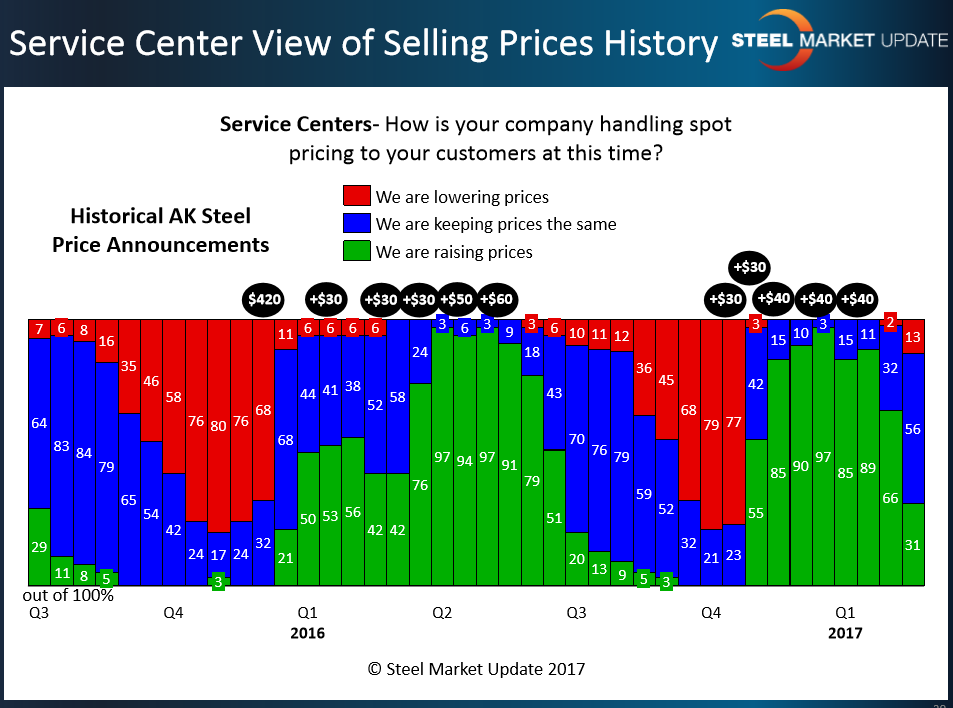

Service Centers in Early Stages of Discounting Spot Steel Prices

Written by John Packard

Steel Market Update (SMU) watches the flat rolled steel service centers very closely for signs of strength or weakness. These signs come in the form of discounting spot prices to their customers (or to each other). As markets weaken and the steel mills become more aggressive in their negotiations with the distributors, the service centers tend to react by attempting to limit their exposure to what they perceive to be high-priced steel inventories.

Right now, the market spot price cycle appears to be similar to what we saw at the end of the “up” pricing cycle in late 2nd Quarter 2016. The price increase announcements stopped and prices began flattening out and then moving lower. In the graphic below, the service centers are just beginning to break ranks and begin lowering spot prices to their flat rolled steel customers. The ovals above the bars represent steel mill price increase announcements as reported by AK Steel. We use AK Steel as their increase announcements are part of their press release files on their website (so anyone can go look at the announcements). The last price announcement was made in early January 2017.

Early last week SMU met with a manufacturing company and we discussed the issue of steel prices and the manufacturer’s ability to increase prices to their customers. We were told that the mills do not do the manufacturers any favors by having successive price increase announcements with just a week or two in between the announcements. We were told the quicker the increases come, the less willing the manufacturer was to increase prices since history has shown the increases that don’t have time to penetrate through the market will ultimately fail and pull back.

SMU believes the steel mills are about to raise prices again as they try to stop the bleeding but also in recognition of higher feed stock price issues to come in March – specifically scrap pricing.

Can they influence service centers and get them to not offer lower spot prices into the market and, instead, move the needle higher? We may have a chance to measure the effectiveness of a new increase in a couple of weeks when we go out for our next flat rolled market trends analysis.

SMU Note: The Power Point slides shown in our articles are available to those who participate by answering our questionnaire and our Premium level members. To get more information about becoming a Premium subscriber please contact us at: info@SteelMarketUpdate.com