Market Data

March 9, 2017

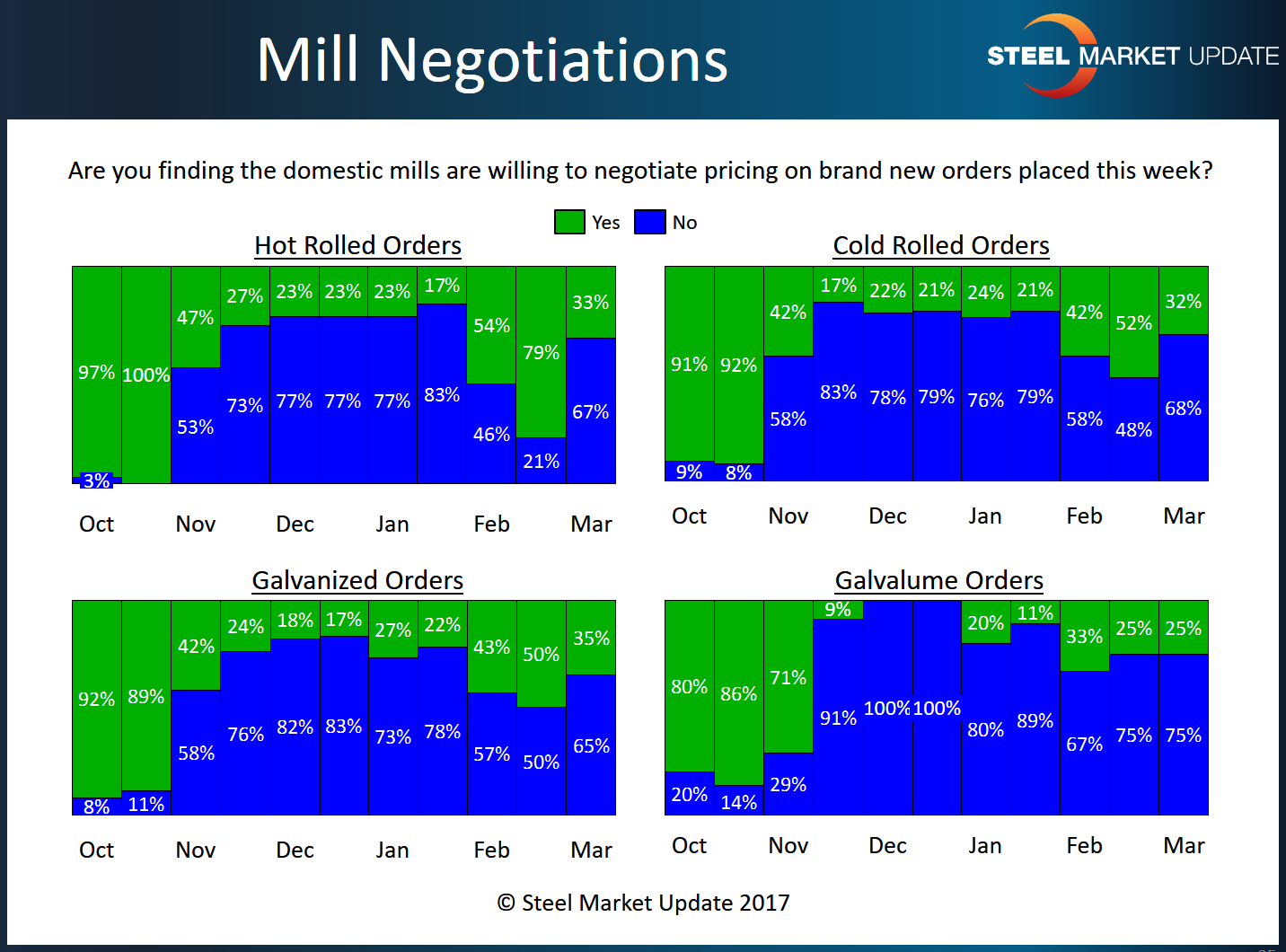

Steel Mills Less Willing to Negotiate Steel Prices

Written by John Packard

Flat rolled steel mills have become less enthusiastic about negotiating prices for new orders of hot rolled, cold rolled, galvanized and Galvalume steels. Based on the results of the flat rolled steel market trends analysis coming out of the survey we have been conducting over the past four days.

We found 33 percent of the respondents to our survey described steel mills as willing to negotiate hot rolled prices. This is a significant move compared to the 79 percent we reported based on our mid-February analysis.

On cold rolled we found 32 percent of our respondents reporting steel mills as willing to negotiate CR pricing. This is down from the 52 percent reported in mid-February.

Galvanized negotiations were also down as 35 percent of our respondents reported mills as willing to negotiate GI prices. This is down from the 50 percent reported in our mid-February survey.

Galvalume was the one item that remained constant with only 25 percent of our respondents reporting steel mills as willing to negotiate pricing.

SMU Note: The domestic steel mills have begun announcing flat rolled steel price increases over the course of the past three days.

A side note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies, or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.