Prices

March 21, 2017

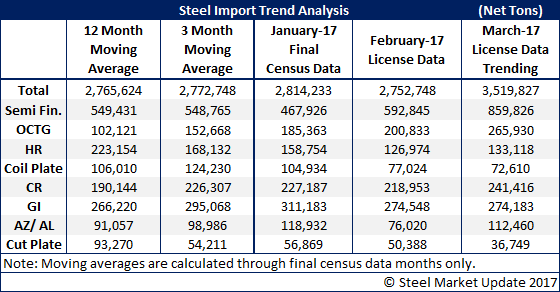

March Imports Trending Over 3 Million Tons

Written by John Packard

The U.S. Department of Commerce released March license data this afternoon that shows foreign steel imports trending toward a 3.5 million net ton month. SMU does not believe the month will come in at that level when all is said and done, but it appears it will be the first month to reach or exceed 3 million tons since August 2016. Last March the U.S. imported a total of 2.6 million tons. The data just released shows import licenses totaling 2,384,400 net tons through the 21st of March.

We remind our readers that the numbers shown above for the months of February and March are based on license data and not census data. The February numbers have been out long enough so they should not vary by more than a couple of hundred thousand tons. The March total is based on a daily import rate of 113,543 tons and when that rate is spread over a 31-day month it comes to the 3.5 million tons.

We work the same formula with all of the other products shown and the notable items to watch to see if the trend continues are:

Semi-finished (mostly slabs but some billets as well) at an 800,000 tons trend means the domestic mills are responsible for more than 25 percent of the total imports since a portion of the hot rolled number is also going to the domestic steel mills for further processing.

OCTG – has been growing as the energy markets improve.

Cold rolled – continues to be at high levels.

Galvanized – continues to be at high levels.

Galvalume – after a milder than normal level in February, March appears to be roaring back.

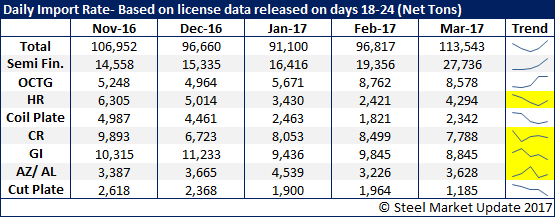

Below is a look at the trend lines by product based on the license rate for this time of the month:

Below is a look at the trend lines by product based on the license rate for this time of the month: