Market Data

April 2, 2017

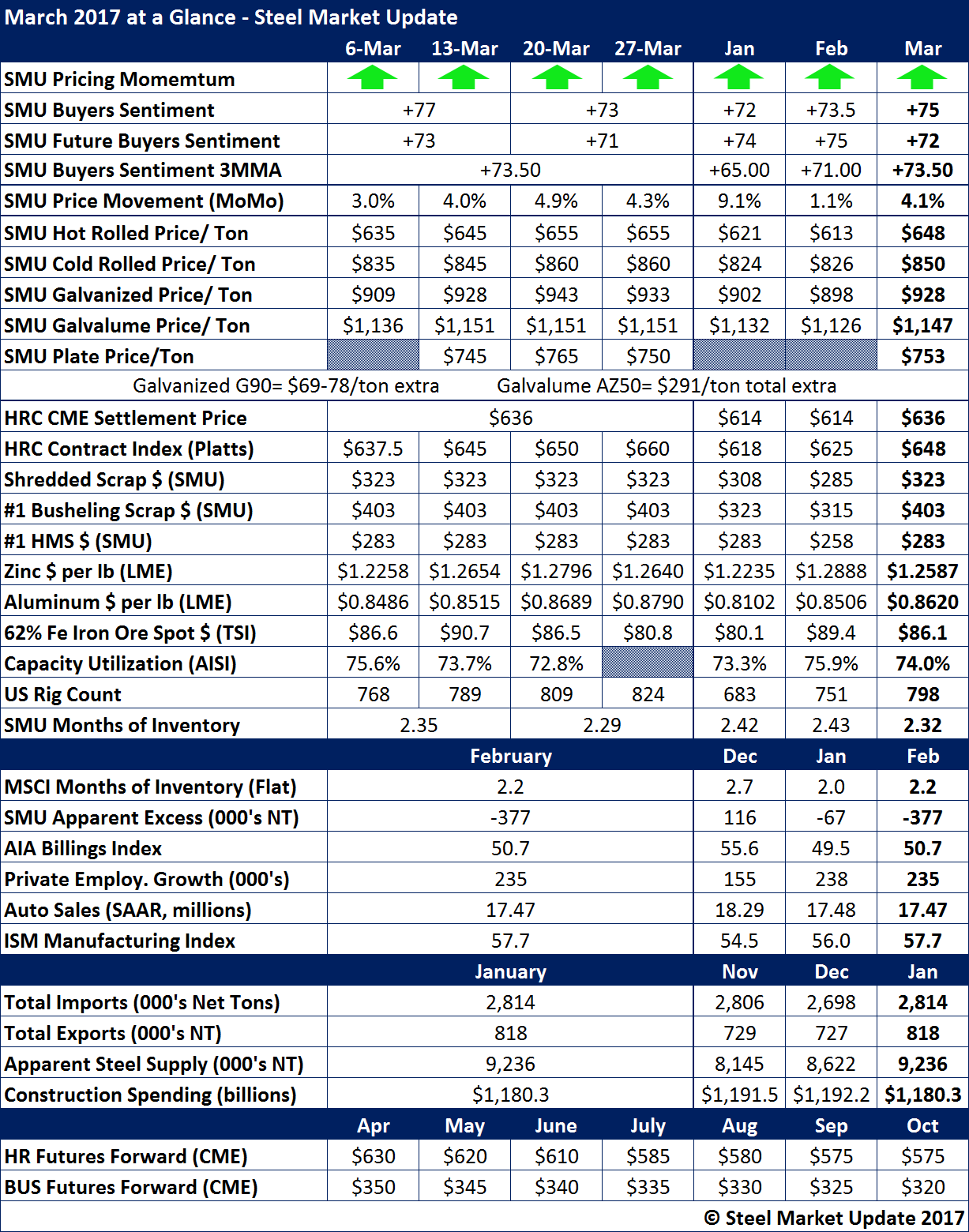

March 2017 at a Glance

Written by John Packard

Flat rolled steel Price Momentum ended the month of March where it began – indicating higher prices for hot rolled, cold rolled, galvanized, Galvalume and now plate prices. The steel and manufacturing industries remain firmly entrenched in the Optimistic camp as the SMU Steel Buyers Sentiment Index hit new highs for the three-month moving average (3MMA) of the Current Sentiment time period as well as that representing Sentiment three to six months into the future. The 3MMA ended March at +73.50.

A bit of a disconnect has been growing between the CME Settlement numbers and the SMU and Platts hot rolled coil index. Both the SMU and Platts average for HRC for the month of March was $648 per ton. The CME Settled HRC contracts for the month of March based on a $636 per ton monthly average.

In the table below you will also find SMU averages for cold rolled, galvanized, Galvalume and this is the first month where we are now including plate prices in our data.

Scrap prices (Chicago/Midwest/Ohio Valley average) were up strong in March on all product categories.

Zinc, used to coat galvanized, Galvalume, Galfan and other coated products was actually down slightly from the prior month.

Iron ore is also down and you need to look at the weekly data rather than the average to get a feel for the trend. This is a potential negative for higher steel prices (or from the manufacturing perspective this is a potential positive associated with future steel price negotiations).

Good news: Oil Rigs are up in the US, Months of Inventory at service centers are down (Apparent Deficit is growing), AIA Billings Index is over 50.0,