Prices

April 23, 2017

Foreign Hot Rolled, Cold Rolled, Galvanized & Galvalume Percentage of US Market Share

Written by John Packard

There has been much discussion about the impact of foreign steel on the U.S. economy and specifically how it impacts the steel industry and steel prices. Most in the steel industry believe foreign steel to be a cancer on world trading while others see it as a way of taking wealth from one country and shipping it to the United States. This is good for the U.S. consumer and bad for the exporting country.

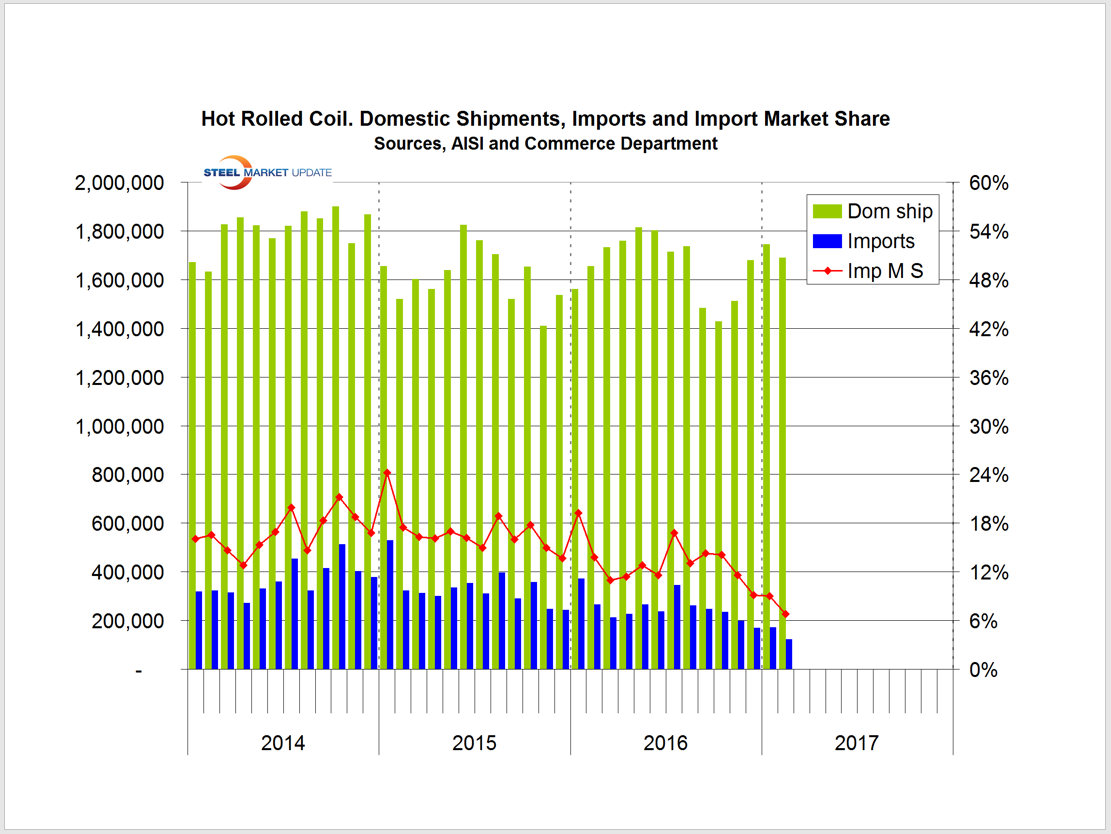

Hot Rolled Imports are Sliding

The graphic below shows hot rolled coil imports and the market share imports represent of the total market. In early 2014, hot rolled coil imports reached 800,000 metric tons during one month, which was 24 percent of the total hot rolled market. Since the trade suits were filed in the summer of 2015 and results from the suits were issued during 2016, we have seen hot rolled import numbers slide (see below).

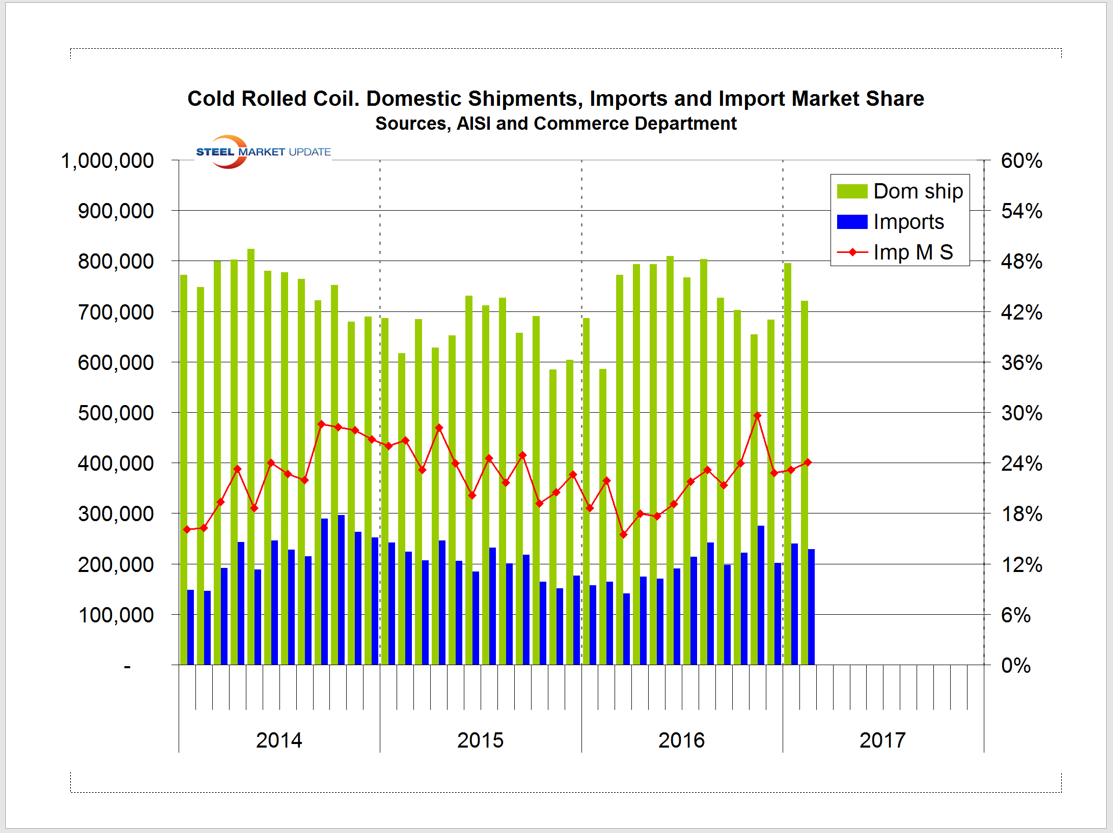

Cold Rolled Imports Gaining Market Share Despite AD/CVD Rulings

Unlike hot rolled, cold rolled shipments have continued to take market share as we moved into 2017. After the initial AD/CVD findings were announced in 2016 we did see an erratic decline in the percentage of market penetration from imports of cold rolled products. However, by mid-2016 the reduction in cold rolled tonnage was reversed as more tons came flowing into the domestic market.

Imports of cold rolled went from 17 percent of total shipments in late 1Q 2016 to a 30 percent share in late fourth Quarter 2016. So far this year, CRC imports are running around 24 percent of the total CR market in the U.S.

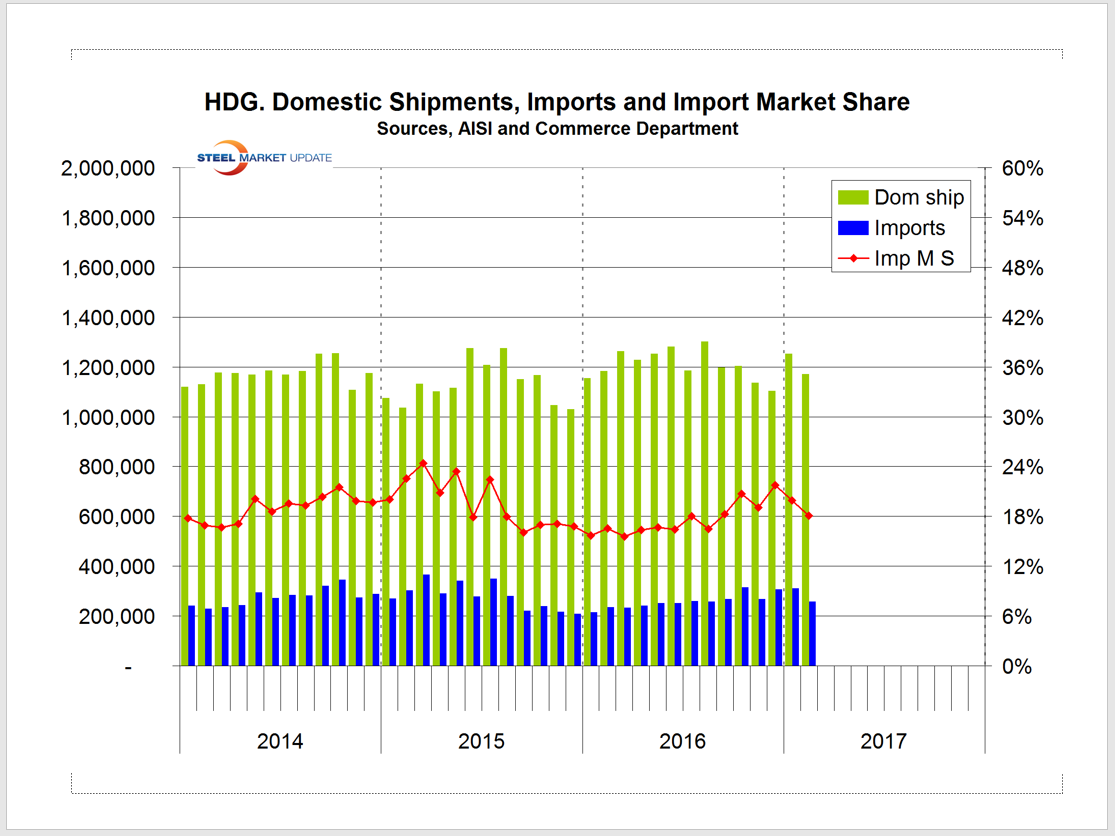

Hot dipped galvanized imports saw anti-dumping and countervailing duty filings in June 2015. From mid-2015 until the fourth quarter 2016, galvanized imports were flat at around 17 percent market share. Once we got into the last quarter of 2016 imports of HDG rose to 18-21 percent share.

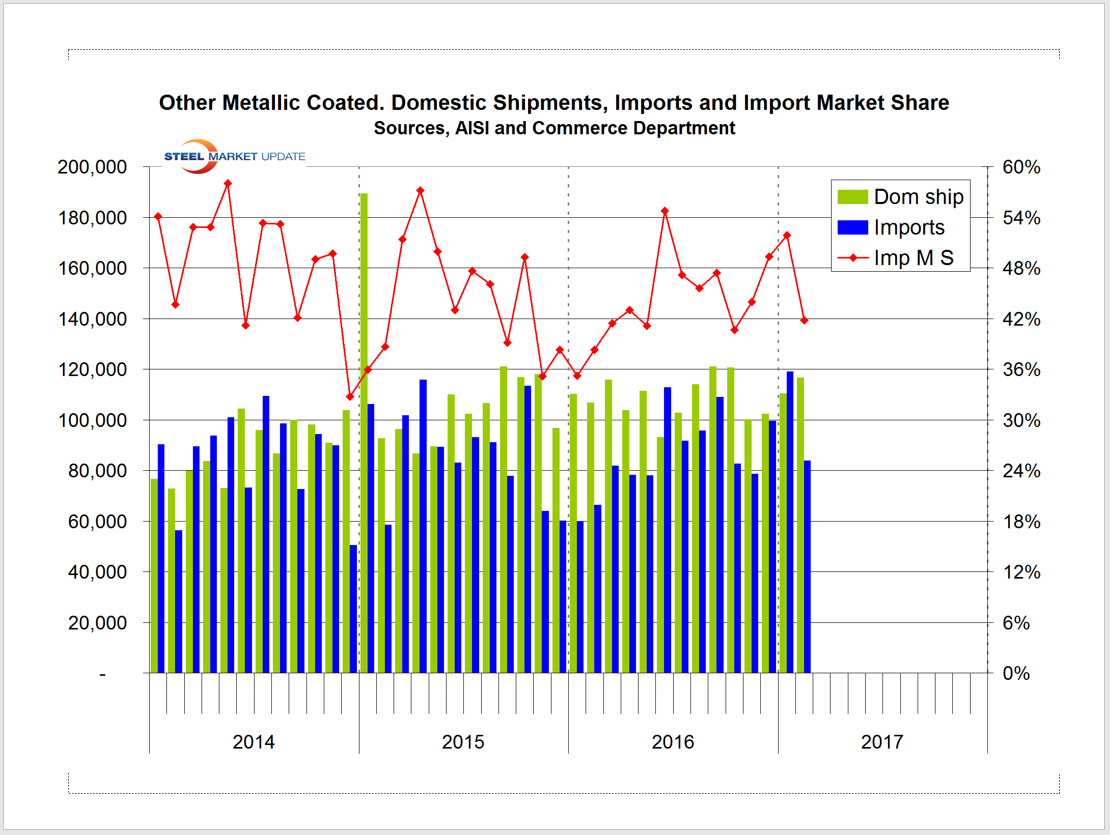

Other Metallic Coated Market Share

Just prior to the dumping suits being filed in June 2015, other metallic coated imports (of which Galvalume makes up the vast majority of the tonnage) accounted for well over 50 percent of the total market share. By fourth quarter 2015 the share dropped to 36 percent before rebounding to 54 percent in mid-2016, right around the time the final determinations were being announced on coated steels.