Distributors/Service Centers

May 23, 2017

Service Centers Report Inventories as Balanced

Written by John Packard

Flat rolled steel distributors are reporting to Steel Market Update (SMU) that their inventories are balanced to slightly over-stocked and there is minimal need to build carbon sheet inventories from here.

At the end of March the MSCI reported flat rolled steel inventories at 1.82 month’s supply. Last week the MSCI reported end of April months on hand (MOH) of 2.1 (not seasonally adjusted) on carbon sheet.

In an article to our Premium level members, Steel Market Update reported our Service Center Inventories Apparent Excess/Deficit model indicates flat rolled steel distributor inventories are in deficit to the tune of -816,000 tons. Our model calls for the deficit to peak in May and then shrink over the summer months.

Over the past two days Steel Market Update has been canvassing service centers to see if our collection of inventory data comes up with a similar months of supply on hand as what was reported by the MSCI. Our service center sources supplied SMU with data which suggests distributor inventories at 2.15 month’s supply (MSCI is 2.1 months supply).

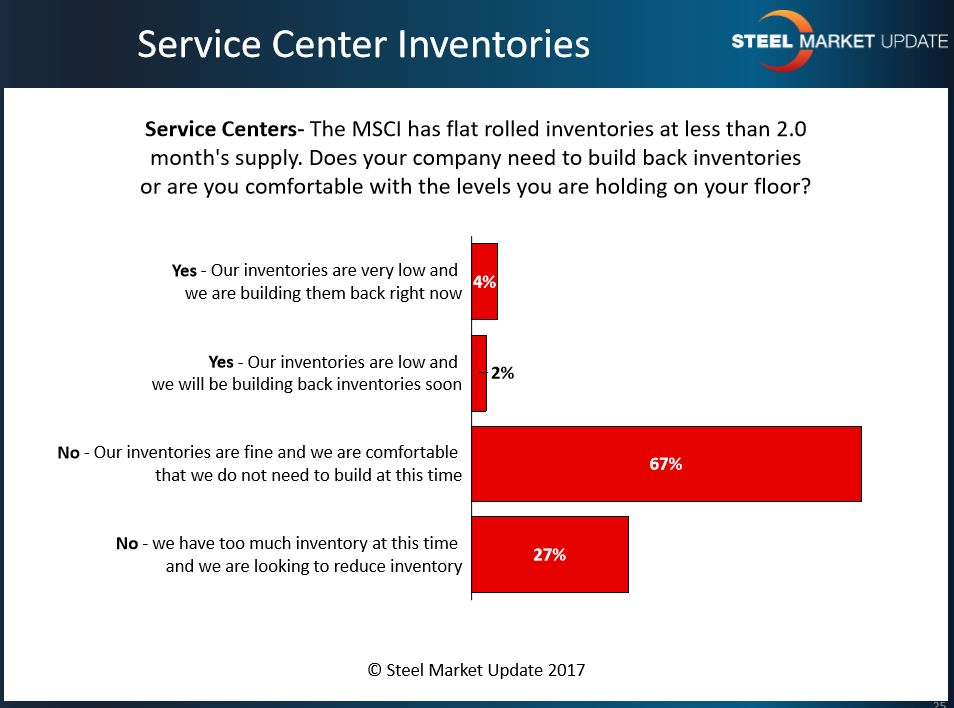

Last week SMU conducted our mid-May flat rolled steel market trends analysis. One of the areas we tested was to ask service centers if their inventories are at “comfortable” levels, too low or too high?

As you can see in the graphic below only 4 percent of the service centers responding reported very low inventories that are in the process of being built back now. Another 2 percent reported inventories as being at the low end and that they would need to be built back soon. The vast majority of the responses (67 percent) reported inventories as being comfortable with no need to build from here and another 27 percent reported having too much inventory and their company was looking to reduce inventory.

It is important to watch service center inventories and to understand whether inventories are “balanced” or out of whack one way or another. Out of whack inventories means adjustments have to be made and, as those adjustments are made they impact lead times and thus pricing. We are seeing lead times slipping (based on our own survey results) which has opened Pandora’s Box for negotiations. We will have more about lead times in upcoming newsletters.