Prices

May 30, 2017

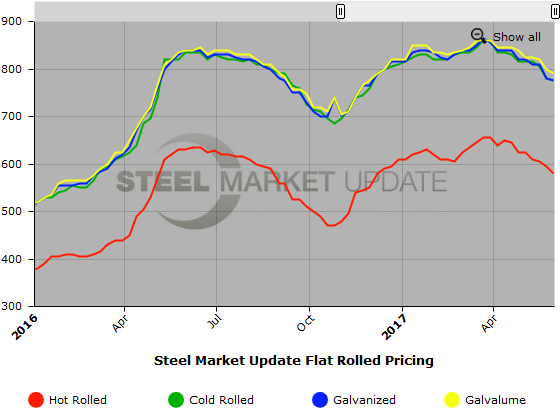

SMU Price Ranges & Indices: Slide Continues

Written by John Packard

Flat rolled prices continued their skid despite the Memorial Day Holiday. Prices were lower by $5 to $15 per ton depending on product. Steel buyers continue to be concerned about the direction of prices and how long this downward spiral will last. We have more on the comments received today as we canvassed both end users and service centers to determine the new range and averages published below.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $550-$610 per ton ($27.50/cwt-$30.50/cwt) with an average of $580 per ton ($29.00/cwt) FOB mill, east of the Rockies. The lower end of our range declined $20 per ton compared to one week ago while the upper end decreased $10 per ton. Our overall average is down $15 per ton compared to last week. Our price momentum on hot rolled steel is pointing to Lower which means we expect prices to decline over the next 30-60 days.

Hot Rolled Lead Times: 3-6 weeks

Cold Rolled Coil: SMU price range is $740-$810 per ton ($37.00/cwt-$40.50/cwt) with an average of $775 per ton ($38.75/cwt) FOB mill, east of the Rockies. The lower end of our range remained the same compared to last week while the upper end declined $10 per ton. Our overall average is down $5 per ton compared to one week ago. Our price momentum on cold rolled steel is pointing to Lower which means we expect prices to decline over the next 30-60 days.

Cold Rolled Lead Times: 5-7 weeks

Galvanized Coil: SMU base price range is $37.00/cwt-$40.50/cwt ($740-$810 per ton) with an average of $38.75/cwt ($775 per ton) FOB mill, east of the Rockies. The lower end of our range was unchanged compared to one week ago while the upper end declined $10 per ton. Our overall average is down $5 per ton compared to last week. Our price momentum on galvanized steel is pointing to Lower which means we expect prices to decline over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU price range is $818-$888 per net ton with an average of $853 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-9 weeks

Galvalume Coil: SMU base price range is $38.00/cwt-$41.00/cwt ($760-$820 per ton) with an average of $39.50/cwt ($790 per ton) FOB mill, east of the Rockies. The lower end of our range declined $20 per ton compared to last week while the upper end remained the same. Our overall average is down $10 per ton compared to one week ago. Our price momentum on Galvalume steel is pointing to Lower which means we expect prices to decline over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1051-$1111 per net ton with an average of $1081 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-8 weeks

Plate: SMU price range is $720-$760 per ton ($36.00/cwt-$38.00/cwt) with an average of $740 per ton ($37.00/cwt) FOB delivered. Both the upper and lower ends of our range remained the same compared to one week ago. Our overall average is unchanged compared to last week. Our price momentum on plate steel is pointing to Lower which means we expect prices to decline over the next 30-60 days.

Plate Lead Times: 3-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. We will add plate prices to this graph once we have gathered a few months of data. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.