Market Data

June 8, 2017

Flat Rolled Lead Times Continue to Slide

Written by Tim Triplett

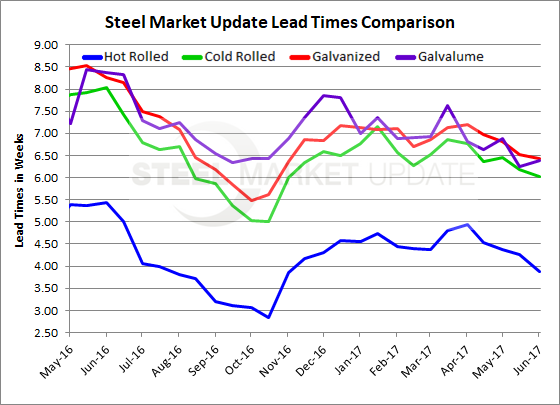

Flat rolled lead times have continued to decline over the past 10 weeks, according to this week’s SMU Flat Rolled Steel Market Trends questionnaire. Buyers and sellers of flat rolled steel report shorter lead times than in early May. Lead times on all products are considerably shorter than one year ago.

Shorter lead times are a key indicator of future steel pricing and tend to reflect weakening demand. The shorter the lead time, the more pressure on flat rolled steel pricing. This is especially important to note when considering the domestic steel mill price announcements of $30 per ton earlier this week. We will have to see if their announcement gets buyers “off their hands” or if inventories are balanced and there is no need to expedite new orders, thus keeping lead times stable. The clear outlier is the Section 232 investigation and whether foreign steel buyers move some of their purchases to the domestic steel mills. That could potentially create a jump in lead times. SMU will be watching this carefully in the days and weeks ahead.

Hot rolled lead times currently average around 3.88 weeks, down from 4.37 weeks at the beginning of May. One year ago, HRC lead times were 5.43 weeks.

Cold rolled lead times also dropped to an average of 6.03 weeks, down from 6.46 weeks in early May and 8.04 weeks a year ago.

Galvanized lead times average 6.42 weeks, down from 6.82 weeks on May 1. One year ago, around June 1, 2016, GI lead times averaged 8.25 weeks.

The story is the same for Galvalume, where lead times dipped to 6.25 weeks from 6.89 weeks a month earlier. One year ago, AZ lead times were reported to be 8.38 weeks.

SMU Note: The data for both lead times and negotiations comes from only service center and manufacturer respondents. We do not include commentary from the steel mills, trading companies, or toll processors in this particular group of questions.

To see an interactive history of our Steel Mill Negotiations data, visit our website here.