Market Data

June 12, 2017

Shipments and Supply of Sheet Products through April

Written by Peter Wright

This report summarizes total steel supply from 2003 through April 2017 and year-on-year changes. It then compares domestic mill shipments with total supply to the market. It quantifies market direction by product and enables a side-by-side comparison of the degree to which imports have absorbed demand. Sources are the American Iron and Steel Institute and the Department of Commerce with analysis by SMU.

Table 1 describes both apparent supply and mill shipments (including exports) of sheet products side by side as three-month moving averages (3MMA) through April for both 2016 and 2017.

Apparent supply is a proxy for market demand. Comparing these two time periods, total supply to the market was up by 3.3 percent and shipments were up by 2.7 percent. The fact that the increase in supply was more than the increase in mill shipments means that imports were more of a factor in the market compared to the same three months last year. Table 1 breaks down the total into product detail and shows that supply grew by more than shipments for every product except hot rolled coil. Electrogalvanized is an oddball because it has net exports.

A review of supply and shipments separately for individual sheet products is given below.

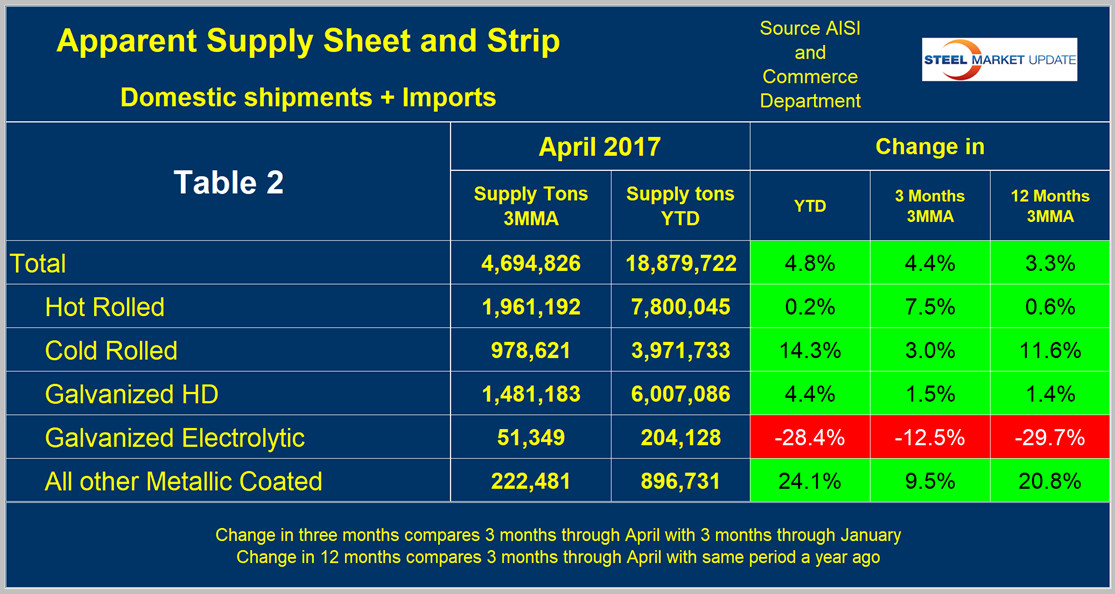

Apparent Supply

Apparent supply is defined as domestic mill shipments to domestic locations plus imports. In the three months through April 2017, the average monthly supply of sheet and strip was 4.695 million tons, up by 3.3 percent compared to the same period ending in April 2016. In the three months through April compared to the three months through January, supply was up by 4.4 percent. The short-term increase (3 months) compared to the long-term improvement (12 months) shows that momentum was positive through April. There is no seasonal manipulation of any of these numbers. By definition, year-on-year comparisons have seasonality removed, but three-month comparisons do not. Table 2 shows the change in supply by product on this basis through April. Momentum was positive for hot rolled coil and negative for other metallic coated, mainly Galvalume, and cold rolled coil. Hot-dipped galvanized had no momentum in either direction.

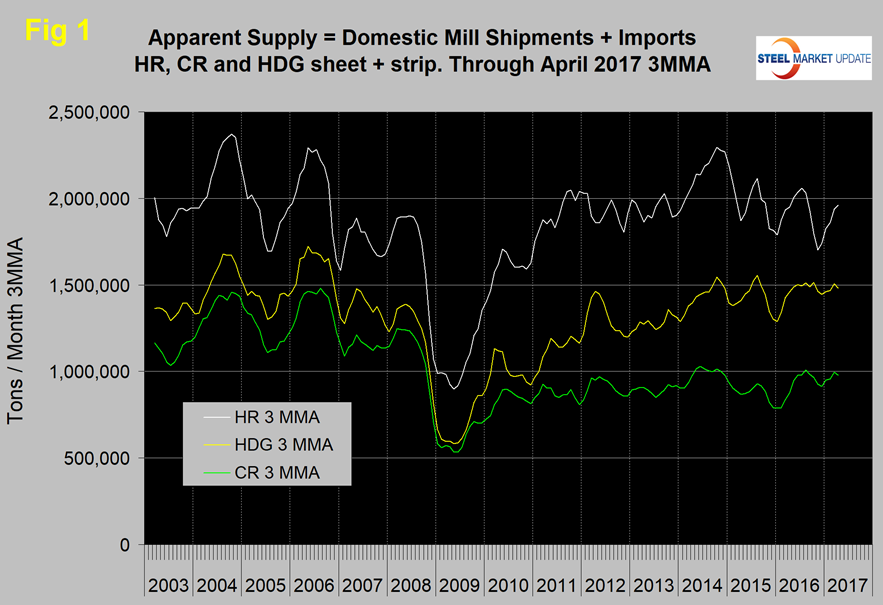

Figure 1 shows the long-term supply picture for the three major sheet and strip products, hot rolled coil (HRC), cold rolled coil (CRC) and hot-dipped galvanized (HDG) since January 2003 as three-month moving averages. All three products have improved this year, particularly HRC on a three-month basis.

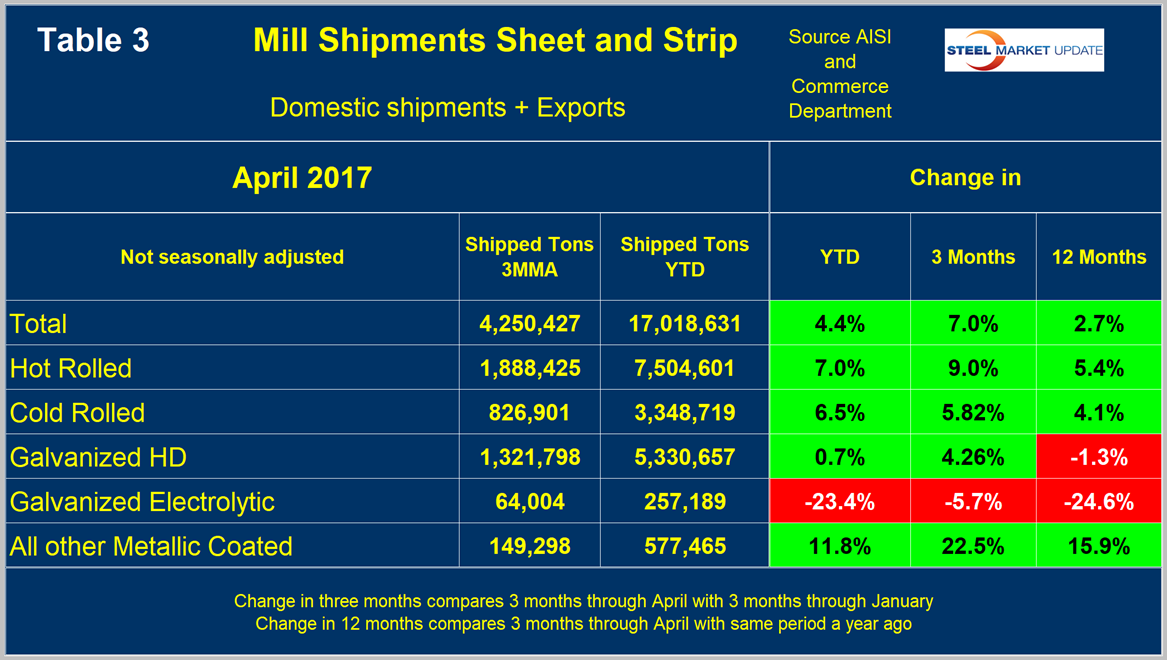

Mill Shipments

Table 3 shows that total shipments of sheet and strip products including HRC, CRC and other metallic coated (OMC) products were up by 2.7 percent in the three months through April year over year.

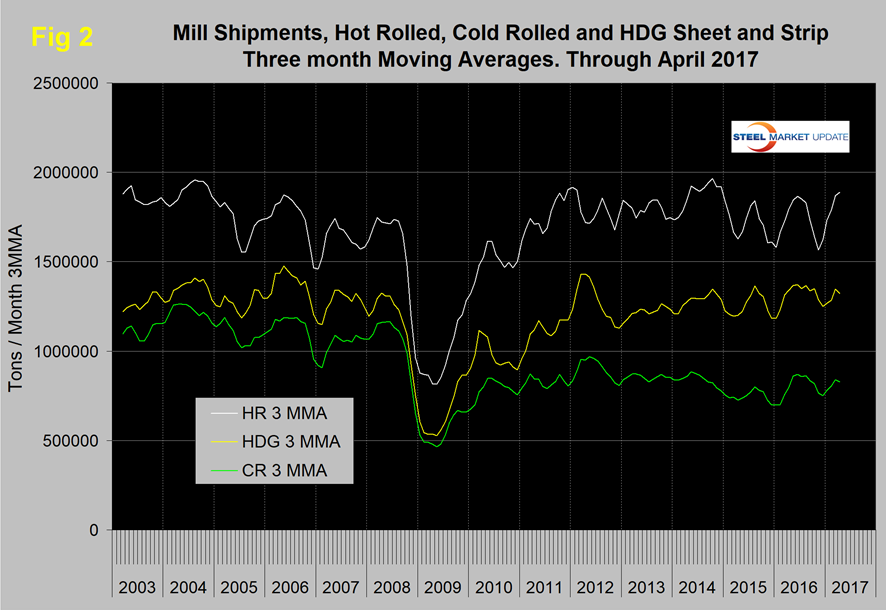

They were also up by 7.0 percent comparing three months through April with three months through January. These January/April numbers have a seasonal content. But discounting that, we believe the momentum was positive, which was also true of all individual products. Figure 2 puts the shipment results for the three main products into the long-term context since January 2003.

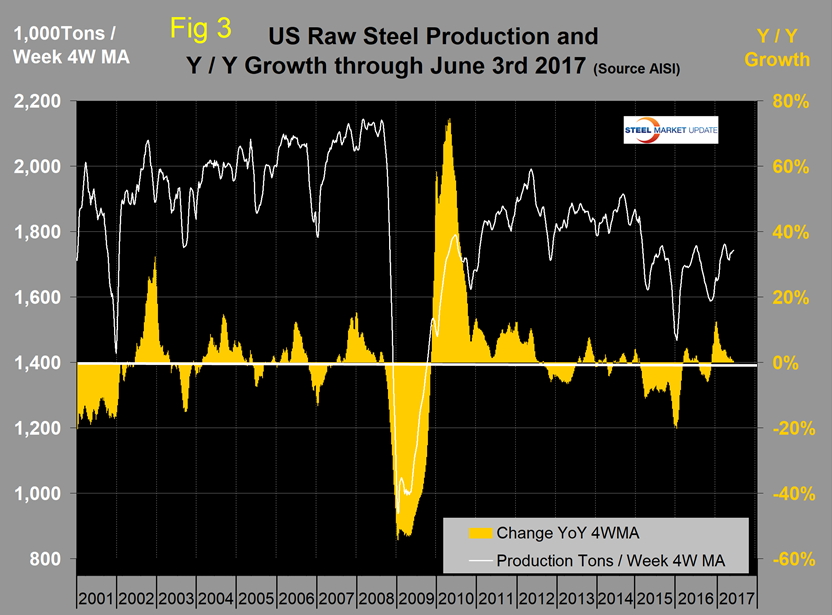

SMU Comment: The steel market is growing at a 3.3 percent rate year over year. Imports are increasing their share as mill shipments grew by a slower 2.7 percent. A problem with this data is that it’s now well into June and the latest information we have for shipments and supply is for April. The AISI puts out weekly data for crude steel production, the latest of which was for the week ending June 3. This provides the most current data for steel mill activity. Figure 3 shows the year-over-year change in weekly crude output on a four-week moving average basis.

Growth became positive year on year in the week ending November 19, 2016, and has been positive for the past 23 weeks, but has been slowing since the recent peak at the end of last year. Based on the strength of the economic indicators analysis that SMU performs and our proprietary measure of buyer sentiment, we are expecting demand for sheet products to continue to increase through the third quarter.