Prices

June 13, 2017

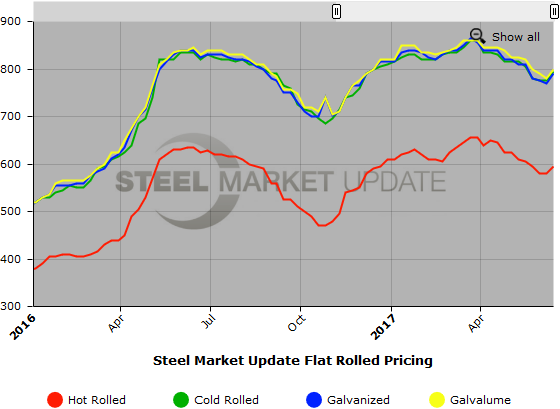

SMU Price Ranges & Indices: Prices Move Higher

Written by John Packard

Flat rolled steel prices moved higher this week as the effects of last week’s price increase announcements begun to take place. Prices on all but plate moved up by $15 to $20 per ton. As one mill pointed out to SMU earlier today many of the orders that are being placed this week are smaller in size than what was done last week before prices were pulled. The big guys have bought their tons. One service center told SMU today they placed 30,000 tons and wouldn’t need to buy again for some time. At least enough time to figure out what Section 232 really means for the market.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $580-$610 per ton ($29.00/cwt-$30.50/cwt) with an average of $595 per ton ($29.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago while the upper end increased $10 per ton. Our overall average is up $15 per ton compared to last week. Our price momentum on hot rolled steel is pointing to Neutral as we evaluate whether the market has truly turned a corner and will head higher or lower from here.

Hot Rolled Lead Times: 3-5 weeks

Cold Rolled Coil: SMU price range is $780-$810 per ton ($39.00/cwt-$40.50/cwt) with an average of $795 per ton ($39.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $40 per ton compared to last week while the upper end remained the same. Our overall average is up $20 per ton compared to one week ago. Our price momentum on cold rolled steel is pointing to Neutral as we evaluate whether the market has truly turned a corner and will head higher or lower from here.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU base price range is $38.50/cwt-$40.50/cwt ($770-$810 per ton) with an average of $39.50/cwt ($790 per ton) FOB mill, east of the Rockies. The lower end of our range increased $30 per ton compared to one week ago while the upper end increased $10 per ton. Our overall average is up $20 per ton compared to last week. Our price momentum on galvanized steel is pointing to Neutral as we evaluate whether the market has truly turned a corner and will head higher or lower from here.

Galvanized .060” G90 Benchmark: SMU price range is $848-$888 per net ton with an average of $868 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-7 weeks

Galvalume Coil: SMU base price range is $39.00/cwt-$41.00/cwt ($780-$820 per ton) with an average of $40.00/cwt ($800 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range rose $20 per ton compared to last week. Our overall average is up $20 per ton compared to one week ago. Our price momentum on Galvalume steel is pointing to Neutral as we evaluate whether the market has truly turned a corner and will head higher or lower from here.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1071-$1111 per net ton with an average of $1091 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-10 weeks

Plate: SMU price range is $700-$760 per ton ($35.00/cwt-$38.00/cwt) with an average of $730 per ton ($36.50/cwt) FOB delivered. The lower end of our range declined $30 per ton compared to one week ago while the upper end declined $20 per ton. Our overall average is down $25 per ton compared to last week. Our price momentum on plate steel is pointing to Neutral as we evaluate whether the market has truly turned a corner and will head higher or lower from here.

Plate Lead Times: 4-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. We will add plate prices to this graph once we have gathered a few months of data. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.