Market Data

July 20, 2017

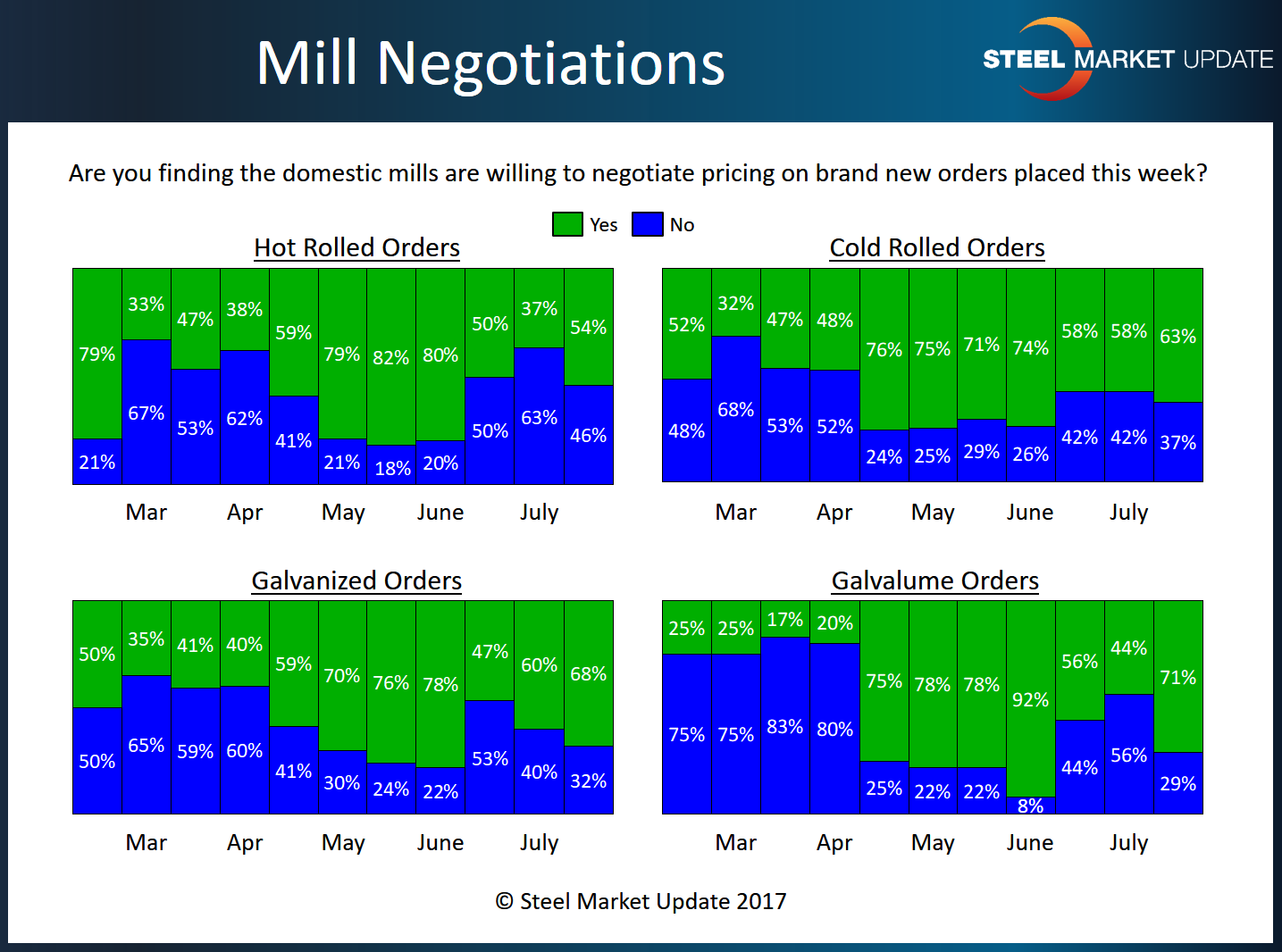

Steel Mills More Willing to Negotiate Prices

Written by Tim Triplett

Despite the risks associated with Section 232 and the belief that flat rolled steel prices will rise prior to and immediately after the announcement of a Section 232 decision, mills appear somewhat more open to price discussions. Based on the responses received this week from our flat rolled market trends questionnaire, buyers and sellers of steel were reporting the domestic mills as being more active than what was measured at the beginning of the month.

The respondents to our market analysis questionnaire reported a modest increase in those reporting the mills as willing to negotiate. Hot rolled saw 54 percent of our respondents reporting mills as willing to negotiate. Cold rolled went from 58 percent to 63 percent reporting mills as negotiable. Galvanized went from 60 to 68 percent and Galvalume rose to 71 percent from 44 percent.

SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.