Prices

August 6, 2017

June Foreign Steel Imports Highest Since January 2015

Written by John Packard

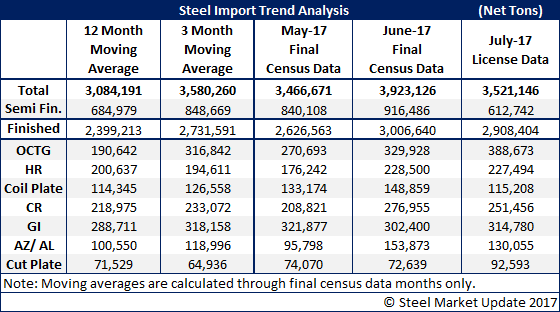

It is now official. According to the U.S. Department of Commerce, June 2017 foreign steel imports totaled 3,923,126 net tons and are at the highest levels seen since January 2015, prior to the antidumping (AD) and countervailing duties (CVD) trade suits being filed.

![]() Approximately one-quarter of the imports were semi-finished steels (mostly slabs) with the domestic mills bringing in 916,486 net tons of semi’s. With the steel mills responsible for a portion of the hot rolled and cold rolled tonnage, they could very well be responsible for 30 percent of total foreign steel imports.

Approximately one-quarter of the imports were semi-finished steels (mostly slabs) with the domestic mills bringing in 916,486 net tons of semi’s. With the steel mills responsible for a portion of the hot rolled and cold rolled tonnage, they could very well be responsible for 30 percent of total foreign steel imports.

Finished steel imports for June reached 3 million net tons, 380,000 tons greater than May and 607,427 tons above the 12-month moving average for finished steels.

We are seeing a surge occurring in oil country tubular goods, which at 329,928 net tons are almost double their 12-month moving average (July license data suggests they will be double when the final July numbers come out).

License data compiled through the 4th of August for July indicates a 3.5 million net ton month. This is lower than June, but is still a very high number when compared to the 12-month moving average at 3.0 million tons. As mentioned above, OCTG is surging. Other items that have to be of concern are hot rolled (227,494 tons), cold rolled (251,456 tons), galvanized (314,780 tons) and Galvalume (130,055 tons).