Market Data

September 27, 2017

Durable Goods Stronger Than Expected

Written by Sandy Williams

Durable goods orders rose more than expected in August, picking up a gain of 1.7 percent versus a forecast for 1.0 percent, the U.S. Census Bureau announced today. The increase was welcomed after a 5.8 percent decline in July. A 45 percent jump in the volatile category of nondefense aircraft orders led the increase.

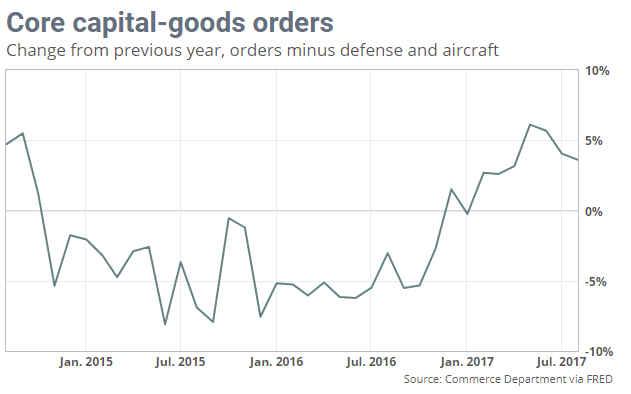

Core capital goods, which exclude defense and aircraft, rose 0.9 percent and shipments of core capital goods increased 0.7 percent. Together, they indicate growing business confidence and bode well for future investment.

The Census Bureau could not determine the impact of Hurricanes Irma and Harvey on this month’s data because the survey is designed to estimate the month‐to‐month change in manufacturing activity at the national level and not for specific geographic areas.

Durable goods are items expected to last for three or more years; orders for such goods are a measure of consumer confidence. Details of the report follow.

New Orders

New orders for manufactured durable goods in August increased $3.9 billion or 1.7 percent to $232.8 billion. This increase, up two of the last three months, followed a 6.8 percent July decrease. Excluding transportation, new orders increased 0.2 percent. Excluding defense, new orders increased 2.2 percent. Transportation equipment, also up two of the last three months, led the increase at $3.6 billion or 4.9 percent to $77.4 billion.

Shipments

Shipments of manufactured durable goods in August, up three of the last four months, increased $0.7 billion or 0.3 percent to $237.2 billion. This followed a 0.1 percent July increase. Machinery, up nine of the last 10 months, led the increase at $0.3 billion or 1.1 percent to $31.4 billion.

Unfilled Orders

Unfilled orders for manufactured durable goods in August, up two of the last three months, increased $0.1 billion or virtually unchanged to $1,132.3 billion. This followed a 0.3 percent July decrease. Fabricated metal products, up seven of the last eight months, drove the increase at $0.5 billion or 0.6 percent to $79.3 billion.

Inventories

Inventories of manufactured durable goods in August, up 13 of the last 14 months, increased $1.4 billion or 0.3 percent to $400.5 billion. This followed a 0.4 percent July increase. Machinery, up nine of the last 10 months, led the increase at $0.6 billion or 0.8 percent to $69.0 billion.

Capital Goods

Nondefense new orders for capital goods in August increased $3.2 billion or 4.7 percent to $71.0 billion. Shipments decreased $1.1 billion or 1.5 percent to $71.6 billion. Unfilled orders decreased $0.6 billion or 0.1 percent to $704.0 billion. Inventories increased $0.7 billion or 0.4 percent to $178.3 billion. Defense new orders for capital goods in August decreased $1.1 billion or 9.4 percent to $10.7 billion. Shipments increased $0.1 billion or 0.8 percent to $10.4 billion. Unfilled orders increased $0.3 billion or 0.2 percent to $142.6 billion. Inventories increased $0.3 billion or 1.1 percent to $23.5 billion.

Revised July Data

Revised seasonally adjusted July figures for all manufacturing industries were: new orders, $465.9 billion (revised from $466.4 billion); shipments, $473.5 billion (revised from $474.3 billion); unfilled orders, $1,132.3 billion.