Market Data

September 25, 2024

Consumer confidence sours in September

Written by David Schollaert

The Conference Board reported that consumer confidence in the US dropped to one of the lowest readings of the year in September. With concerns mounting about business conditions and the labor market, the tumble was the biggest monthly decline since August 2021.

The headline Consumer Confidence Index declined to 98.7 in September from an upwardly revised 105.6 in August. The index measures Americans’ assessment of current economic conditions. September’s lower reading was somewhat of a surprise.

Inflation still a major sticking point

High prices and inflation continue to weigh on consumers, influencing their view of the economy in September, a trend seen for much of the year. Inflation appears to be cooling, but prices have risen more than 16% over the past three years, and the job market shows signs of weakness.

Both the Present Situation and the Expectations indices also declined in September. Despite the downgrade in confidence, consumers’ intent to purchase big-ticket items was mixed, though buying plans for homes and new cars improved slightly.

“Consumers’ assessments of current business conditions turned negative while views of the current labor market situation softened further. Consumers were also more pessimistic about future labor market conditions and less positive about future business conditions and future income,” commented Dana Peterson, chief economist at The Conference Board.

The Present Situation Index, which measures consumer sentiment toward current business and labor market conditions, declined for a third consecutive month, falling 9.1 points from August to 124.3 in September. The Expectations Index, which assesses the short-term outlook for income, business, and labor market conditions, also moved slightly lower to 81.7.

Consumer Confidence 3MMA trend

Calculated as a three-month moving average (3MMA) to smooth out volatility, The Conference Board’s Composite Index was 101.5, a 0.3-point increase from August, marking September as the third straight month to see a rise.

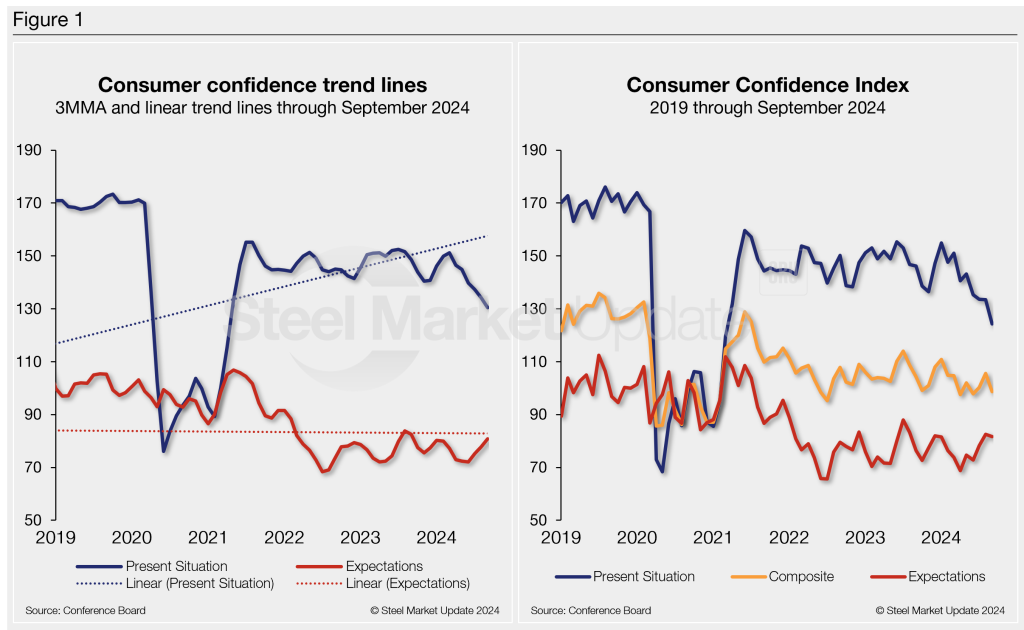

The Composite Index is made up of two sub-indexes: Consumers’ view of the present situation and their expectations for the future. Figure 1 below notes the 3MMA linear trend lines from January 2019 through September 2024 vs. the trend lines of all three subcomponents of the index, Present Situation, Composite, and Future Expectations. All three subcomponents were above the average composite line of 95.7 before the pandemic, then fell consecutively through February 2021. A surge from March through June of 2021 again pulled all three indexes above the composite line. However, economic uncertainty continues to weigh on expectations, keeping them below the average.

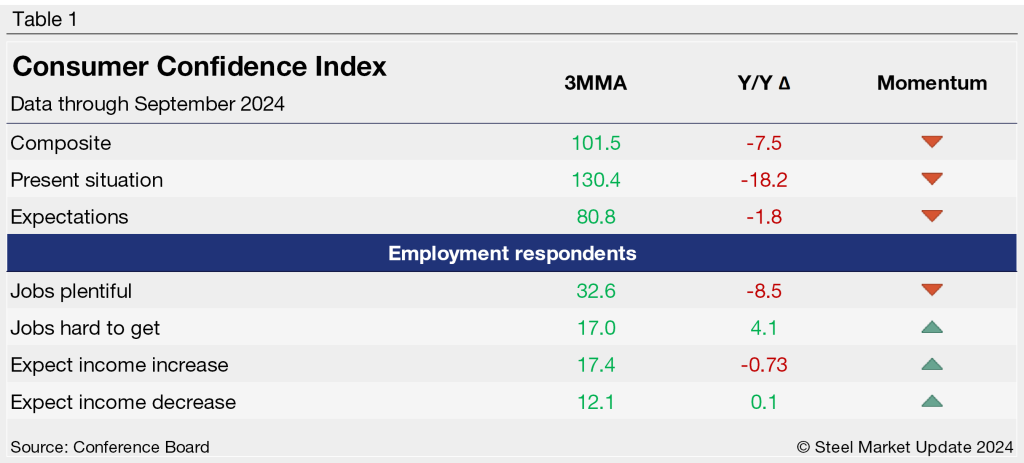

The table below compares September 2024 with September 2023 on a 3MMA basis. The headline index and its two sub-indexes have been declining on a year-over-year (y/y) basis, with the Present Situation showing a much sharper decline. All three indexes also show downward momentum, something worth keeping an eye on, with September’s notable dip.

Business and employment conditions

The present situation saw a sharp cut in September as consumer “confidence declined in September across most income groups, with consumers earning less than $50,000 experiencing the largest decrease,” according to the report.

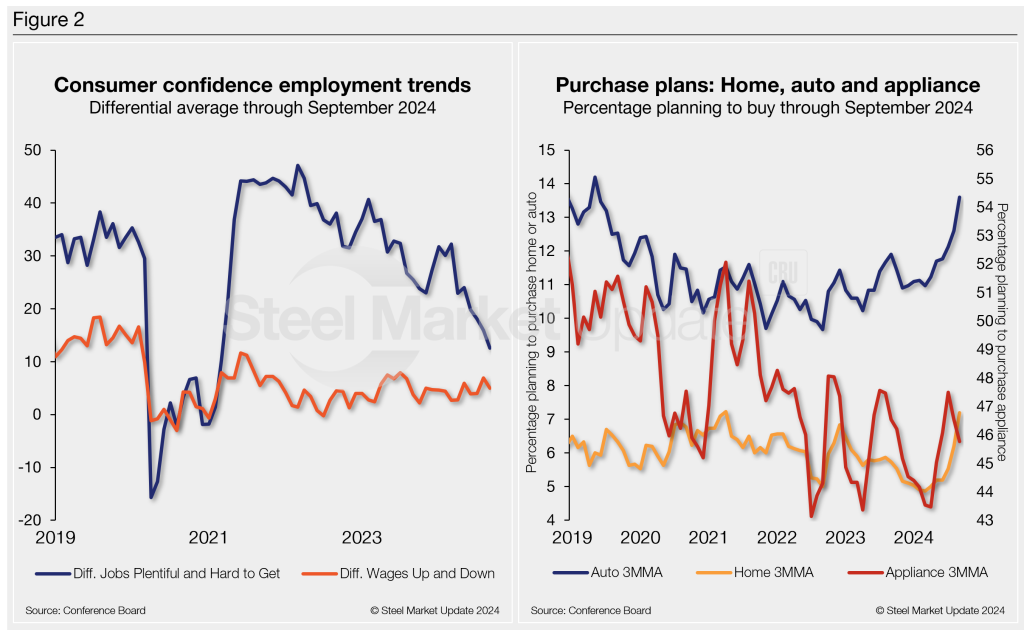

The differential between those finding jobs and those having difficulty was 12.6 in September, down from 15.9 in August and well behind the year-to-date high of 32.2 in March. The difference between those expecting wages to rise vs. those expecting wages to decline moved to 5.0 in September from 6.9 the month prior but is still above a low of 2.7, also registered in March.

Buying intentions for big-ticket items — cars, homes, and major appliances — were mixed in September. While consumers were slightly more keen to purchase autos and homes, they were less so for major appliances.

These recent dynamics and historical movements are illustrated below in Figure 2.

Note: The Conference Board is a global, independent business membership and research association working in the public interest. The monthly Consumer Confidence Survey®, based on a probability-design random sample, is conducted for The Conference Board by Nielsen. The index is based on 1985 = 100. The composite value of consumer confidence combines the view of the present situation and expectations for the next six months.