Prices

September 28, 2017

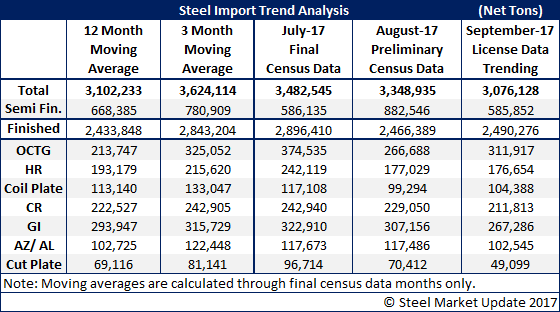

September Foreign Steel Imports Trending toward 3.0 Million Ton Month

Written by John Packard

As was mentioned in the previous issue of Steel Market Update, foreign steel imports for September continue to trend toward another 3.0 million net ton month based on SMU analysis of import license data. If imports come in around 3.0 million tons it would be the lowest level since February 2017 when total steel imports were 2.7 million net tons.

Here are some data points for you to consider:

In 2016 foreign steel imports averaged 2,751,789 net tons per month.

In 2016 foreign steel imports averaged 2,756,030 net tons for the first eight months of the year.

In 2017 foreign steel imports average for the first eight months is 3,315,920 net tons per month.

Compared to 2016, the first eight months of 2017 are averaging 559,890 net tons per month more foreign steel.

Looking at the 12-month moving averages we are seeing OCTG (oil country tubular goods) in September trending above the 12-month moving average. We are seeing a reduction (compared to 12MMA) in the other products referenced in the table above (with exception of Galvalume/Aluminized which are about the same).

Imagine how tight supply would be on the flat rolled mills in the U.S. if those 559,890 tons per month were being produced here in the U.S.