Prices

October 17, 2017

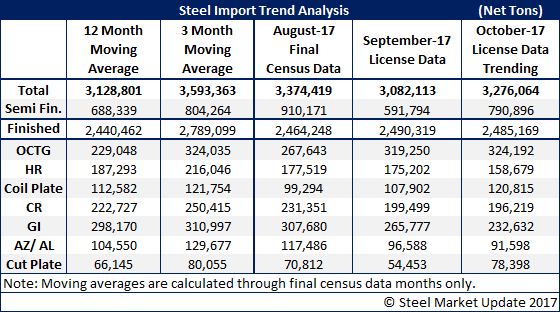

Foreign Steel Imports Trending Toward Another 3 Million Ton Month

Written by John Packard

The U.S. Department of Commerce (DOC) provided license data through Oct. 17 (today) regarding the amount of foreign steel slated to come into the United States during the month of October. Based on the license data, the trend is for yet another 3 million net ton (or higher) month.

There are some significant changes to the numbers that should be viewed carefully. The trend on semi-finished steels (mostly slabs) is for close to 800,000 net tons. This would be up 200,000 tons compared to the previous month. The three-month moving average (3MMA) is 804,000 net tons, so the data is staying consistent. Oil country tubular goods continue to surge with the trend now for 324,000 net tons, which is within the 3MMA for the product and well above the 12-month moving average. Larger imports of OCTG hurts sales of domestic hot rolled coil.

Hot rolled is trending below both 3MMA and 12MMA. Cold rolled is also trending lower and is looking to be below 200,000 net tons. Galvanized is well below the 12MMA and 3MMA and is trending toward 232,000 net tons.

Galvalume continues at high levels just below 100,000 net tons (12MMA is 104,000 tons and 3MMA is 129,000 net tons).