Market Data

November 5, 2017

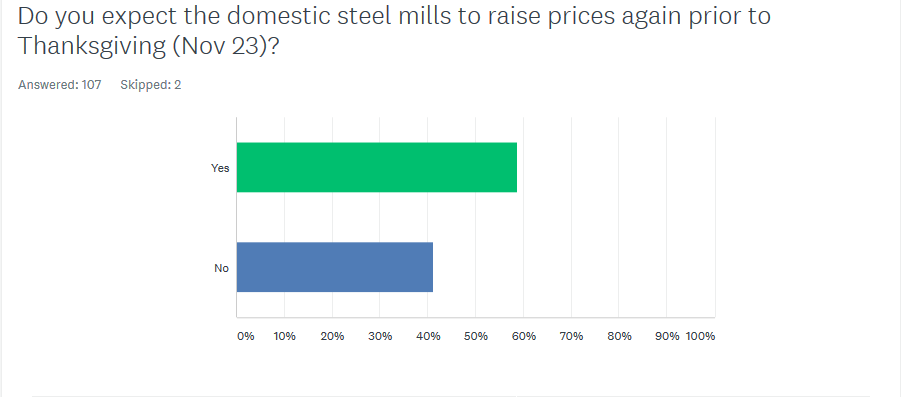

SMU Market Trends: Another Price Hike by Thanksgiving?

Written by Tim Triplett

Is another mill price hike likely? Nearly 60 percent of respondents to Steel Market Update’s market trends questionnaire earlier this week said they do expect the steel mills to make another price announcement this month before the Thanksgiving holiday on Nov. 23. The other 40 percent are doubtful. Following are some of their comments:

· “Yes, I’m 99 percent certain.” Service Center/Wholesaler

· “Yes, they will raise them and probably be a lot more successful with it next time.” Service Center/Wholesaler

· “Yes, if lead times continue to extend.” Steel Mill

· “Yes, zinc will have to be addressed if it stays in the present range.” Steel Mill

· “Yes, once domestic mills get into January shipments they will try to raise prices again. It depends on the product.” Trading Company

· “Yes, they will keep announcing until prices stick and HR gets back up over $600.” Service Center/Wholesaler

Most service center executives who don’t expect another price hike hedged their comments. “No, not unless scrap goes up,” said one. “Some mills might increase their extras. Zinc is still a wild card,” said another. “No, unless circumvention and Section 232 result in some punitive actions. There’s plenty of steel, demand has softened and there’s too many distributors with lots of inventory right now,” concluded a third.