Market Data

November 21, 2017

Strong Distributor Shipments, Receipts Keep Inventories Balanced

Written by John Packard

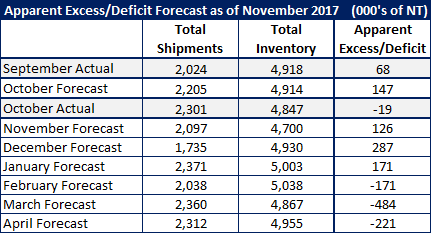

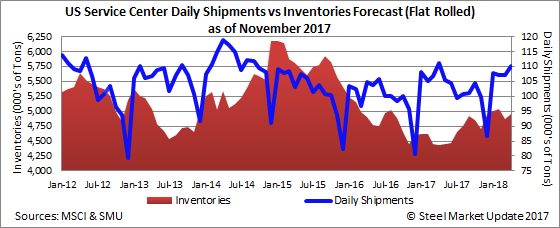

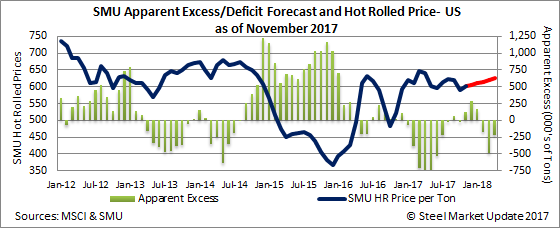

Flat rolled steel inventories ended the month of October in a balanced situation based on the Steel Market Update Apparent Excess/Deficit proprietary model, which is applied to the MSCI inventories and shipment data.

U.S. steel service centers ended the month of September with +68,000 tons of excess inventories, based on the SMU model.

Our forecast called for flat rolled steel distributors to ship 2,205,000 tons of sheet and coil products during the month of October. We also forecast inventories to be at 4,914,000 tons, which if correct would have resulted in the service centers carrying an apparent excess of +147,000 tons.

According to the Metals Service Center Institute (MSCI), October shipments of flat rolled were 2,301,000 tons or almost 100,000 tons better than our forecast.

Our forecast called for receipts to fall in October from the 101,185 tons per day received in September to 100,210 tons per day in October. In actuality, receipts rose to 104,600 tons per day in October.

Inventories of carbon flat rolled came in at 4,847,000 tons or 64,000 fewer tons than forecast.

Service centers are -19,000 tons from having their inventories perfectly balanced.

November Forecast

Steel Market Update believes shipments of flat rolled products will total 2,097,000 tons for the month of November.

We believe inventories of carbon flat rolled will total 4,700,000 tons at the end of the month.

Our forecast calls for the service centers to hold +126,000 tons of excess inventories at the end of the month.