Prices

November 30, 2017

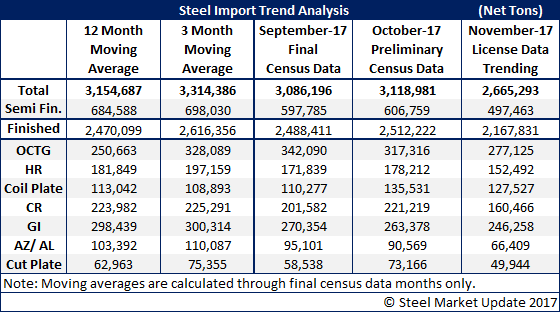

November Foreign Steel Imports 14% Below October Levels

Written by John Packard

Imports of foreign steel will be much lower in November than at any time since April 2016. Based on the most recent license data released on Tuesday, Nov. 28, imports will be approximately 2.6 million tons. This is down from 3.1 million tons in October and is also less than the 2.8 million tons imported last November.

As you can see in the table below, virtually every item followed by Steel Market Update is below the 12-month and 3-month moving averages.

Semi-finished (mostly slabs being brought in by the domestic steel and pipe mills) is 24.2 percent below November 2017 levels and 18 percent less than October 2017 imports.

Hot rolled is 17 percent below year-ago levels and 14.4 percent lower than last month.

Cold rolled is 38.7 percent below November 2016 and 27.5 percent less than October 2017.

Galvanized also dropped, but by far less than the other flat rolled products. GI imports in November were 7.9 percent below last year and 6.5 percent less than last month.

Galvalume (other metallic) imports dropped 15.4 percent M-O-M and totaled 26.7 percent fewer tons than what we recorded in October 2017.

The one sore spot is oil country tubular goods (OCTG) where business has rebounded and so have imports. OCTG imports were up 159.5 percent compared to November 2016. OCTG did drop compared to October by 12.7 percent.

Preliminary Census Data for October 2017

Based on Preliminary Census Data, imports reached 3,119,000 net tons. Here is what the American Iron and Steel Institute (AISI) had to say about imports for the month of October:

Washington, D.C. – Based on preliminary Census Bureau data, the American Iron and Steel Institute (AISI) reported today that the U.S. imported a total of 3,119,000 net tons (NT) of steel in October 2017, including 2,493,000 net tons (NT) of finished steel (unchanged and down 0.4%, respectively, vs. September final data). Year-to-date (YTD) through ten months of 2017, total and finished steel imports are 32,850,000 and 25,449,000 NT, up 19.4% and 15.4%, respectively, vs. the same period in 2016. Annualized total and finished steel imports in 2017 would be 39.4 and 30.5 million NT, up 19.4% and 16.0%, respectively, vs. 2016. Finished steel import market share was an estimated 27% in October and is estimated at 28% YTD.

Key finished steel products with significant import increases in October compared to September include wire rods (up 32%), cut lengths plates (up 27%), plates in coils (up 23%) and standard pipe (up 10%). Major products with significant YTD increases vs. the same period in 2016 include oil country goods (up 231%), line pipe (up 68%), standard pipe (up 44%), mechanical tubing (up 34%), cold rolled (up 26%), sheets and strip all other metallic coatings (up 25%), hot rolled bars (up 21%) and sheets and strip hot dipped galvanized (up 17%)