Plate

January 11, 2018

Sheet and Plate Imports by District of Entry and Source-November 2017

Written by Peter Wright

This analysis breaks down the imported tonnage of six flat rolled products into the district of entry and the source country. We believe that misinformation (or lack of) about regional import volumes is often used to influence purchase decisions. Our intent with this analysis is to describe in detail what is going on in a company’s immediate neighborhood and thus provide a negotiating advantage for our premium subscribers.

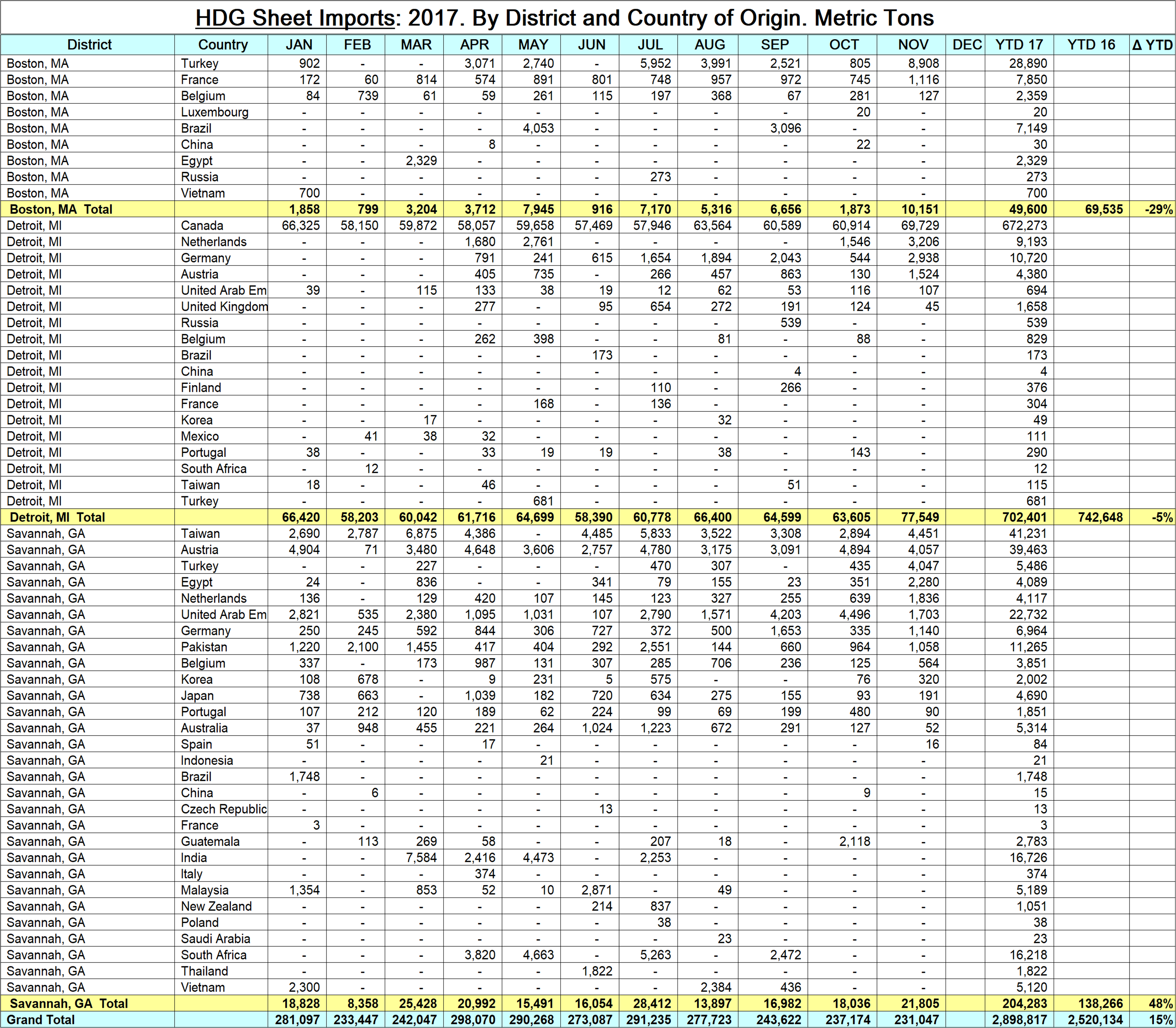

Premium members will find reports in the Imports/Exports section of our website that break down the import tonnage through November into the port of entry and country of origin in metric tons. Products analyzed in this way are HRC, CRC, HDG sheet, OMC sheet, CTL plate and coiled plate. This data set is large; therefore, we will make no attempt to provide a commentary. Each reader’s interest will be different and he or she simply needs to select one of the six products, then find the nearest port or ports of entry to see how much came into the region each month and from where. It is clear from these detailed reports that the change in tonnage entering a particular district in many cases is completely different from the change in volume at the national level.

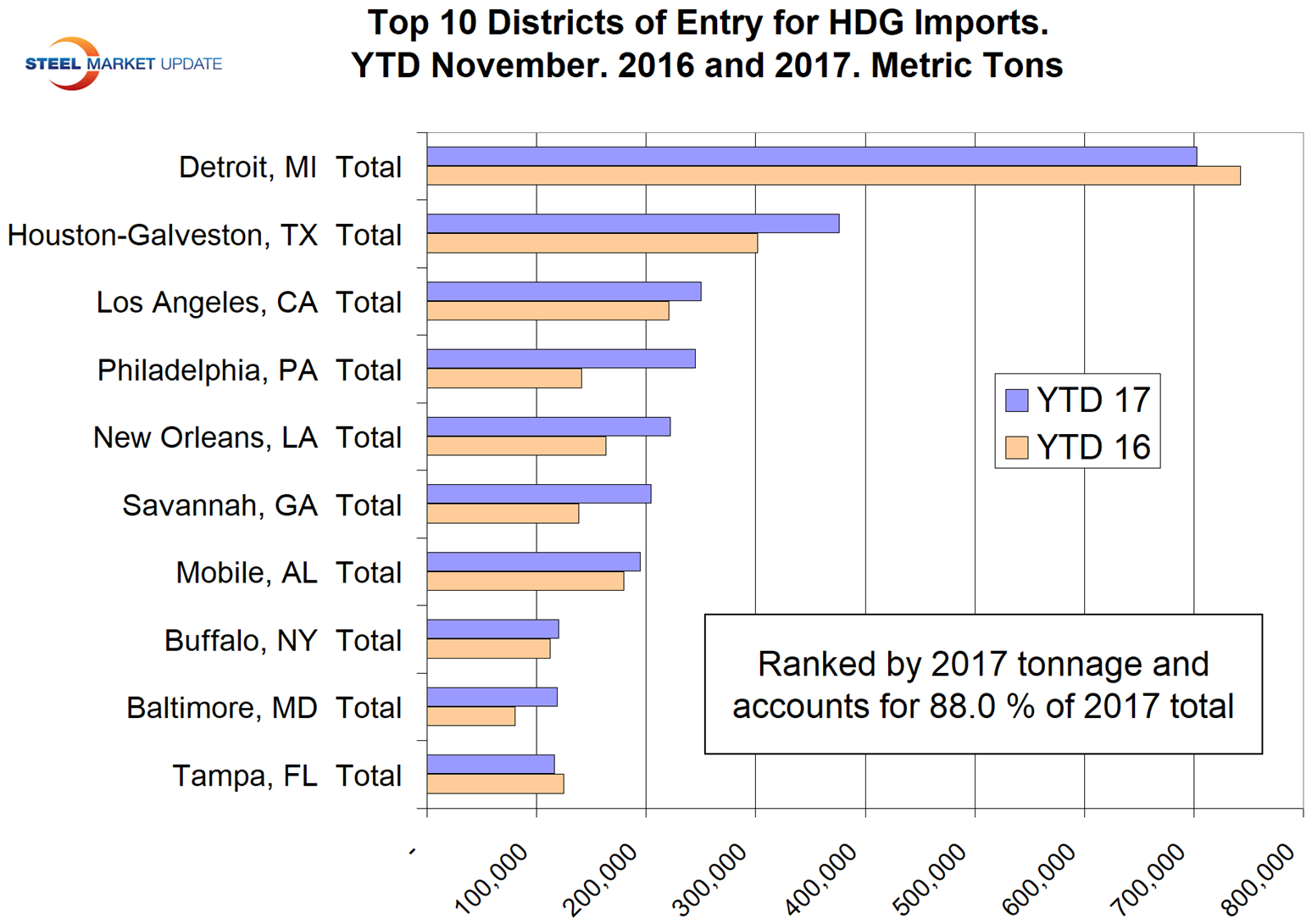

Here are some recent examples to illustrate why this information can be actionable: Total cold rolled imports increased by 27 percent year-to-date through November, but Philadelphia was up by 170 percent and Laredo was down by 18 percent. Total HDG imports increased by 15 percent in the first 11 months of 2017, but Savannah was up by 48 percent and Boston was down by 29 percent. The discrepancy between the change in the national total and the individual regions is why we think it’s important for both market understanding and negotiating position to know what’s going on in your own backyard.

The table included here (click to enlarge) is a small part of the detailed analysis of HDG tonnage. The bar graph shows the tonnage that entered the top 10 districts in year-to-date November for 2016 and 2017 ranked by 2017 tonnage. These 10 districts account for 88.0 percent of the grand total in 2017. Detroit received the most tonnage through November 2017 followed by Houston, Los Angeles and Philadelphia.

The data in these detailed reports is compiled from tariff and trade data published by the U.S. Department of Commerce and the U.S. International Trade Commission. Our other import reports are sourced from U.S. Department of Commerce, Enforcement and Compliance, aka the Steel Import Monitoring System. In the development of these reports by district and source country, we have discovered that the SIMA data for HRC and CRC contains some high-alloy steel such as stainless and tool steel, which have been misclassified at the ports. These alloy steels are not included in our detailed reports, which results in a small discrepancy between the two data sets, for CRC in particular and for HRC to a lesser degree.