Prices

April 10, 2018

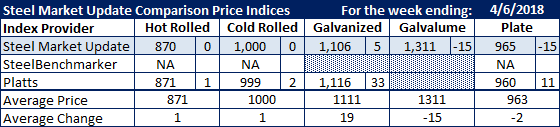

Comparison Price Indices: Stability

Written by John Packard

The pace of flat rolled steel price expansion slowed this past week with hot rolled and cold rolled barely budging off the levels reported for the week ending March 30.

Galvanized average pricing rose slightly (+$5) on SMU’s index to $1,106 per ton for .060” G90. Platts took their average up $33 per ton and is now within $10 of SMU at $1,116 per ton.

Galvalume prices dropped $15 per ton, according to our index average.

Plate prices also dropped by $15 on our index, while Platts took theirs up $11 and now the two indexes are within $5 of one another.

SteelBenchmarker did not report prices this past week.

SMU Note: Galvanized prices include $86 in extras for a .060″ G90 product. Galvalume prices include $291 in extras for a .0142” AZ50 Grade 80 product.

FOB points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Plate price FOB points are different for each of the indexes:

SMU: FOB Delivered to the Customer (includes freight)

Platts: FOB Midwest Mill (includes freight)

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.