Analysis

May 2, 2018

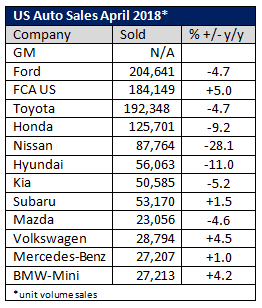

U.S Auto Sales Slide in April

Written by Sandy Williams

U.S. auto sales slipped in April after a robust March. WardsAuto estimated the seasonally adjusted annual rate at 17.1 million and actual light vehicle sales for the month at 1.35 million, down from 17.4 million and 1.5 million, respectively, from the previous month.

“With fracking, I don’t see prices going to $5 or $6 a gallon, which is what it would take to change consumer behavior,” said Jackson.

Ford sales dipped 4.7 percent in April. “We believe the industry continues to operate at a very healthy level,” Ford’s U.S. sales chief Mark LaNeve said. “With a plateauing market, you are going to get some bumpiness.

Ford announced last month that it will quit producing sedans in North America, keeping only the Mustang and crossover version of the Focus in the U.S.

General Motors is no longer reporting monthly sales but said on Wednesday that it is increasing SUV production after its strongest first quarter ever for its Acadia and Terrain SUVs. Global SUV sales were up 9.4 percent in the first quarter, said GM.

Honda light truck sales are at record levels, but the company has no plans to abandon its passenger car customers.

“Even as we increase our sales of light trucks to record levels, we remain committed to delivering a balanced lineup of cars and light-truck offerings for our customers,” said Henio Arcangeli Jr., senior vice president of the Automobile Division & general manager of Honda sales. “Our flexible manufacturing capabilities allow us to evolve our production mix in real-time to meet these continued shifts in consumer demand. Moreover, we recognize not all customers in the market want a truck or SUV, so growth opportunities still exist within the passenger car side of our business.”

Nissan sales plunged 28 percent in April with passenger car sales down 35 percent and SUV/truck sales down 23.1 percent. “April was an extremely challenging month with intense competition in the U.S. market,” Nissan said in a statement.