Market Data

May 3, 2018

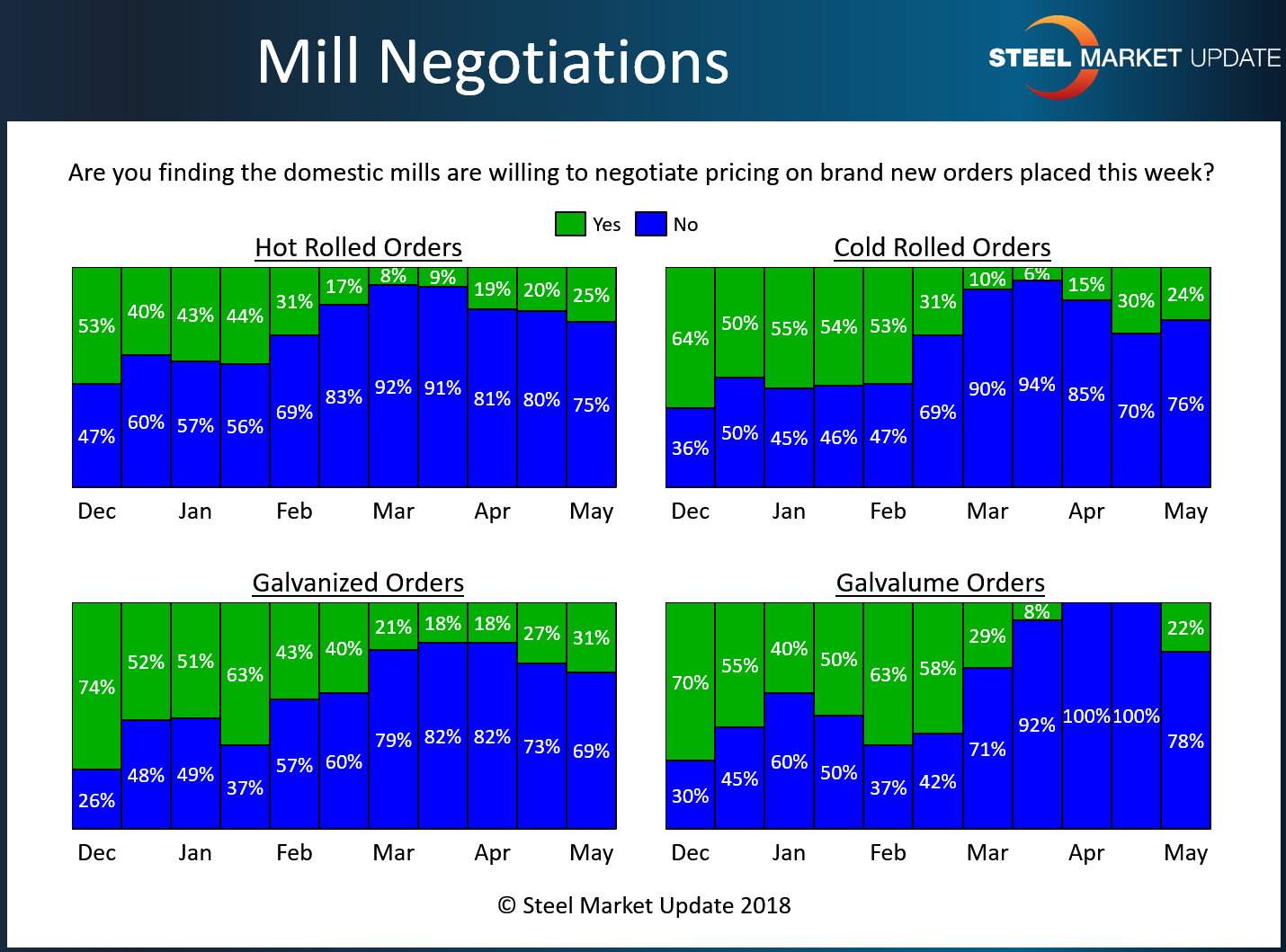

Mills Still Stingy in Negotiating Prices (But Not as Much as 1 Month Ago)

Written by John Packard

Extended lead times will generally lead to steel mills being stingy about offering “deals” below the company pricing guidelines. Flat rolled steel prices have essentially plateaued. There may be a small number of “deals” out there (is $860 HRC really a “deal?”), but most mills are sticking to their guns.

In all four products (hot rolled, cold rolled, galvanized and Galvalume) about one-quarter of the respondents report that their mill suppliers are being responsive to some price negotiations.

We will need to watch lead times and negotiations closely as our Sentiment Index is pointing toward possible weakening in the market.

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.