Prices

May 29, 2018

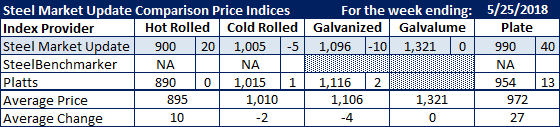

Comparison Price Indices: HR Averages $895

Written by Brett Linton

Flat rolled and plate prices had yet another mixed week, according to the latest comparison of leading price indices.

Steel Market Update’s hot rolled average increased by $20 to $900 per ton, while Platts’ hot rolled price was unchanged at $890 per ton.

SMU’s cold rolled average fell $5 to $1,005 per ton, while Platts cold rolled price inched up $1 to $1,015 per ton.

Galvanized prices declined $10 to $1,096 per ton for SMU .060 G90. Platts’ index rose $2 to $1,116 per ton for galvanized.

The SMU Galvalume .0142” AZ50 Grade 80 price was unchanged at $1,321 per ton.

Plate prices jumped by $40, according to SMU, to $990 per ton. Platts reported a $13 increase for plate to $954 per ton.

SteelBenchmarker did not report prices this past week as they only report twice per month.

SMU Note: Galvanized prices include $86 in extras for a .060″ G90 product. Galvalume prices include $291 in extras for a .0142” AZ50 Grade 80 product.

FOB points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Plate price FOB points are different for each of the indexes:

SMU: FOB Delivered to the Customer (includes freight)

Platts: FOB Midwest Mill (includes freight)

Note that SteelBenchmarker produces numbers twice per month. On the weeks they do not report prices (NA = not available), their data is not included in the CPI average.