Prices

September 11, 2018

SMU Survey: Service Center Spot Prices Falling

Written by John Packard

Manufacturing companies and service centers are in agreement, service center spot prices to their customers are negotiable and dropping.

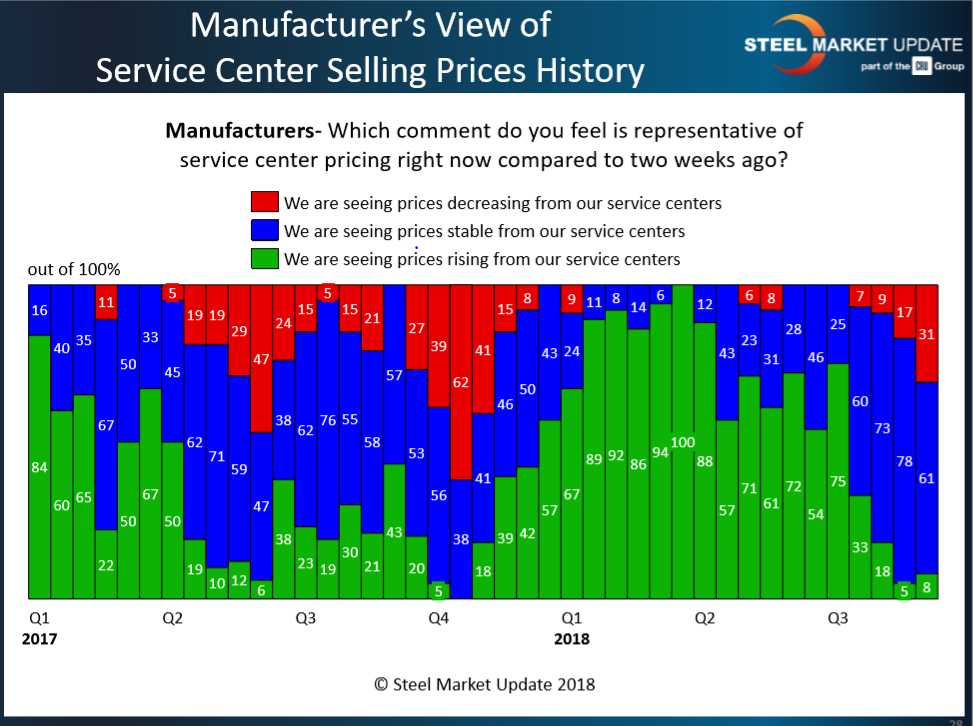

Our most recent flat rolled steel market analysis conducted this past week found a growing percentage of manufacturing companies reporting their service center suppliers as lowering spot steel prices. At the beginning of July 2018, there were no manufacturing companies reporting prices as dropping from their service center suppliers. By mid-August, 17 percent of the manufacturers were reporting prices as falling. Last week that percentage increased 31 percent.

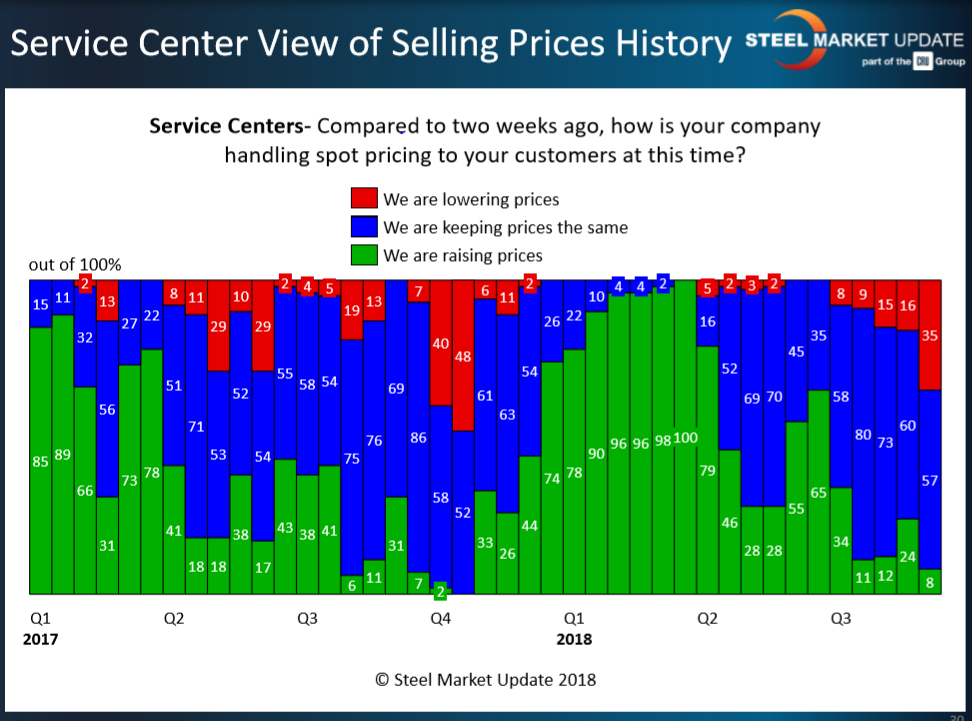

Steel distributors agreed with their manufacturing customers as 35 percent of service centers reported spot prices as moving lower than what they were quoting two weeks ago. This is more than double the 16 percent who reported higher spot prices during the middle of August analysis.