Market Data

December 23, 2018

Service Centers Close to Capitulation

Written by John Packard

Service centers are perilously close to capitulation as the percentage of respondents reporting service centers as lowering spot prices continues to increase.

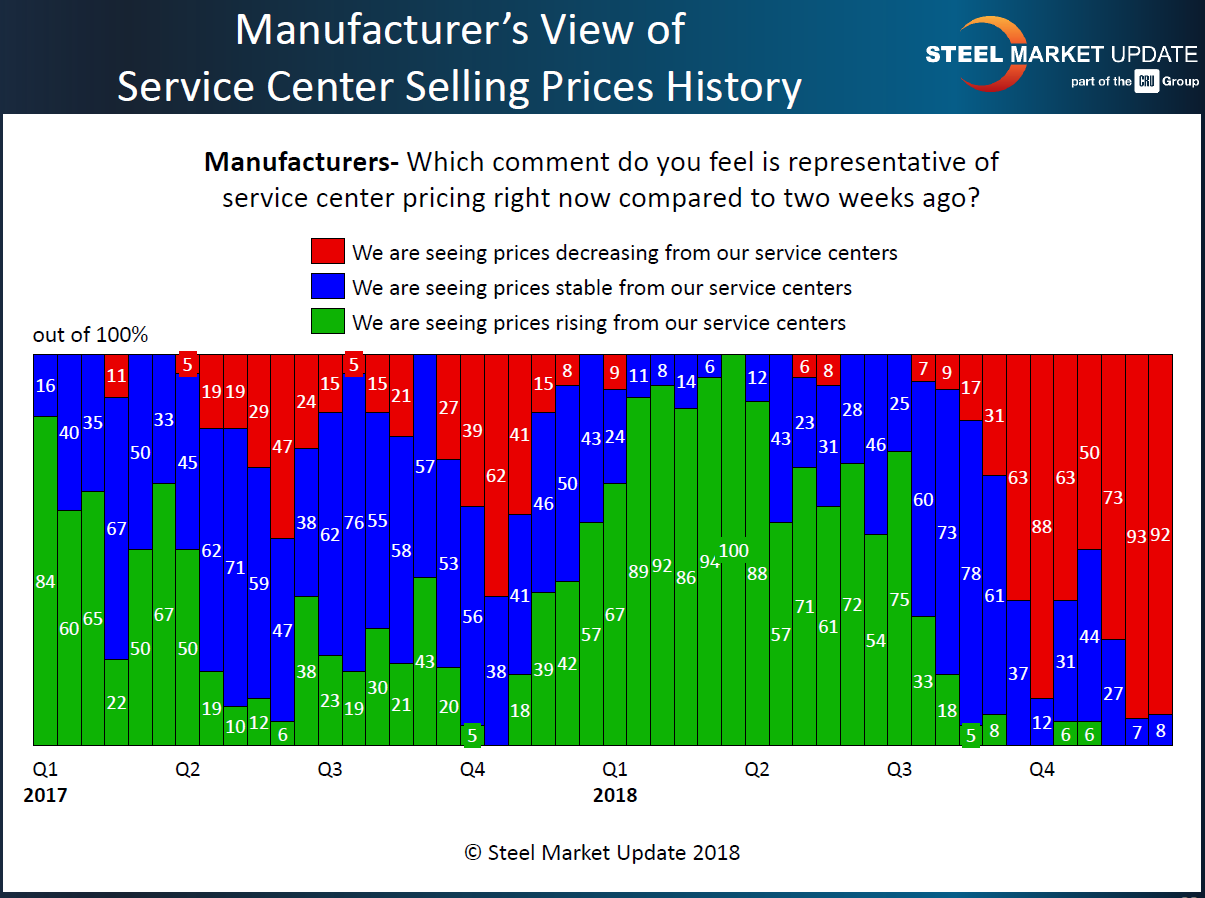

Manufacturing companies are telling Steel Market Update that they are receiving lower and lower spot pricing from their service center suppliers. In our latest flat rolled steel market trends analysis conducted this past week, 92 percent of the manufacturing companies responding to our survey reported distributors as lowering pricing. Earlier this month, 93 percent of the OEMs were making that claim. As you can see by the graphic below, you have to go back a few months to see any spot pricing support by the steel distributors.

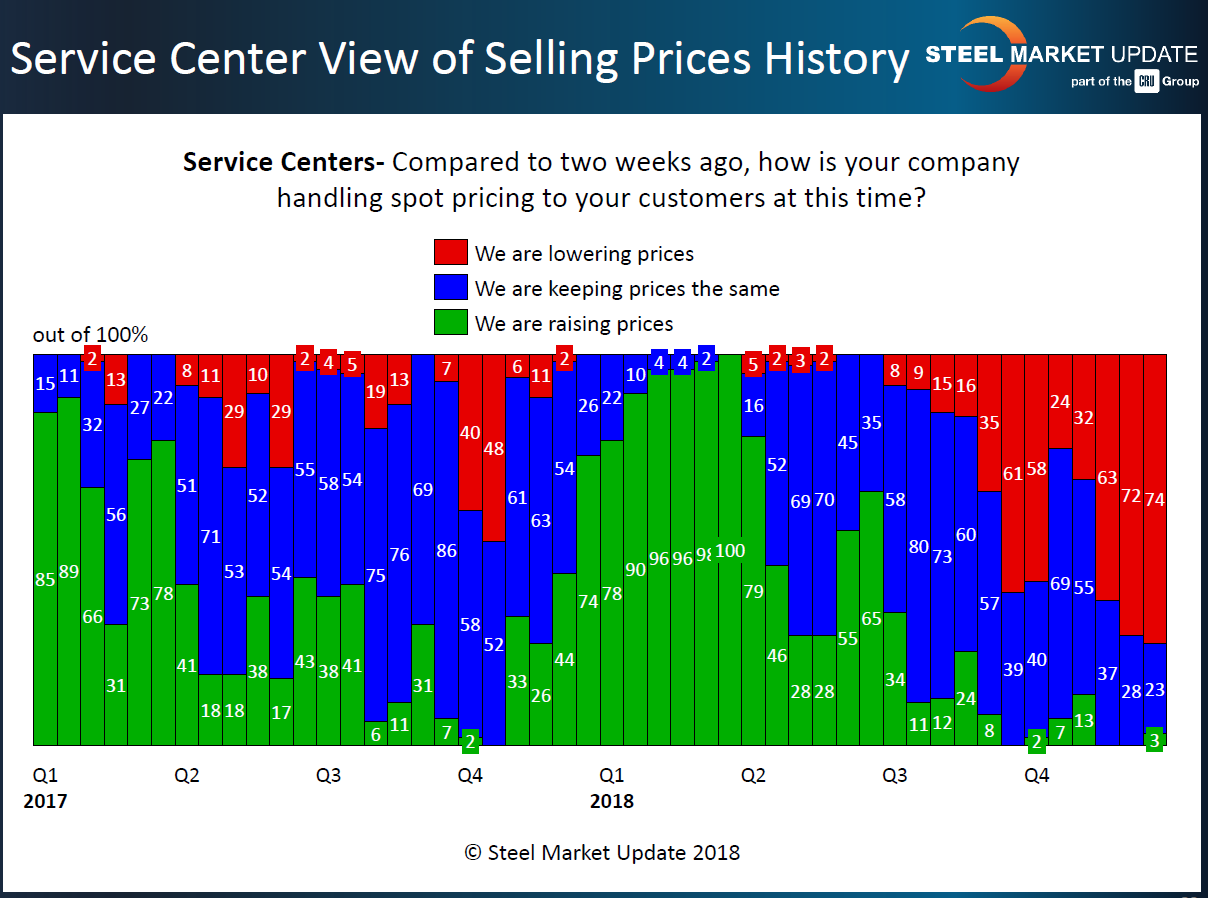

The percentage of service centers reporting their company as lowering spot pricing increased to 74 percent from the 72 percent measured at the beginning of December. Pain, in the form of lower spot sale pricing, is increasing and is very close to the point we refer to as capitulation. Capitulation is when the pain of decreasing inventory values coupled with the seemingly unending downward spiral of spot prices, can be a motivating factor for the service centers should the domestic mills announce an increase. The pain needs to be intense enough and over an extended period to get the support needed as was shown in early fourth quarter when Nucor and a number of other domestic steel mills attempted to raise flat rolled spot pricing. The pain was not intense enough with only 61 percent and 58 percent of the service centers reporting lower spot offers being made to their customers. The mill price increase failed.

It is SMU’s opinion, based on our past experience with this index, that if service centers continue to lower spot prices once we move into calendar year 2019, they will most likely support an attempt by the domestic steel mills to increase spot pricing.