Market Data

January 25, 2019

BLS: Pacific Region Leads in U.S. Job Creation

Written by Peter Wright

In Q3 and Q4 2018, the Pacific region regained the lead as the engine of national job creation.

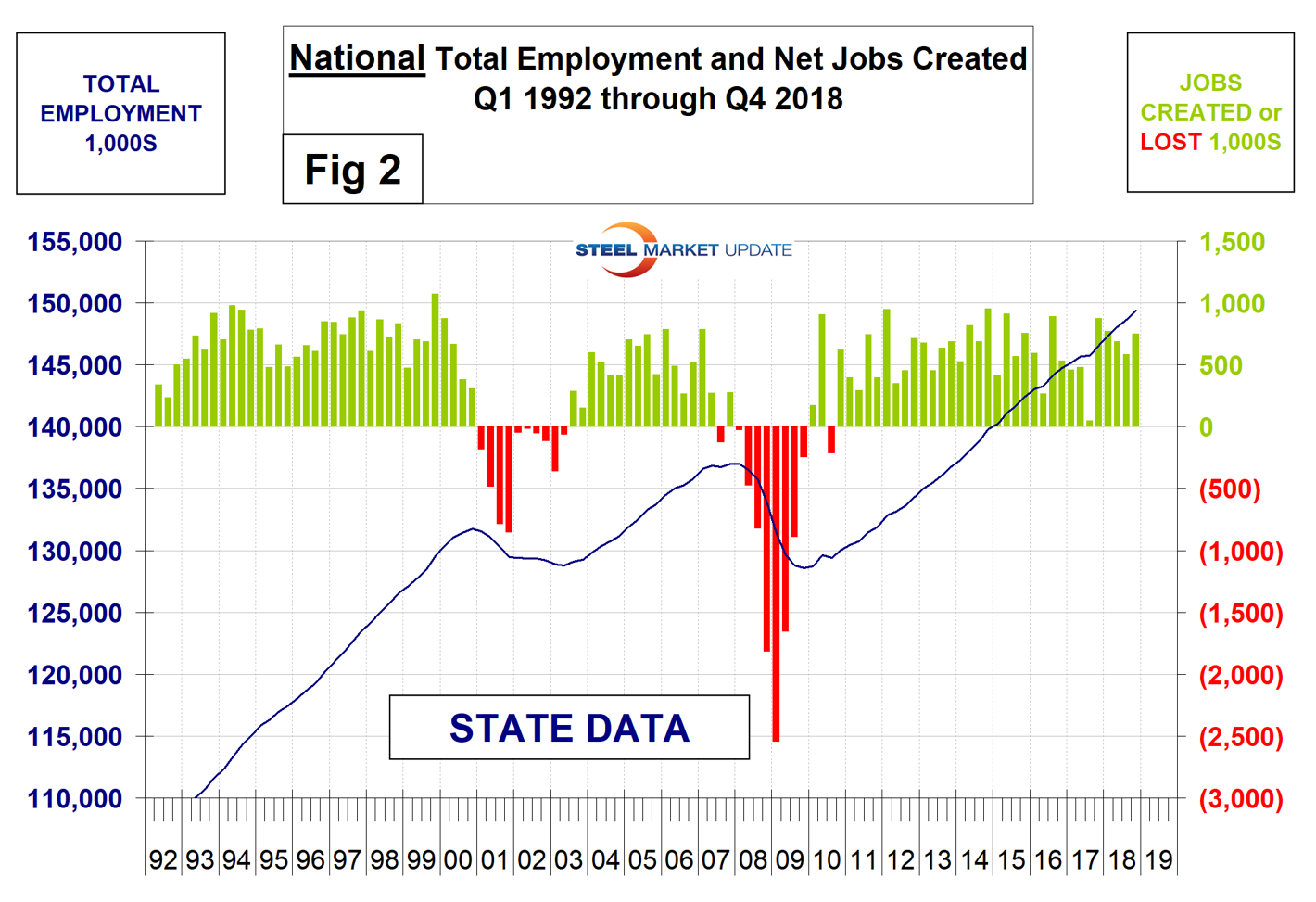

Fourth-quarter employment data by state was released by the Bureau of Labor Statistics (BLS) on Friday. The state data follows and confirms the strong employment situation that we reported earlier at the national level. In the fourth quarter, the states reported a total of 749,000 jobs created. The national report indicated a total of 762,000 jobs.

The question of which government departments are operating during the shutdown is confusing. The following statement was copied from the BLS website: “The Department of Labor, including the Bureau of Labor Statistics, is funded through September 30, 2019. BLS is operating as usual and expects to follow its announced release schedule.”

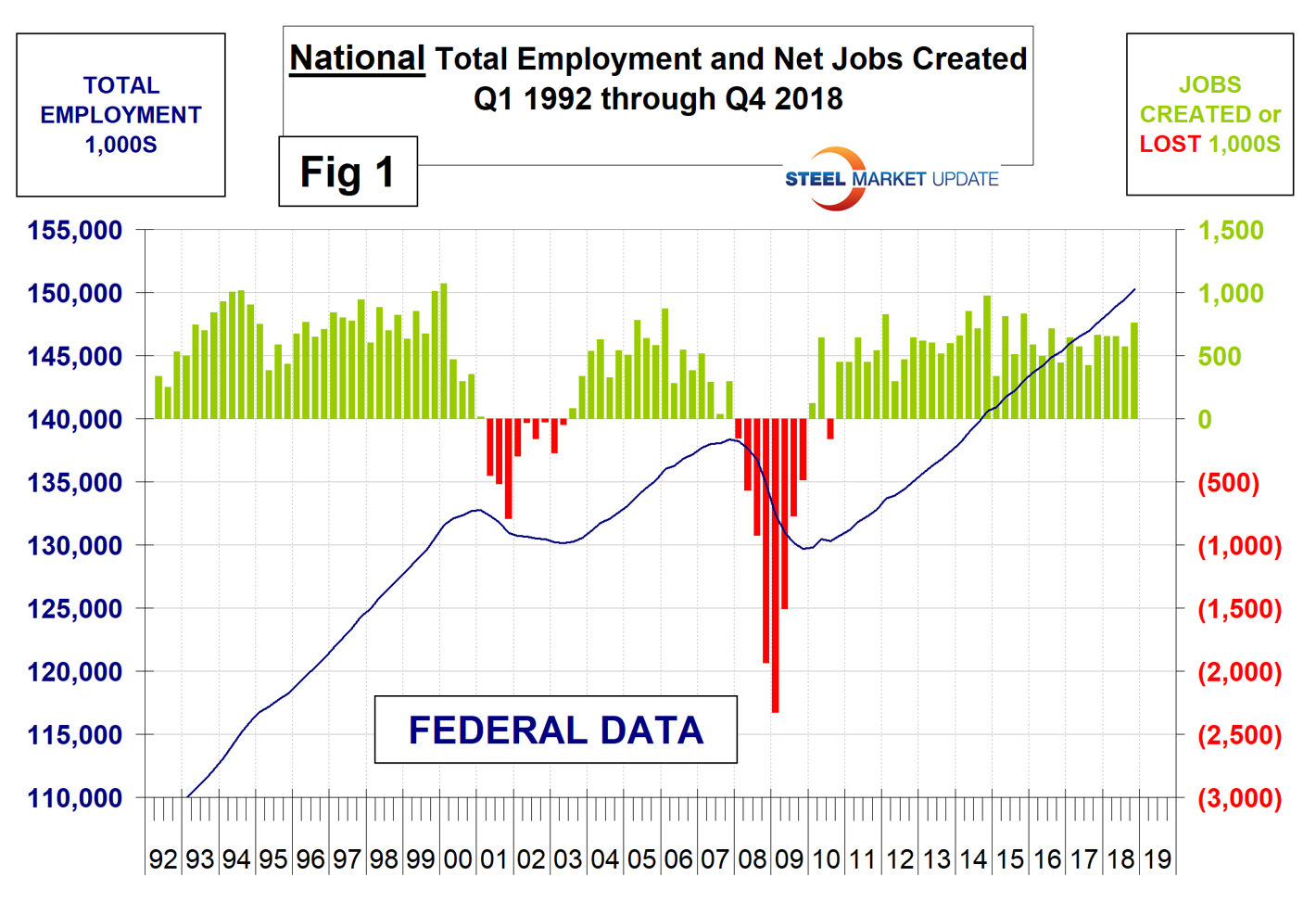

The states compile their employment numbers independently of the Feds, and then both are reported by the BLS. In the six years since and including Q1 2013, the Feds reported total job creation of 15,199,000 and the states reported 15,049,000, a difference of just 1.0 percent. Our report covers only the lower 48 states, and the state numbers don’t include those such as the military that are employed overseas. Therefore, the Fed and State totals are impressively close. Figure 1 shows the history of Federal data totals since 1992 and Figure 2 shows the same format for the State data.

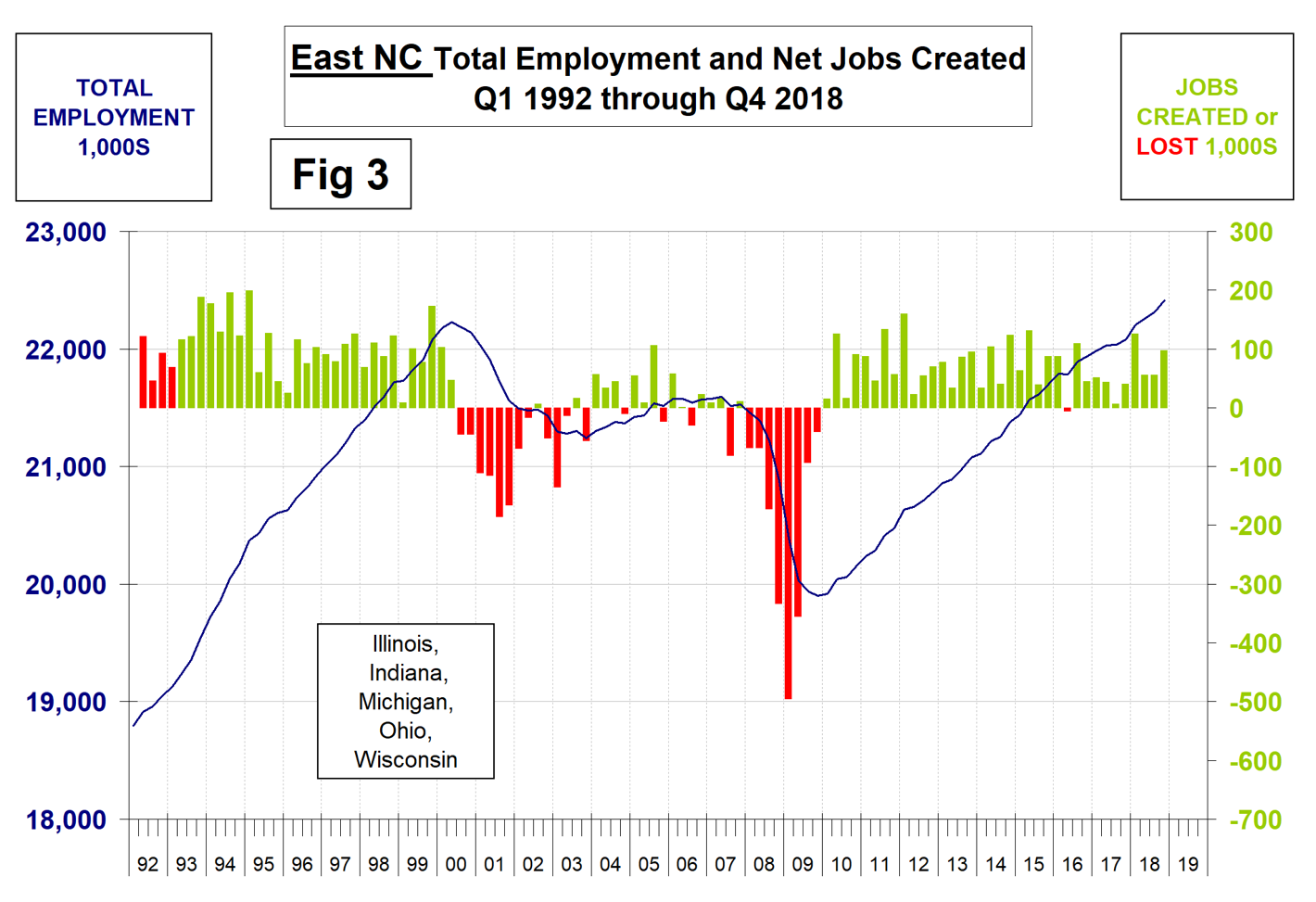

SMU has graphs in the same format for 10 geographic regions and can produce them for individual states on request. Figure 3 shows the history of the East North Central region, which is second only to the Pacific region for total employment.

The 10 geographic regions described in this report are:

New England, (CT, ME, MA, NH, RI, VT)

North East, (NY, PA, NJ)

Mid Atlantic, (DE, DC, MD, NC, SC, VA, WV)

North Central, (IA, KS, MN, MO, NE, ND and SD)

East North Central, (IL, IN, MI, OH and WI)

East South Central, (AL, KY, MS and TN)

South Central, (TX, OK, LA and AR)

Mountain, (AZ, CO, ID, MT, NV, NM. UT, WY)

Pacific, (CA, OR and WA)

South East, (FL, GA)

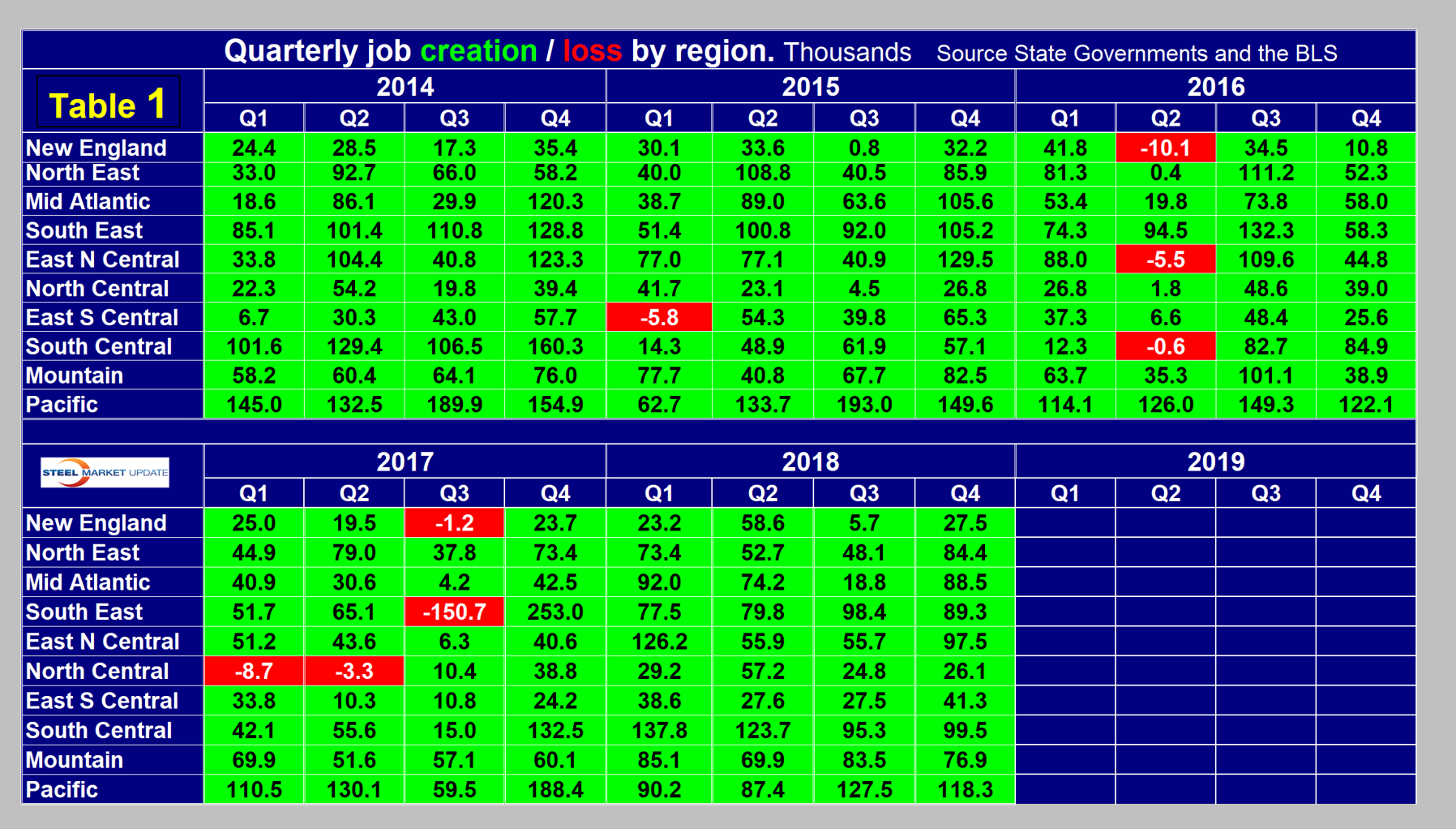

Table 1 shows the history of quarterly job creation by region since Q1 2014. In Q1 and Q2 2018, the South Central region created the most jobs. In Q3 and Q4 2018, the Pacific region took the lead. The numbers are seasonally adjusted and all regions had a positive net gain in the last five quarters.

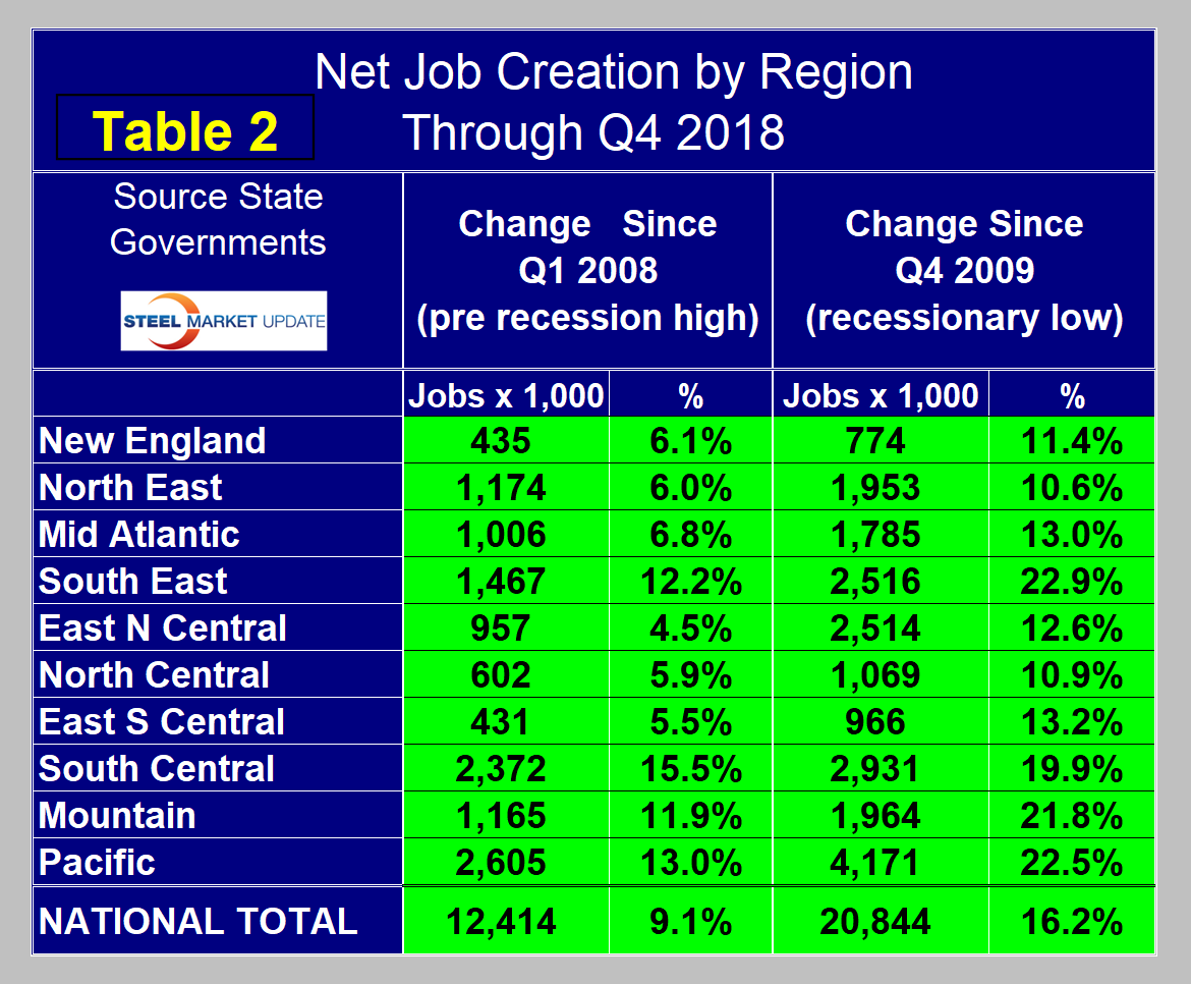

The regions have fared very differently since the pre-recession high of first-quarter 2008 and since the low point of fourth-quarter 2009. By the states’ calculations, there are now 12,414,000 more people employed than there were immediately before the recession, but of that number 40.1 percent were created in the South Central and Pacific regions (Table 2).

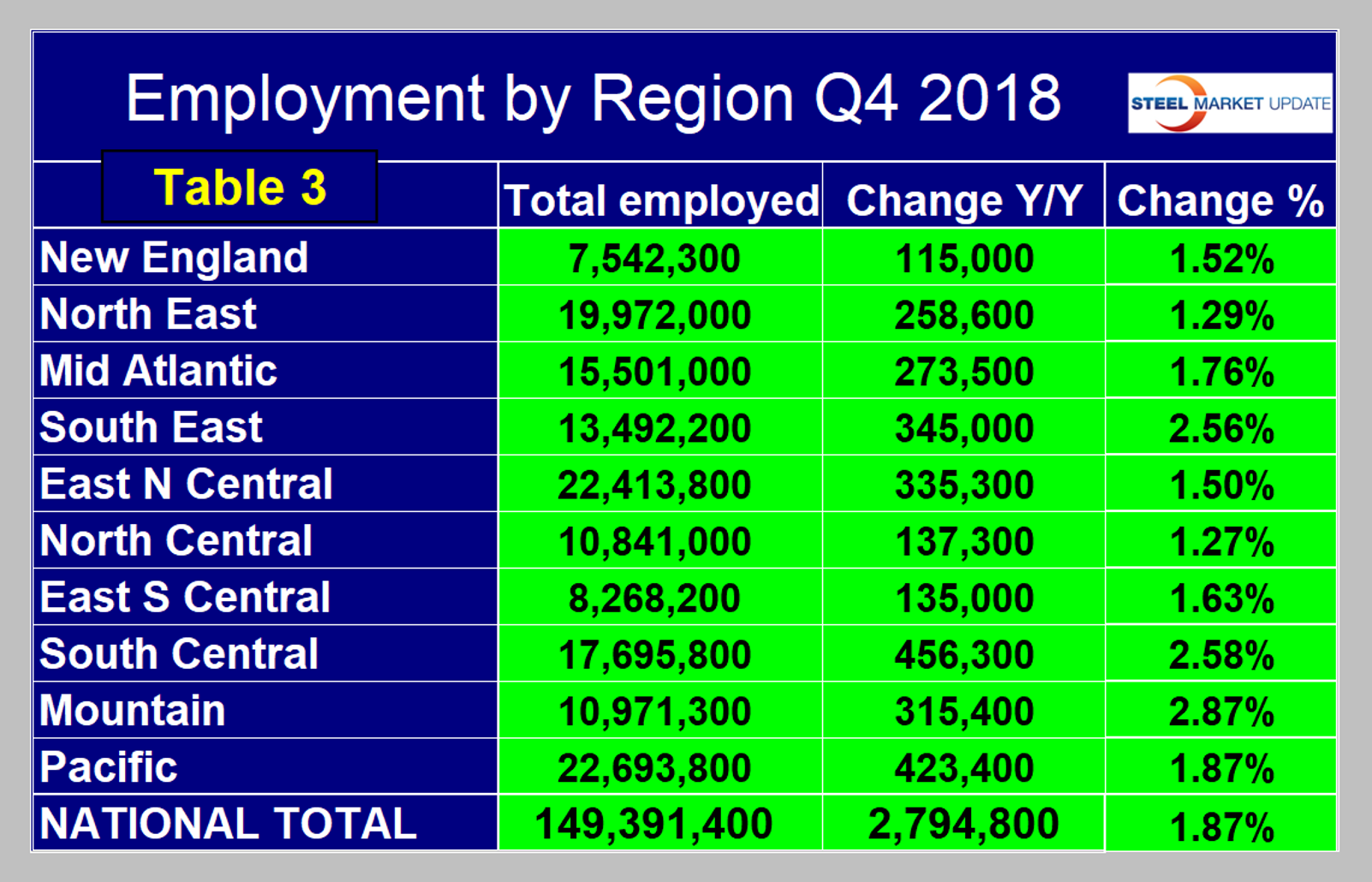

The third quarter of 2015 was the first time that every region had more people employed than it did at the pre-recession peak. The rate of job creation still varies widely across the country. In the last four quarters, the Mountain region has had the highest rate of job growth at 2.87 percent. The North Central region has had less than half this rate of job creation at 1.27 percent (Table 3).

SMU Comment: We believe it’s important for those subscribers whose businesses are substantially regional to have as much data as possible to compare their own results with those of their locality. This report, along with our quarterly reports on regional GDP and regional imports, are intended to help in that respect.