Analysis

January 28, 2019

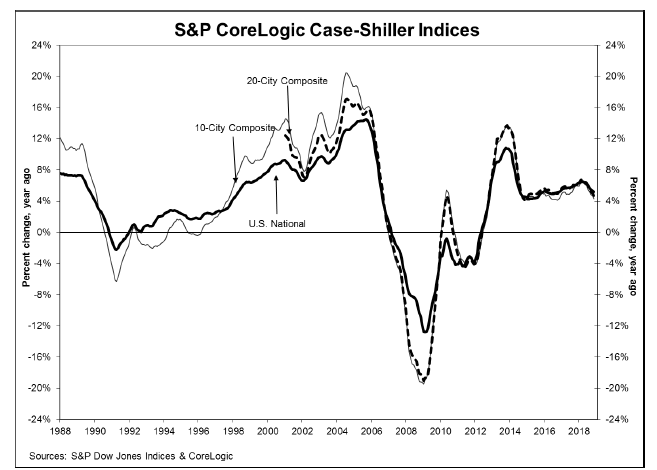

Case-Shiller: Home Prices Rising at Slower Rate

Written by Sandy Williams

Home prices are continuing to rise but at a slower rate, reports S&P Dow Jones Indices. The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index was nearly flat in November, slipping 0.1 percent to a 5.2 percent annual gain for the month. Indices showed a steady drop in price gains throughout 2018.

The 10-City Composite annual increase dropped to 4.3 percent, down from 4.7 percent in October, while the 20-City Composite posted a 4.7 percent year-over-year gain compared to 5.0 percent the previous month.

“Home prices are still rising, but more slowly than in recent months,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “The pace of price increases is being dampened by declining sales of existing homes and weaker affordability. Sales peaked in November 2017 and drifted down through 2018. Affordability reflects higher prices and increased mortgage rates through much of last year. Following a shift in Fed policy in December, mortgage rates backed off to about 4.45 percent from 4.95 percent.

“Housing market conditions are mixed while analysts’ comments express concerns that housing is weakening and could affect the broader economy. Current low inventories of homes for sale – about a four-month supply – are supporting home prices. New home construction trends, like sales of existing homes, peaked in late 2017 and are flat to down since then. Stable 2 percent inflation, continued employment growth and rising wages are all favorable. Measures of consumer debt and debt service do not suggest any immediate problems,” he added.