Prices

February 19, 2019

CRU: Coke Prices Fall as Chinese New Year Restocking Fades

Written by Tim Triplett

By CRU Analyst Jordan Permain

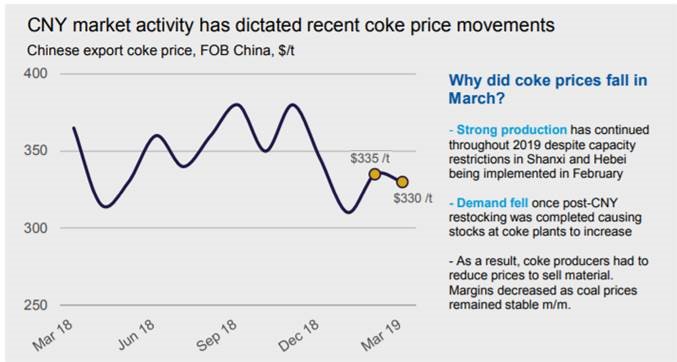

In the previous edition of CRU’s Steelmaking Raw Materials Monitor, we outlined our expectation of falling prices as coke demand would weaken once restocking after the CNY holidays finished. This turned out to be true; coke demand has been low after mills completed their restocking and, as coke production remained high, producers were forced to cut their prices to sell rising inventories.

As a result, the domestic coke price (i.e. Shanxi 1st class coke, ash <12.5%) has been assessed at RMB1,900 /t for March, following a m/m decrease of RMB50 /t. Coke traders selling on the export market were reluctant to decrease their prices as they had acquired material at higher prices a few weeks ago. Thus, the export coke price decreased by only $5 /t, from $335 /t, FOB China in February to $330 /t in March.

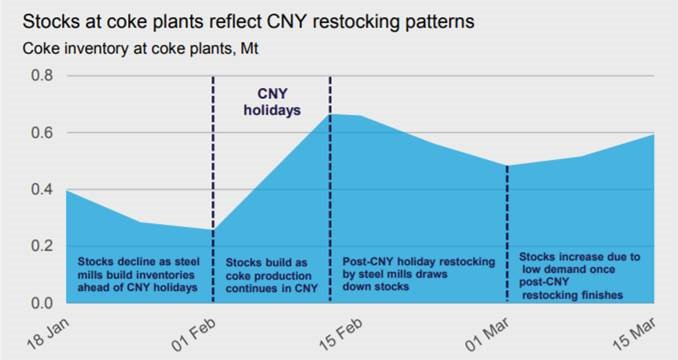

Stocks at Coke Plants Climb as Post-CNY Restocking Ends

In the past month, inventory levels at coke producers have behaved as expected. Just prior to CNY, mills increased buying activities and inventories at coke plants declined. Once the holiday was over, mills had to replenish their supplies, which had been drawn down during the holidays. This uptick in demand only lasted until early-March, but coke production remained at a high level.

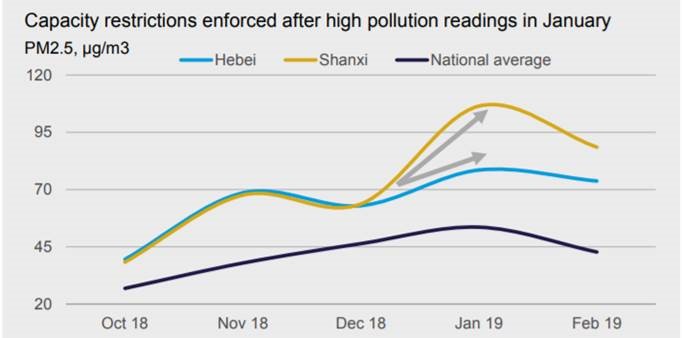

Capacity Restrictions in Response to Higher Pollution

During February, governments in Hebei and Shanxi provinces imposed restrictions on coke capacity, a decision that is consistent with our understanding that restrictions are imposed as a result of an increase in pollution levels. This may have been due to higher coke production or from unrelated matters, such as variable weather. However, irrespective of the source, when emissions have been high, as they were for both provinces before CNY, production restrictions have been imposed. Notwithstanding, overall coke production remained strong, as capacity restrictions were not observed in other provinces.

Outlook: Prices Will Fall Again

We expect coke prices to decline in the coming month. Our expectation of falling seaborne coal prices, coupled with strong coke production, will put downward pressure on coke prices. Demand may increase once the “winter heating season” (WHS) period officially ends in April, but we expect this impact will be absorbed by high coke inventories.

Explore this topic further with CRU.