Analysis

March 2, 2019

Auto Sales Chilled in February

Written by Sandy Williams

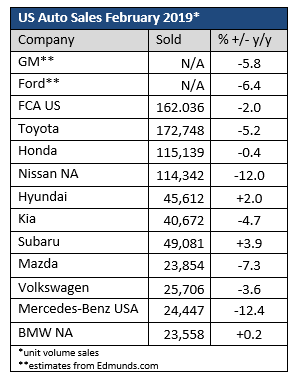

U.S. light vehicle sales in February missed analysts’ forecasts, falling 2.8 percent year-over-year, reported Edmunds.com. Sales were estimated at 1.26 million last month with a seasonally adjusted annual rate of 16.6 million units, down from 17.01 million a year ago. Sales are forecast to remain strong in 2019, but slower than in recent record years.

“Shopping conditions are pretty unfavorable for consumers across the board, and even those with good credit are having trouble finding compelling finance offers,” said Jeremy Acevedo, Edmunds’ manager of industry analysis. “As rising vehicle costs and interest rates continue to compromise affordability, more shoppers might find themselves priced out of the new vehicle market.”

FCA sales slipped 2 percent in February and could have been worse if not for a 24 percent jump in the Ram truck brand. FCA also reported a 50 percent decline in sales of its Fiat brand.

“The overall industry is starting off slower due in part to weather, the U.S. government shutdown, and concern over tax refunds,” said FCA U.S. Head of Sales Reid Bigland. “We still see a strong, stable economy and anticipate any lost winter sales will be made up in the spring.”

Automakers remain concerned that the White House will follow through on a 25 percent tariff on imported cars, which will damage both demand and profits.