Market Data

March 26, 2019

CRU: National People’s Congress 2019: The Year of Lower Growth and Modest Stimulus

Written by Tim Triplett

By CRU Chief Economist Jumana Saleheen

The 13th National People’s Congress (NPC), China’s Parliament, concluded its annual two-week meeting in March. The NPC is arguably the most important policy meeting in China because it is when key macroeconomic targets are announced together with the policies required to support them. This year’s NPC has drawn attention given the U.S.-China trade war, which has raised concerns about the slowing pace of growth in China and the global economy more generally.

The important questions facing our clients are:

- Will economic growth in China slow below the growth rates we have seen recently?

- Will China de-emphasize its environmental and credit deleveraging policies?

- How much additional policy stimulus might we see in 2019 (as in 2008 and 2015)?

- Will the stimulus be positive for commodity markets?

- Is China “opening up” its market to foreign companies at a faster pace?

Growth Target Revised Down

The Chinese economy grew by 6.6 percent in 2018, the lowest annual rate since 1990. The growth target for 2018 was “about 6.5 percent.” The growth target for 2019 has been revised down to the range of “6-6.5 percent.” This downgrade to the growth target was widely expected by the market, and it is in line with CRU’s expectation and our global economic and industrial forecast. The revision reflects the strong headwinds that China faces in 2019, such as the negative impact on the export sector arising from the 10 percent tariffs imposed by the U.S. last September on $200 billion worth of Chinese exports to the U.S. This growth target is consistent with the Chinese government’s commitment to double the level of GDP between 2010 and 2020. To achieve this the government needs to achieve a growth rate of above 6 percent in 2019 and 2020.

Supply Side Reform and Deleveraging Remains Intact

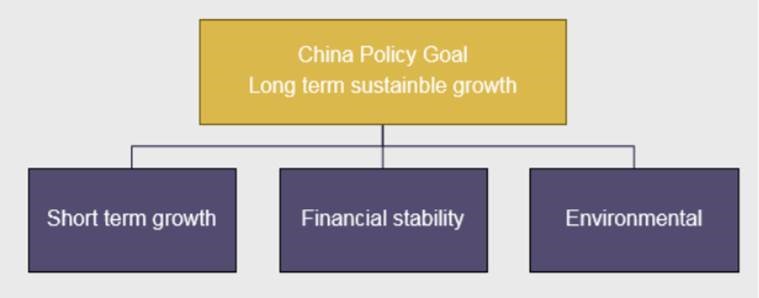

Our narrative of a managed slowdown in China is predicated on the view that the Chinese authorities want to ensure the economy grows at a pace that is sustainable over the long term, both in terms of the environment and in terms of financial risk. Indeed, over the past few years, the government has made efforts to stabilize the economy and financial system (deleveraging and controlling debt levels), in order to achieve a sustainable growth path.

The chart below tries to capture these competing objectives. To gain a better environment (e.g. blue skies) or a more robust financial system (e.g. deleveraging) is likely to require the authorities to accept slightly lower rates of growth.

The revision to the growth target announced at the NPC provides reassurance that the authorities are still committed to those sustainable rates of growth. There was no news in the NPC that would lead us to change our view on the environmental and deleveraging policies.

Modest Policy Stimulus to Continue into 2019

Fiscal policy

- The finance ministry pledged to cut corporate taxes by RMB 2trn in 2019, up from tax cuts of RMB1.3trn in 2018. Most of these cuts will take place in the form of VAT cuts (see below).

- Spending was also cut in some areas. For example, enterprises’ contribution to urban employees’ pension fund reduced to 16 percent across all provinces.

- The government general budget deficit target for 2019 was increased only slightly to 2.8 percent of GDP, up from 2.6 percent in 2018. This means that the announced tax cuts will be funded by off-budget spending, such as land sales and local government borrowing. As a result, we expect the recently announced fiscal stimulus to show up in “augmented” measures of government debt and deficits. These augmented measures are specifically designed to capture increases in such off-budget measures.

- The quota for Local Government Special Bonds issuance has been raised by RMB 800bn to RMB2.15trillion.

- Growth stimulus will be increasingly aimed at the local level. Such a decentralized approach is good for resource allocation.

Monetary policy

- Monetary policy will remain in easing mode in 2019 with real interest rates to be lowered.

- The government has also pledged to step up efforts to support small enterprises. The support measures include a cut in the required reserve ratio (RRR) for small enterprises and a 30 percent growth target of loans to small enterprises by the large national banks.

The Newly Announced Stimulus is Skewed Towards Industry

The NPC announced stimulus measures (corporate tax cuts) that were targeted to help the sectors of the economy that have been most exposed to U.S. tariffs—manufacturing and industry. The cuts were focussed on productive sectors of the economy and on small businesses. The VAT cuts are expected to be positive for the demand for raw materials (e.g. aluminium and steel). The policies this year differ from the global financial crisis, in that a large share of the 2008/09 stimulus plan came in the form of additional government spending.

This year the aim is to incentivize companies to make those investments themselves.

- Manufacturing sector VAT rates are reduced from 16 percent in 2018 to 13 percent in 2019.

- Transport and construction sector VAT rates are reduced from 10 percent in 2018 to 9 percent in 2018.

Market Opening Up to Foreign Entities, but Details to Follow

On March 15, the NPC approved a Foreign Investment Law (FIL). The new law is deemed to be a simplification of three previous laws that aim to speed up the “opening up” of China to foreign companies. It aims to promote increased foreign investment into China, mainly by enhancing protection of foreign investors’ rights.

- The law comes into effect on Jan. 1, 2020.

- The FIL prohibits forced technology transfers and states that China will sanction all intellectual property infringements strictly in accordance with the prevailing laws.

Allowing foreign entries is partly the outcome of U.S.-China negotiation and partly (more importantly) the government’s intention to reform. We have already seen foreign entries in the auto sector – Tesla being the first wholly foreign owned car company in China. Foreign entries are good for productivity in the long run as they promote more intensive competition but may present challenges for domestic firms in the short run.