Prices

March 31, 2019

Cutting Through the Noise with "The CRU"

Written by Tim Triplett

By Chris Houlden, CRU Research Manager, Steel

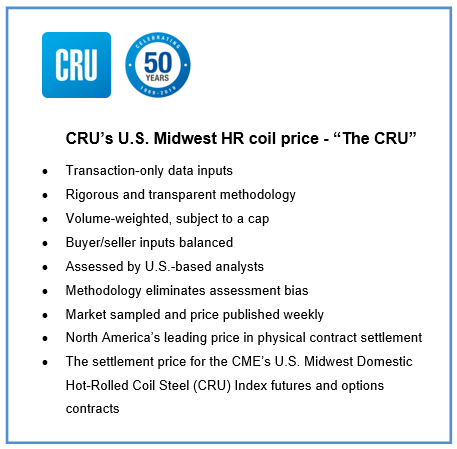

CRU has a long-established and proud history of serving the market with its U.S. Midwest HR coil price or “The CRU” as it has become known. Independent market research, including that concluded very recently, has again established that The CRU is used in the determination of the vast majority of physical index-linked contracts in North America.

It also continues as the settlement price for the CME’s U.S. Midwest Domestic Hot-Rolled Coil Steel (CRU) Index futures and options contracts, the use of which reached near record levels this year. This follows substantial growth throughout 2018, despite the increasing options available for financial derivative users. CRU welcomes all forms of choice in the market, and those who choose to rely on The CRU do so because it is:

- Based exclusively on transaction data, avoiding errant opinion, noise or wayward bid/offer information. The evidence is that the vast majority of physical market players agree this should be the case;

- A representative sample of the market price. CRU achieves this with a balanced representation of buyers and sellers, its capped volume-weighted calculation and the extent it captures spot market transactions sampled over the most appropriate timeframe;

- Overseen by expert industry analysts, implementing a strict methodology and applying expert judgement that is informed by a depth of steel industry and market understanding and experience.

We do not determine the price – that is for the market. Rather, we faithfully reflect it. In doing so we are fiercely independent in our approach and desire to be accurate, not just because our stakeholders expect that, but also for its own sake. Where businesses depend on a robust price to serve their key commercial operations, they should expect to use the best price which CRU takes the responsibility to provide. If you would like to know more on our methodology, approach or discuss price and market dynamics, please contact josh.spoores@crugroup.com