Market Data

June 11, 2019

Service Center Spot Pricing – Capitulation?

Written by John Packard

A higher percentage of manufacturing companies and flat rolled steel service centers are reporting distributors as continuing to lower spot pricing to their customers. We have now passed through the mythical “capitulation” level and we will explain what that means in a moment.

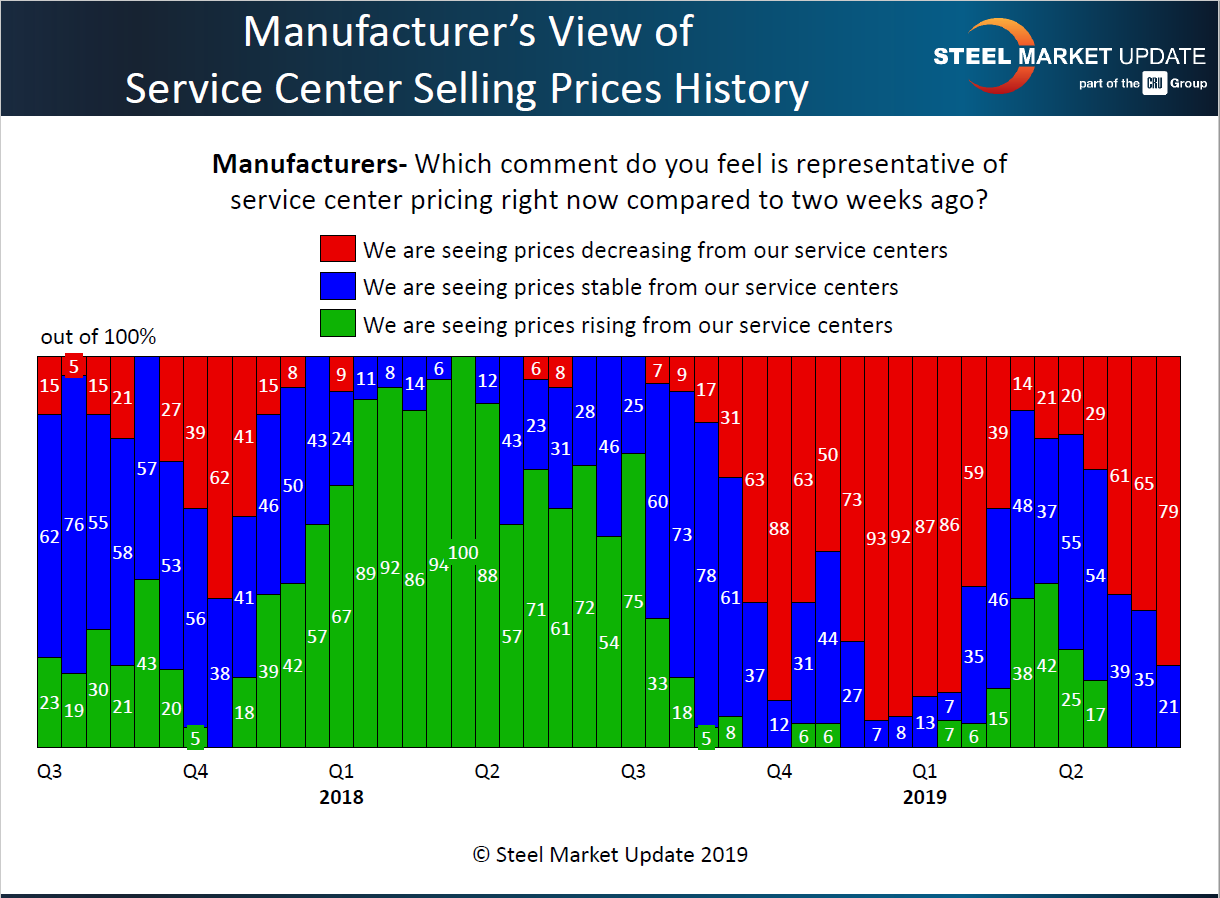

First, we saw 79 percent of the manufacturing companies responding to our flat rolled and plate steel market trends survey this past week reporting decreasing spot pricing out of their service center suppliers. This is an increase of 14 percent compared to the middle of May and we are at levels not seen since early first-quarter 2019 (just prior to the domestic mill price increase announcements, which started at the end of January 2019).

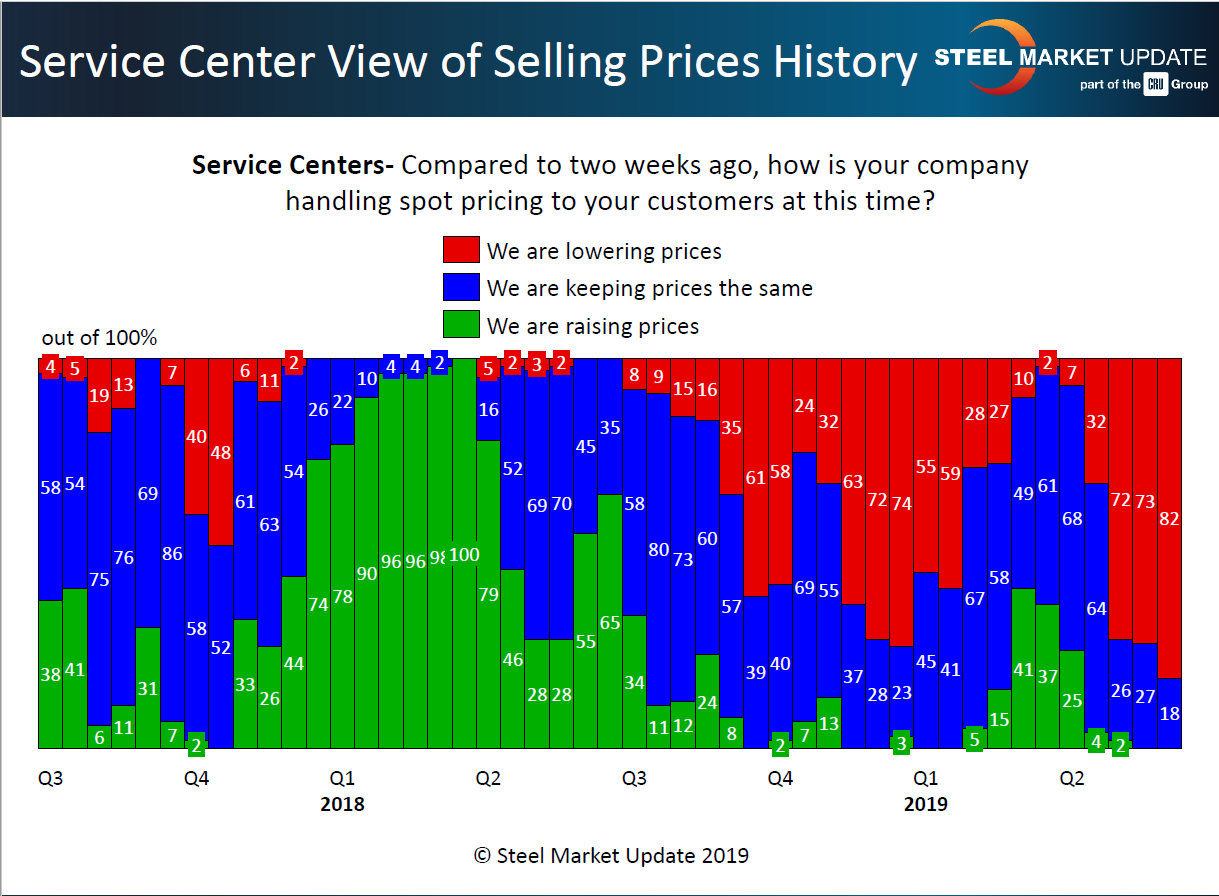

Service centers agreed with the assessment made by the manufacturing segment with 82 percent of distributors reporting their company was lowering spot prices. This is 9 percentage points greater than what we saw during the middle of May and is much higher than what we recorded in late fourth-quarter 2018 and early first-quarter 2019 prior to the mill price increase announcements. As you may recall, those announcements ultimately failed.

From Steel Market Update’s perspective, what is important is both manufacturing companies and the service centers themselves are within the capitulation area of our index. We have seen in the past when 75 percent or more service centers are dumping inventories and lowering prices to their end customers, their ability to run their businesses on ultra-lean to no margin creates an environment conducive to change. Distributors will therefore support mill price increases in order to reverse the direction of spot prices, and in the process upgrade the value of their inventories.

This is one piece of the puzzle that will help support price increase announcements should they come. Our analysis of flat rolled and plate pricing is picking up signs of demand weakness and continued weakness regarding price offers out of the domestic steel mills. It could be weeks before the price direction changes, but we are more inclined to believe in days and weeks rather than in months. Keep your eyes on this index as we move into early third-quarter 2019.