Prices

June 13, 2019

U.S. Steel Exports Increase in April But Remain Weak

Written by Brett Linton

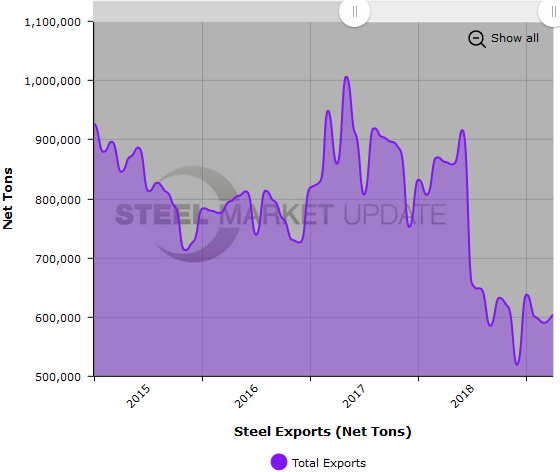

U.S. steel exports in April totaled 602,652 net tons (546,717 metric tons), up 2.3 percent from March, but down 30.0 percent from levels one year ago.

This is the fifth lowest monthly export level seen in Steel Market Update’s 10-year history, behind December 2018 at 519,099 tons, September 2018 at 584,858 tons, March 2019 at 589,057 tons and February 2019 at 599,430 tons. Around this time last year, exports were averaging 850,000 tons.

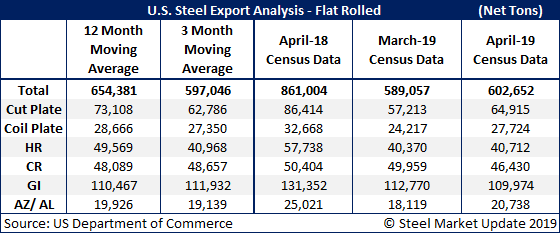

The total April export figure is above the three-month moving average (average of February, March and April), but below the 12-month moving average (average of May 2018 through April 2019). Here is a breakdown by product:

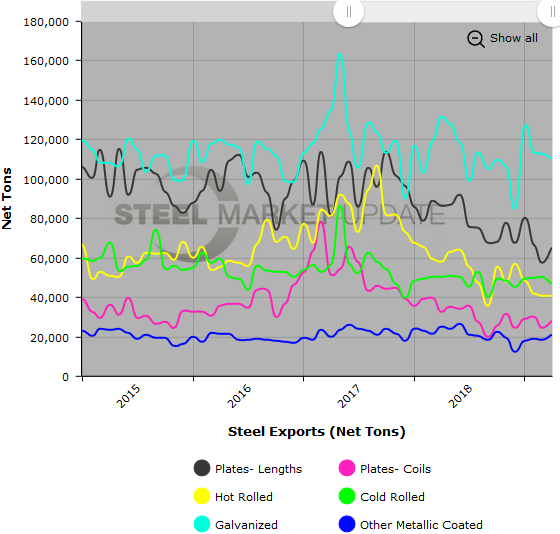

Cut plate exports rose 13.5 percent from March to 64,915 tons, but were down 24.9 percent compared to levels one year ago. This is the second lowest export level seen in our limited history, with the lowest being the previous month.

Exports of coiled plate were 27,724 tons in April, up 14.5 percent month over month, but down 15.1 percent year over year.

Hot rolled steel exports rose 0.8 percent over March to 40,712 tons, but were down 29.5 percent from April 2017 levels. This is the third lowest level seen in our limited history, with the lowest occuring September 2018 at 35,480 tons and the second lowest being just last month.

Exports of cold rolled products were 46,430 tons in April, down 7.1 percent from March, and down 7.9 percent over the same month last year.

Galvanized exports fell 2.5 percent month over month to 109,974 tons. Compared to one year ago, April levels declined 16.3 percent.

Exports of all other metallic coated products were 20,728 tons, up 14.5 percent from March, but down 17.1 percent compared to one year ago.

Below are two graphs showing the history of U.S. steel exports, in total and by product. To use their interactive features, view the graphs on our website by clicking here. If you need assistance logging into or navigating the website, contact us at info@SteelMarketUpdate.com.