Prices

June 23, 2019

SMU Market Trends: Will the Mills Seek a Price Hike Soon?

Written by Tim Triplett

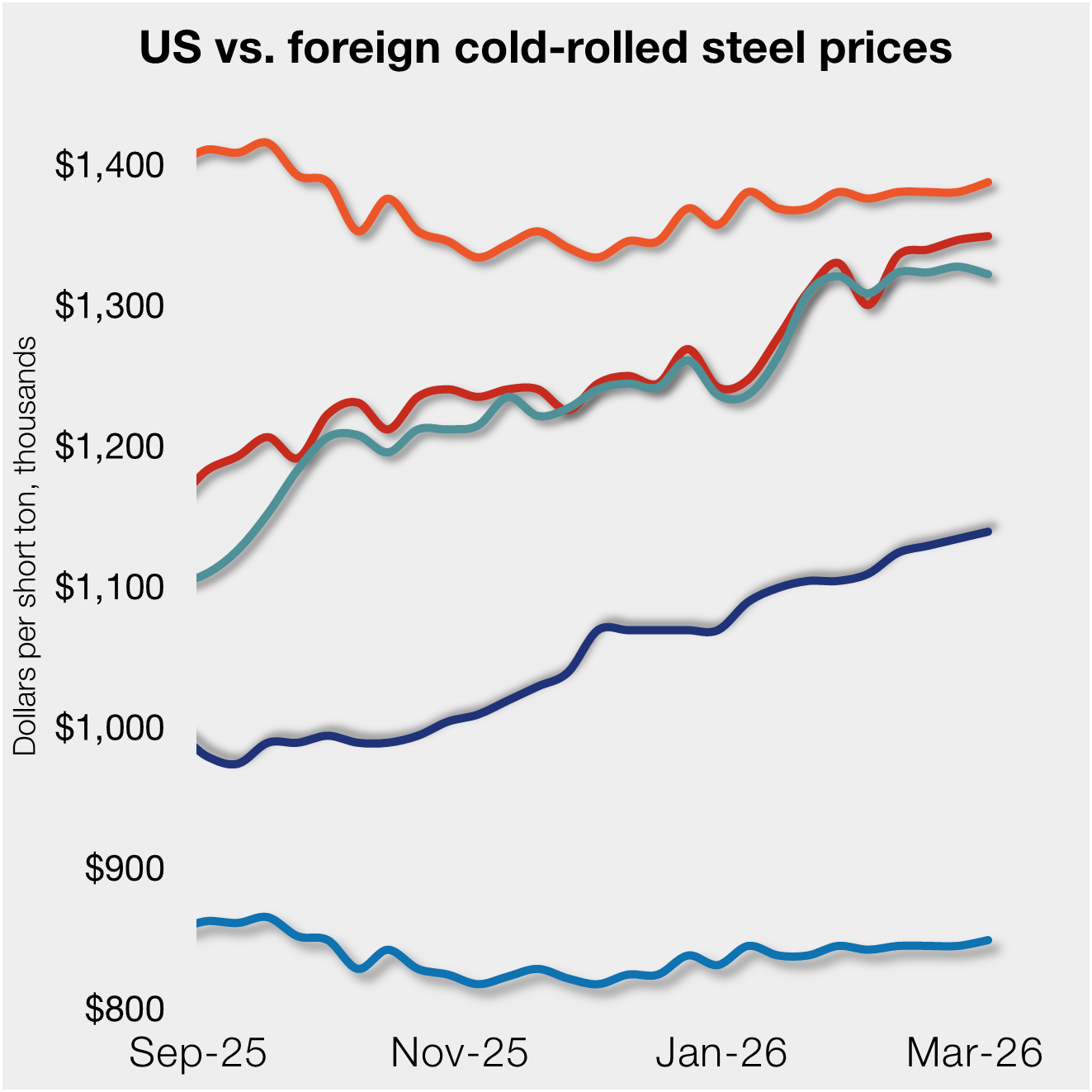

With steel prices at such surprisingly low levels, it’s only a matter of time before the domestic mills announce a price increase. The only point of debate is when. There’s clearly some disagreement over whether the market has found a bottom yet.

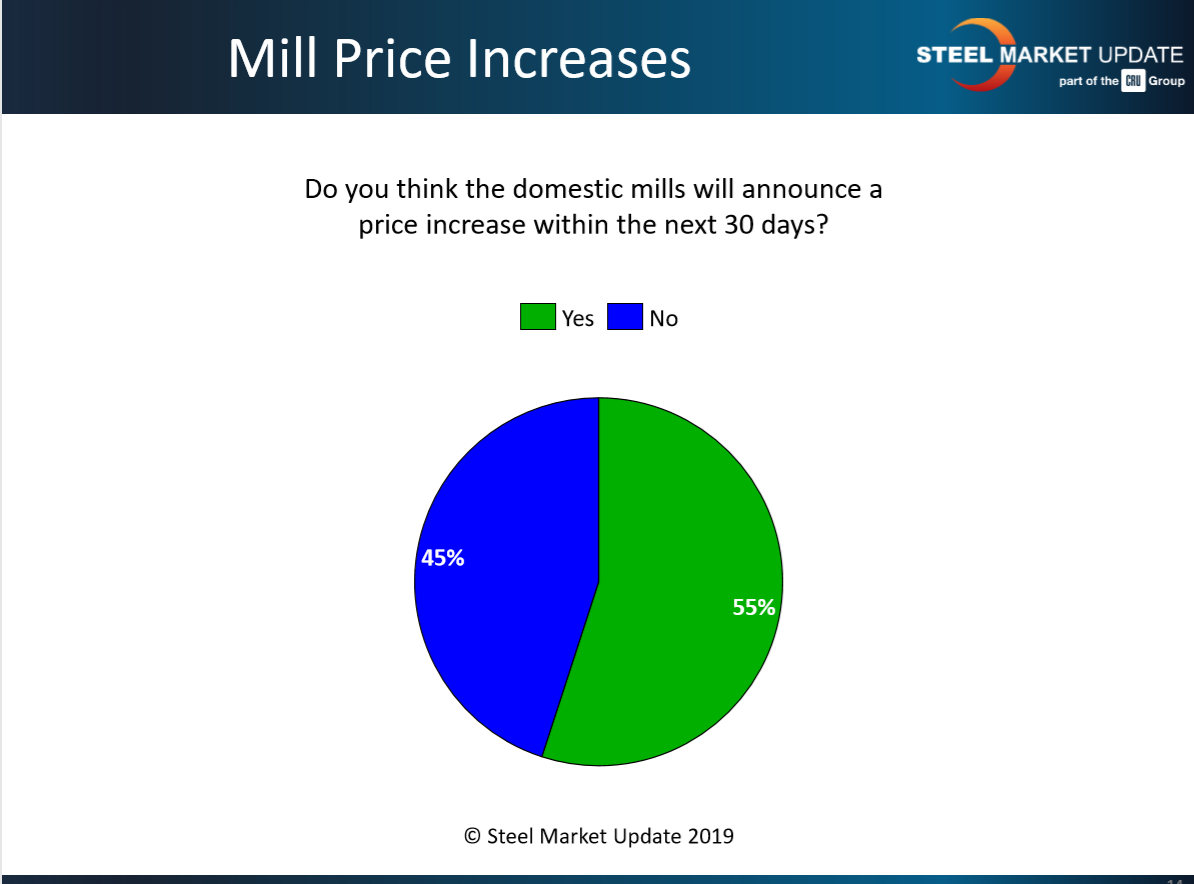

Slightly more than half of the service center and OEM executives responding to Steel Market Update’s market trends questionnaire this week believe the domestic mills could announce a price increase within the next 30 days. The other half feel prices still have further to fall before the market will support a price hike. If the mills do make an announcement soon, more than two out of three respondents to SMU’s latest poll say they will fight it.

Steel Market Update asked: Do you think domestic mills will announce a price increase within the next 30 days?

Here’s what some respondents had to say:

• “With current CRU prices below pre-tariff numbers, why wouldn’t they?”

• “Lead times need to extend a little and scrap has to stop going down for a price increase to be announced.”

• “They need to start cutting back on capacity first.”

• “Capacity shuts are imminent and this will support price increases.”

• “They will try, but demand is steady and there’s less available output. Several mills will cave and not support it even if they announce.”

• “They won’t announce unless some market fundamentals change like scrap starts to increase or inventories bottom out and lead times lengthen, etc.”

• “Probably not, but they will try to stabilize offerings in the spot market.”

Increase Likely to Get Support?

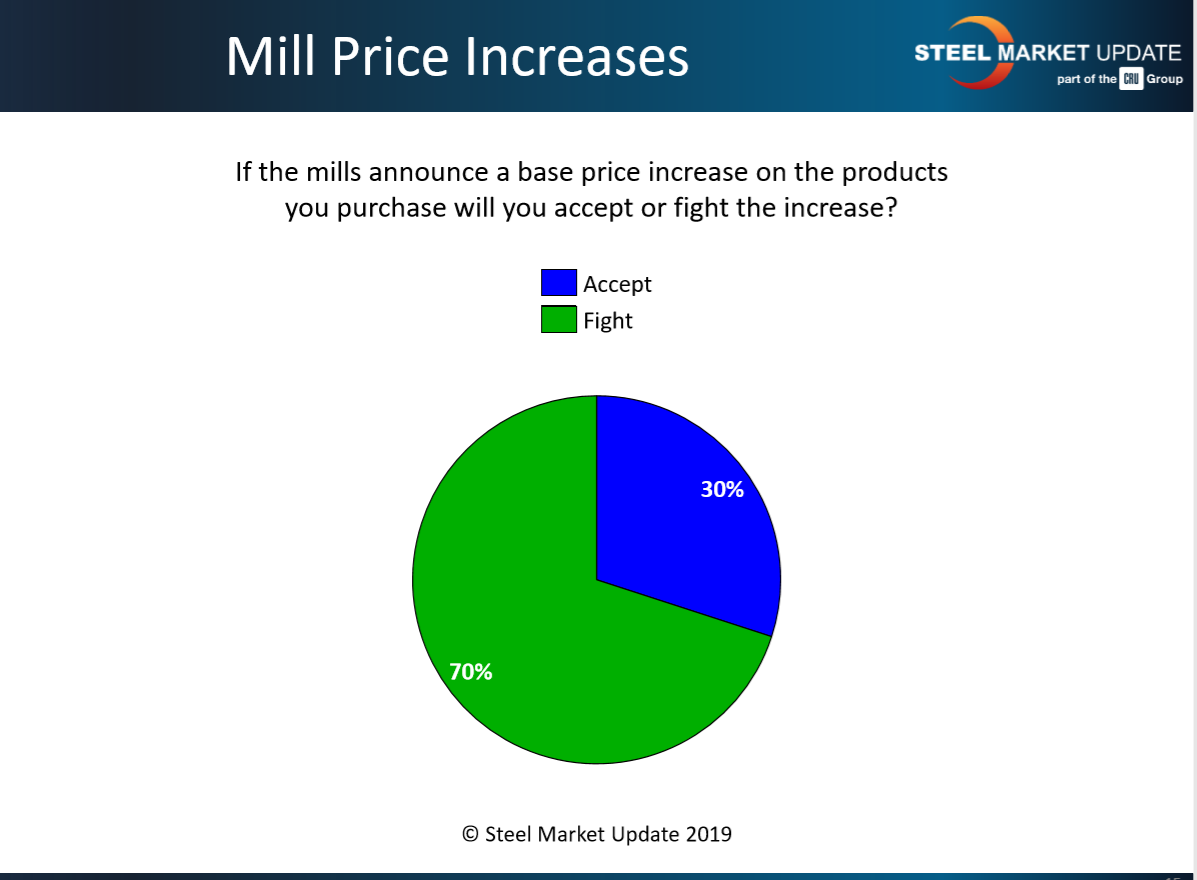

SMU also asked: If the mills announce a base price increase on the products you purchase, will you accept or fight the increase? Seventy percent of respondents said they would fight it.

Here’s some of their comments:

• “We always fight it, but the market will dictate whether or not the increase will stick. My strong gut feel is that the next increase will be successful.”

• “Everyone would welcome them. Stop the inventory devaluation and put a floor on prices.”

• “I suspect service centers and distributors are at capitulation, especially from a cash flow basis. Financial partners can be very persuasive in forcing money-making moves.”

• “It would have to be supported by something other than wishful thinking, like increased scrap costs or a demand surge.”

• “Until they can stabilize this downward trend and get scrap up, there is no justification.”

• “If it’s just to stop the bleeding, it will be hard to support. If the usage is behind it, I will support it.”