Prices

August 13, 2019

U.S. Raw Steel Production Slips in June

Written by Brett Linton

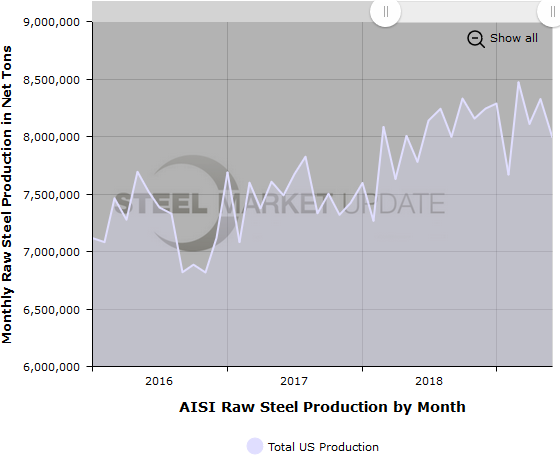

Total U.S. raw steel production in the month of June declined 4.1 percent to 7,984,988 net tons, reports the American Iron and Steel Institute in Washington. This is the first time monthly production levels have dipped under eight million tons since February 2019. Although down over the previous month, June production is only slightly below the 2019 average of 8,141,097 tons and is up 2.6 percent compared to the same month last year. Also keep in mind May production was one of the higher levels seen in the past few years.

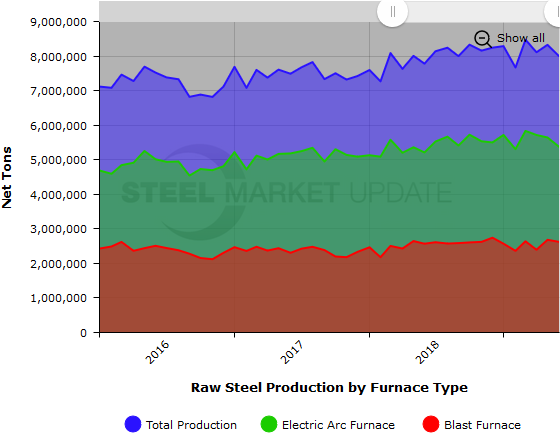

Broken down by production method, 5,364,846 tons (67.2 percent) were produced by electric arc furnaces (EAFs) and 2,620,142 tons (32.8 percent) were produced by blast furnaces.

June production was 340,501 tons lower than May, but 205,529 tons higher than the same month last year. AISI’s monthly estimates are different than the weekly estimates SMU reports each Tuesday; the monthly estimates are based on over 75 percent of the domestic mills reporting versus only 50 percent reporting for the weekly estimates.

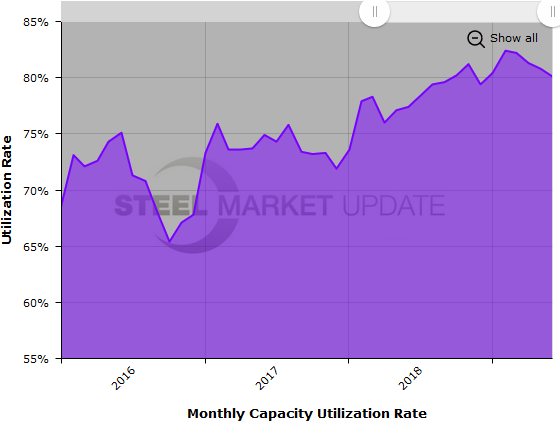

The mill capacity utilization rate for June averaged 80.1 percent, down from 80.8 percent in May, but up from 77.4 percent one year ago. The yearly capacity utilization rate has been adjusted down to 81.2 percent, up from 76.7 percent compared to the same six-month period last year.

The chart below shows total monthly steel production (blue) broken down by electric arc furnace production (green) and blast furnace production (red).

SMU Note: Interactive versions of the raw steel production graphics above can be seen in the Analysis section of our website here. If you need assistance logging into or navigating the website, contact us at info@SteelMarketUpdate.com.