Market Data

September 4, 2019

WSA: Global Steel Production Down 4.1 Percent

Written by Peter Wright

World steel production is down this year. Between May and July, global steel production declined by 4.1 percent. For the year, steel output is down by 0.9 percent, excluding China which continues to overproduce.

![]()

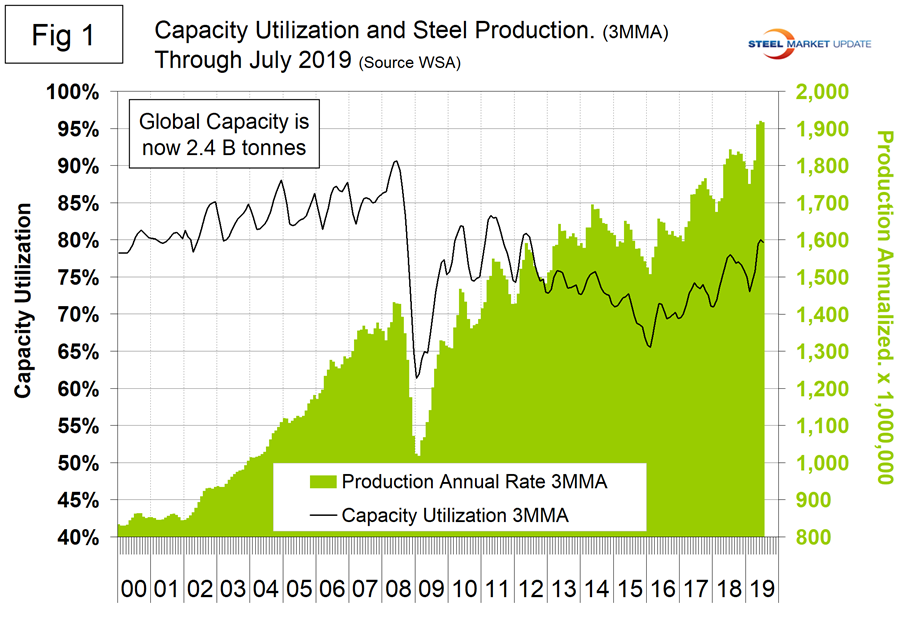

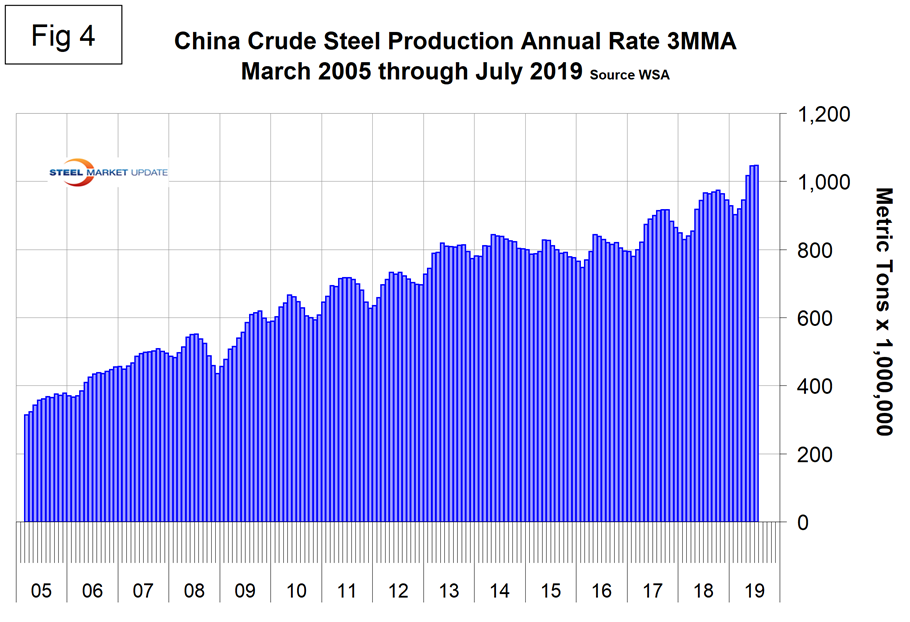

Capacity is calculated to be 2.4 billion metric tons and capacity utilization in July was 79.0 percent, according to the latest Steel Market Update analysis of World Steel Association data. In the months of April through July, Chinese production exceeded an annual rate of one billion metric tons.

Figure 1 shows annualized monthly production on a three-month moving average (3MMA) basis and capacity utilization since January 2000. On a tons-per-day basis, production in July was 5.055 million metric tons, down from June’s all-time high of 5.298 million metric tons.

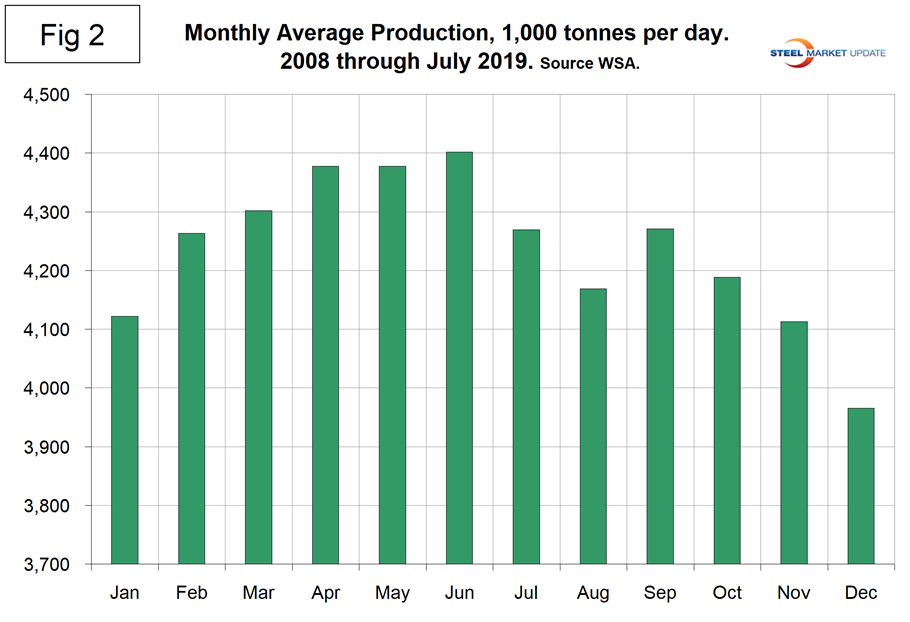

On average, global production on a tons-per-day basis peaked in the early summer in the years 2010 through 2016, but in 2017 and 2018 the second half downtrend was delayed until the fourth quarter. Figure 2 shows the average tons per day of production for each month since 2008. On average, July decreased 3.01 percent. This year, July decreased by 4.59 percent.

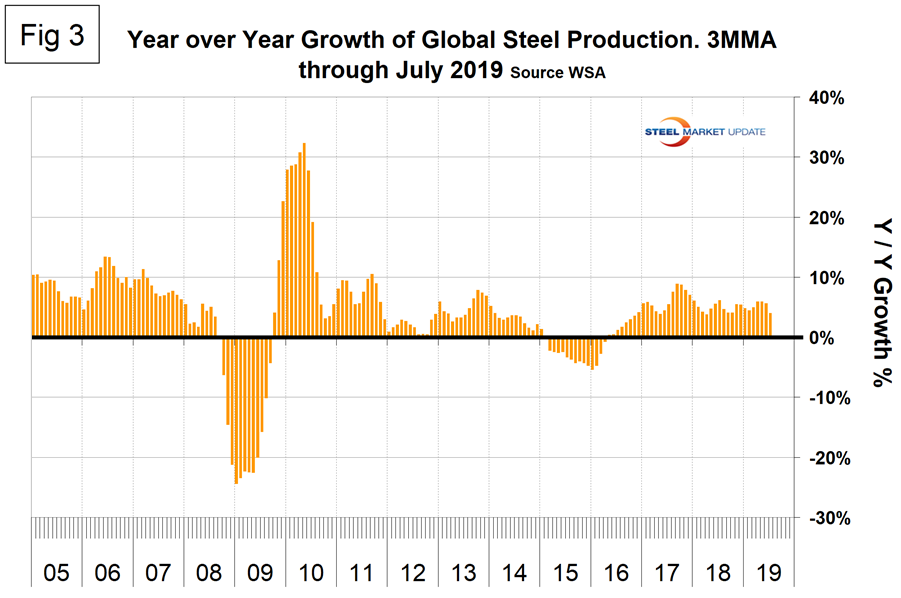

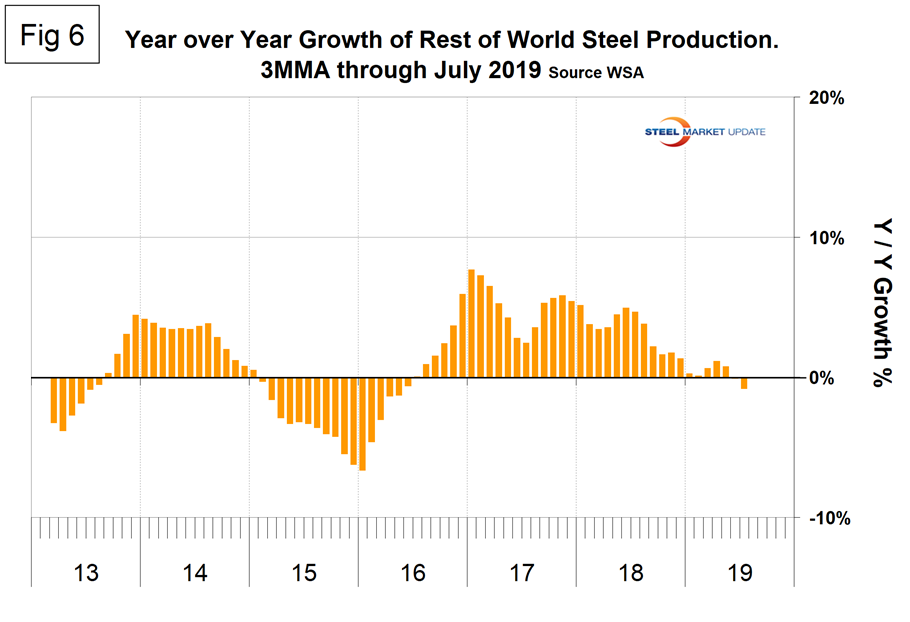

Figure 3 shows the year-over-year growth rate of global production since January 2005. Growth in three months through July was 4.0 percent, down from 5.9 percent in April and May and 5.6 percent in June. All of this growth occurred in China. The rest of the world growth of steel production was negative 0.8 percent in three months through July.

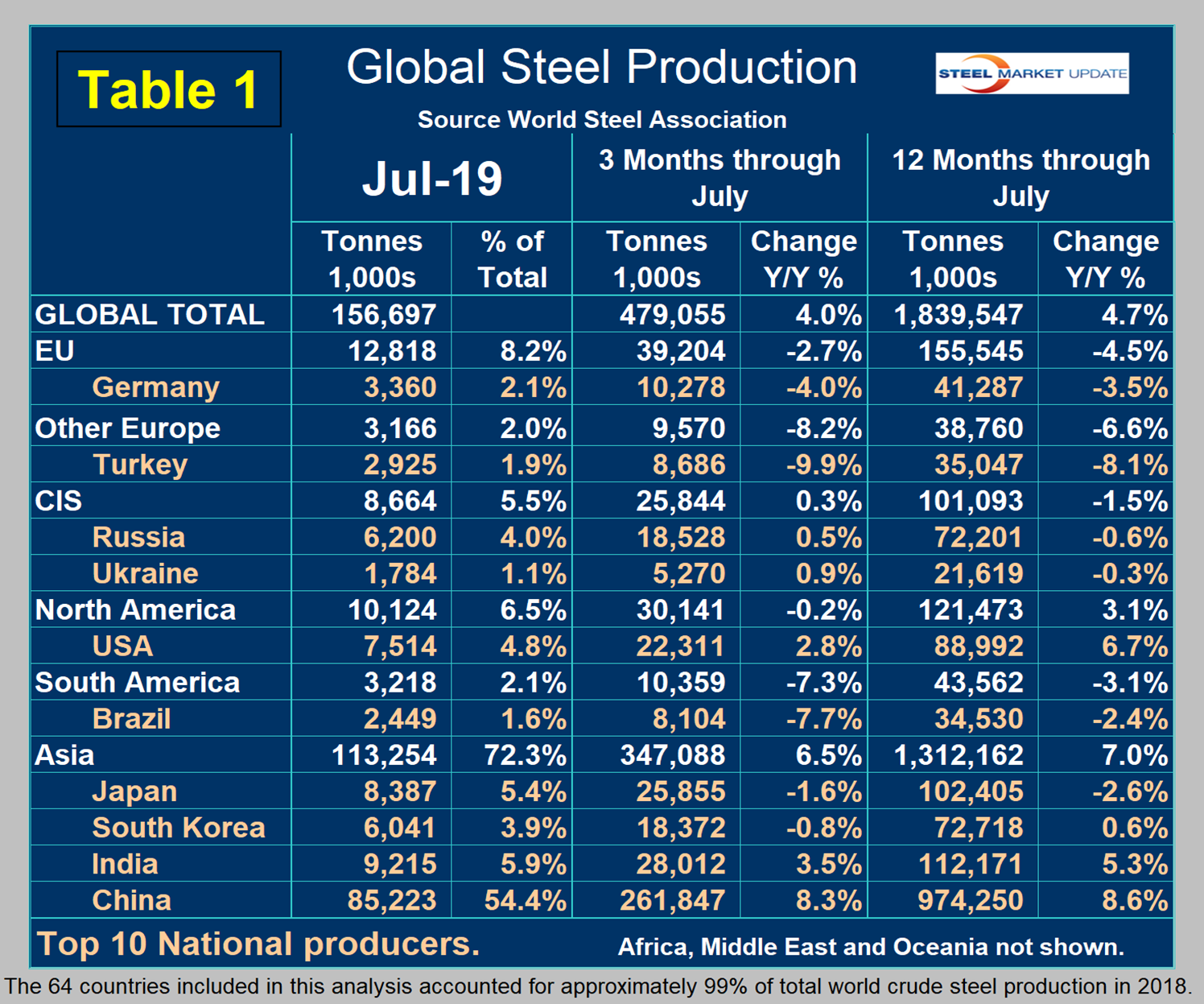

Table 1 shows global production broken down into regions, the production of the top 10 nations in the single month of July, and their share of the global total. It also shows the latest three months and 12 months of production through July with year-over-year growth rates for each period. Regions are shown in white font and individual nations in beige. The world overall had positive growth of 4.0 percent in three months and 4.7 percent in 12 months through July. When the three-month growth rate is lower than the 12-month growth rate, as it was in July, we interpret this to be a sign of negative momentum. Momentum was positive in seven of the previous eight months. On the same basis in July, China grew by 8.3 percent and 8.6 percent, therefore also had negative momentum. All regions except North America and Asia had negative growth in three months through July year-over-year. Table 1 shows that North America was down by 0.2 percent in three months. Within North America, production was up by 2.8 percent in the U.S., up by 2.1 percent in Canada and down by 14.2 percent in Mexico (Canada and Mexico are not shown in Table 1.)

In the 12 months of 2018, 119.9 million metric tons were produced in North America, of which 72.3 percent was produced in the U.S., 10.9 percent in Canada and 16.8 percent in Mexico.

Figure 4 shows China’s production since 2005. As just stated, global steel production was up by 4.0 percent in three months through July year-over-year and China was up by 8.3 percent, both with negative momentum. In the three months May through July, world steel production excluding China contracted by 0.8 percent.

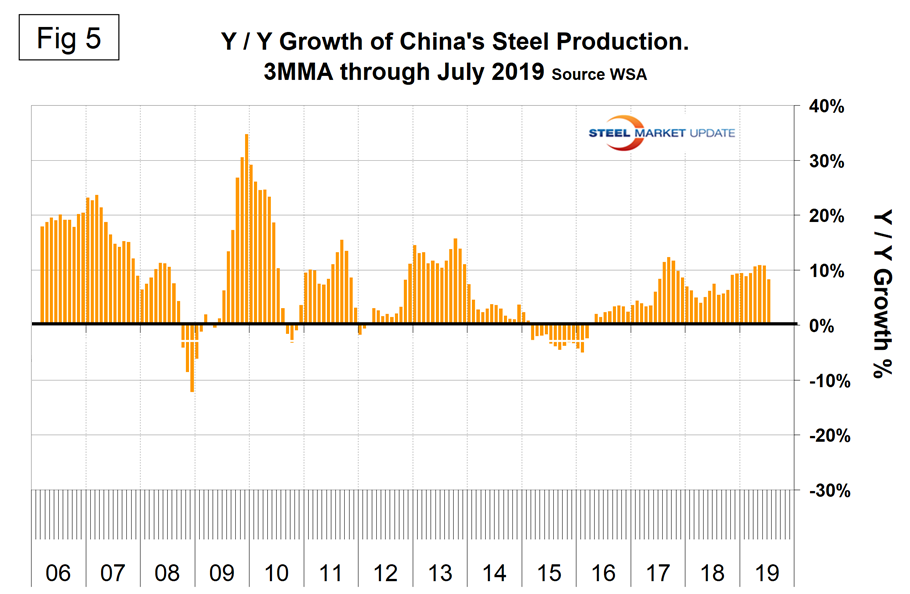

Figure 5 shows the growth of China’s steel production since January 2013 and Figure 6 shows the growth of global steel excluding China. China’s domination of the global steel market is increasing, and in each month April through July for the first time had an annualized production rate of over one billion metric tons. The WSA is forecasting a deceleration in China’s steel production growth in 2019.

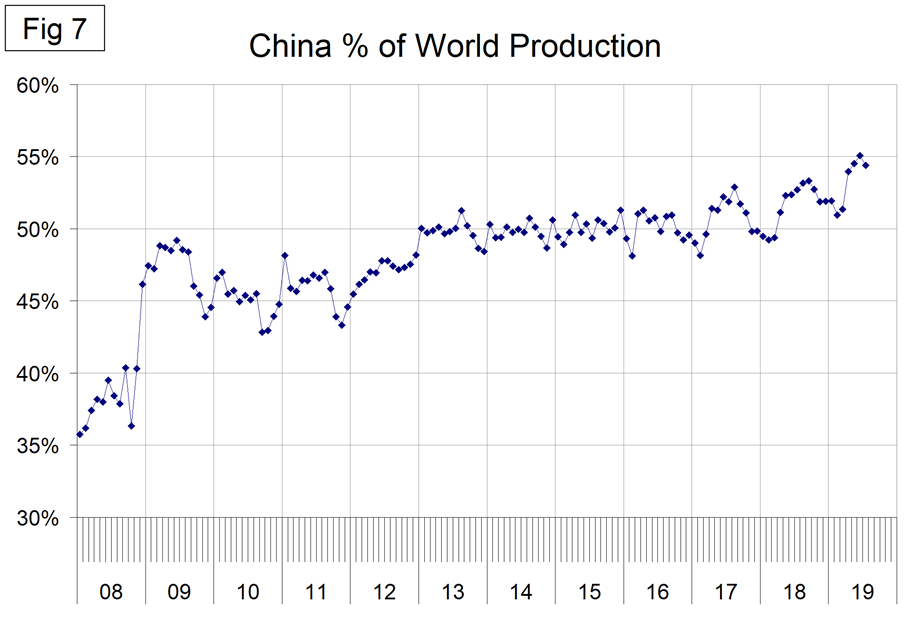

Figure 7 shows the growth of China’s share of global steel production, which in July was 54.4 percent.

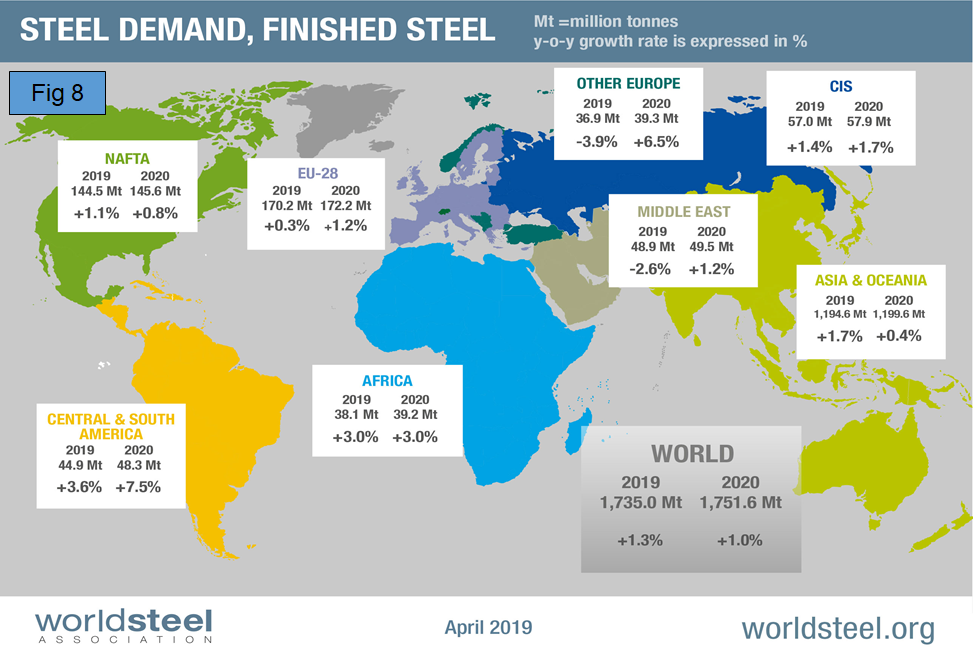

The April 2019 WSA Short Range Outlook (SRO) for apparent steel consumption in 2018 and 2019 is shown by region in Figure 8. The WSA forecasts global steel demand will reach 1,735 billion Mt in 2019, an increase of 1.3 percent over 2018. Note that the essence of this piece is crude steel production, therefore the numbers are greater than for steel consumption which relates to rolled products.

SMU Comment: If the IMF update of the World Economic Outlook is accurate, global steel production will be negatively impacted in the coming months. In 2019, the U.S. growth pattern is slowing as the effect of fiscal stimulus declines. Construction and manufacturing growth is expected to moderate. Investment in oil and gas exploration is also expected to decelerate.

This analysis is based on data made public monthly by the WSA. Its members represent approximately 85 percent of the world’s steel production, including over 160 steel producers, national and regional steel industry associations and steel research institutes.