Analysis

September 10, 2019

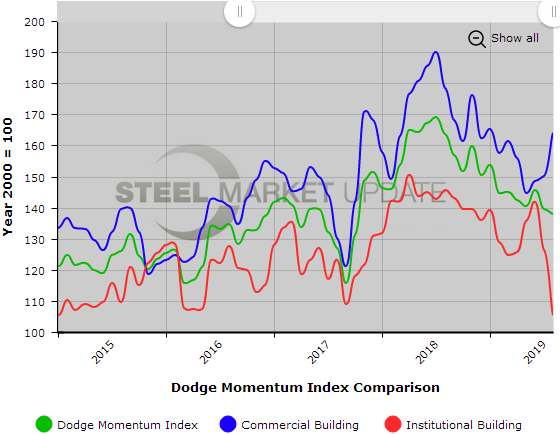

Dodge Momentum Index Shows Easing in Construction

Written by Sandy Williams

Planning activity for nonresidential construction declined in August, according to the latest report issued by Dodge Data & Analytics. The Dodge Momentum Index slid 1.3 percent to 127.8 last month primarily due to a 16.6 percent decline in the institutional component that offset a 9.1 percent gain in the commercial component. The index is a measure of the first report for nonresidential building projects in planning, which have been shown to lead construction spending by a full year.

“On a year-over-year basis, the overall Momentum Index is 10.3 percent below August 2018, suggesting that construction spending will be settling back as the year progresses,” said Dodge. “However, most of the decline occurred in 2018 – the Momentum Index has lost only 1.8 percent since the beginning of 2019, indicating that while construction activity will ease it is not in a freefall.”

On a year-over-year basis, the institutional component is 22.5 percent lower, while the commercial component is down 2.4 percent.

Eleven projects valued at $100 million or more entered the planning phase in August, including a $200 million Amazon fulfillment center in Memphis, Tenn.

Below is a graph showing the history of the Dodge Momentum Index. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.